Reunit is an innovative wallet with a unique feature: omni-chain transfer. This means that users can simultaneously transfer cryptocurrencies from different blockchains in a single transaction and towards any other blockchain. For the launch of its beta version, Reunit is planning an airdrop and a pre-sale of its REUNI token. How to participate

What is Reunit and what is its special feature

Reunit is the first omni-chain portfolio. In concrete terms, this means that a user can simultaneously transfer or exchange tokens from several blockchains at the same time, all in the same transaction and towards any other blockchain.

The idea to create such a wallet comes from Naïm Boubziz, a blockchain developer who contributed to the development of DEX SushiSwap and the LayerZero and Stargate Finance protocols.

In fact, Reunit could not exist without the revolution initiated by LayerZero and Stargate Finance. Based on LayerZero, Stargate Finance allows the transfer of ERC-20 tokens from one blockchain to another in a decentralised manner with reduced costs. Reunit uses this technology for all its cross-chain operations.

Let’s take a very simple example to illustrate the interest of this functionality. Let’s assume that a user holds 1,000 USDC spread across several blockchains, namely Ethereum, Polygon and Avalanche.

He therefore has a global purchasing power of 1,000 USDC, but cannot interact with all of his funds in a single transaction. If, for example, he wants to stash his USDC on a decentralised finance protocol (DeFi), he will have to execute at least 3 transactions, which will incur fees. This is where the Reunit wallet changes the game and allows the user to use all of their funds in one transaction

This unique feature of Reunit has profound implications for both decentralised applications (dApps) and users:

- For dApps: more liquidity, volume, transactions and the ability to attract users from other blockchains, provided they are compatible with them. To best achieve this goal, a dApp Store will be accessible directly from Reunit;

- for users: significant savings on transaction fees and the possibility to use applications initially reserved for other blockchains.

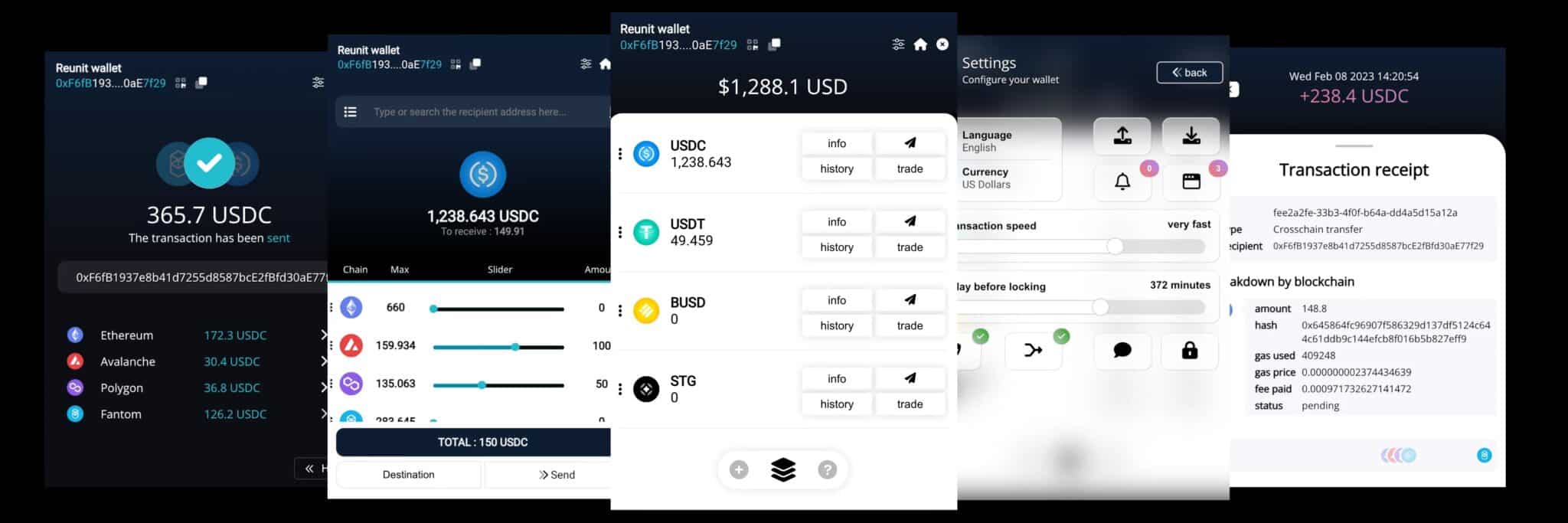

Reunit interface overview

The Reunit wallet has its own token, the REUNI. Initially intended to play a role in the governance of Reunit, the uses of this token will multiply over time. More details on the roles and tokenomics of the REUNI are outlined in the rest of this article.

The privacy conscious will be pleased to know that Reunit does not store any of its users’ connection logs (IP address, fingerprint, date of connection, wallet address, etc.) or the content of various requests and transactions.

It should also be noted that transfers of cryptocurrencies from one Reunit user to another do not incur any fees other than those applied by the selected native blockchain and the Stargate user fees.

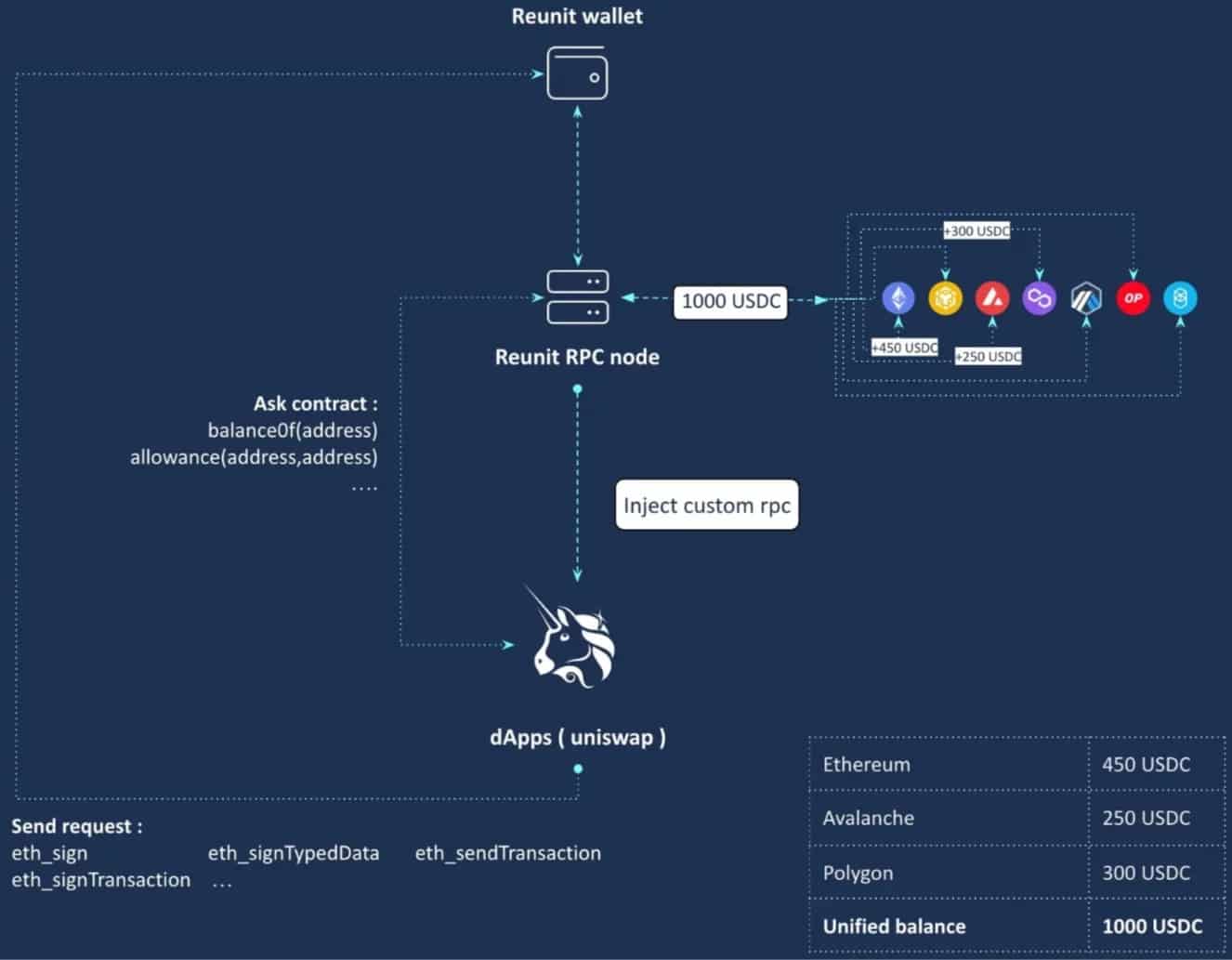

How the Reunit architecture works

To deliver such innovation, the Reunit wallet uses its own RPC node, which in turn is connected to all the blockchains that Reunit supports.

Here’s how it works, using Uniswap as an example, and the USDC balance on the wallet

- Reunit uses WalletConnect to establish a connection with Uniswap;

- Reunit then injects its own RPC node;

- When Uniswap queries the USDC balance of an address, Reunit’s custom RPC node understands this and sends a query to each of the blockchains, to return the cumulative USDC balance available to Uniswap;

- Finally, when Uniswap initiates a swap involving USDC by example, Reunit will:

- Detect on which network the transaction should be executed;

- Decode the transaction;

- If the required balance is available on the network, the transaction is executed;

- i. If not, Reunit checks the available balance on all other blockchains;

- ii. Reunit transfers funds from other blockchains to the blockchain where the transaction is to be executed;

- iii. Once the balance is available, the transaction is executed.

How the Reunit architecture works

Roles and Tokenomics of the REUNI token

What are the roles of the REUNI token

The Reunit wallet ecosystem is built around its token, the REUNI. Initially, the REUNI will act as a governance token. REUNI holders will be able to influence the development of the portfolio by becoming members of the project’s decentralised autonomous organisation (DAO).

In the longer term, REUNI token holders are expected to receive benefits such as reimbursement of a portion of gas fees or a 50% share of the fees generated by the Reunit dApp Store.

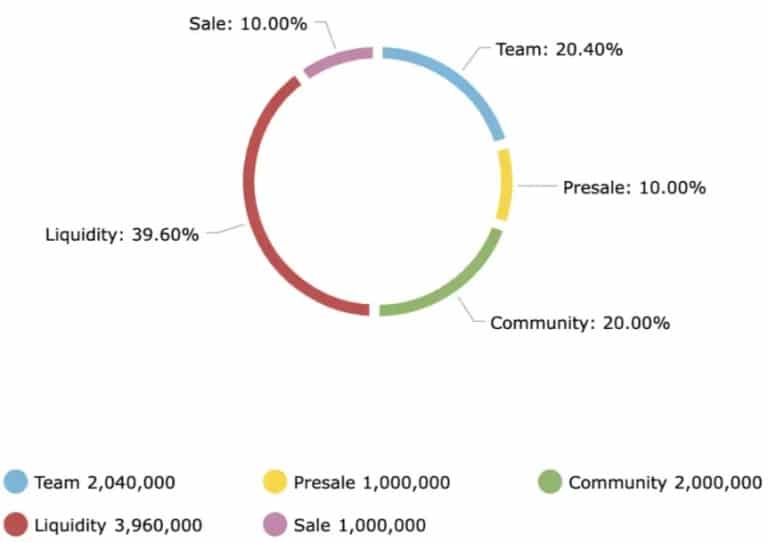

What are REUNI’s Tokenomics?

A total of 10 million REUNI tokens will be issued. Here is how the issuance of these tokens will be carried out over time:

Pre-sale: 1 million REUNI at $1:

- 50% without lockup;

- 50% with 6 month lockup.

Sale: 1 million REUNI at $2 :

- 75% without lockup;

- 25% with 3 month lockup.

Airdrop: 2 million REUNI to STG, veSTG and aaSTG token holders :

- 25% without blocking;

- 75% with 9 months blocking.

By the way, the Stargate Finance community is currently being asked to vote on the terms of this airdrop. At the time of writing, more than 9,000 people have already participated in this vote.

The remaining 6 million REUNI tokens will be issued at a rate of 250,000 units per month. Thus, all REUNI tokens will be put into circulation after 2 years.

Here are the proportions in which these 6 million tokens will be distributed:

- 33% to provide liquidity on the Uniswap and PancakeSwap DEXs as well as on several centralized platforms;

- 33% to provide liquidity so that REUNI can be used directly via the Stargate protocol;

- 34% to ensure the long term development of Reunit.

REUNIT token allocation

Next steps for Reunit

In the short term

1st step in the launch of the Reunit wallet, the pre-sale of its REUNI token. This will begin on February 28. A beta version of the wallet will be available shortly after. Then, the public sale of the token will take place at the end of March. This will be followed by the airdrop for STG and veSTG and aaSTG token holders on 29 March.

In the long term

These are some of the features that will join the Reunit ecosystem during 2023.

dApp Store

Any decentralised application will have the possibility to be referenced in the Reunit dApp Store. To do so, dApps will have to hold a certain amount of REUNI tokens and place them in staking.

Thanks to this dApp Store, decentralised applications will be able to build a community of users who use other blockchains than their own. In addition, each transaction carried out via the dApp Store will generate a fee of 0.1%, half of which will be redistributed to the users who stack REUNI.

Mobile version

A mobile version will be developed and made available on iOS and Android.

Gas reimbursement

The REUNI token can be used to reimburse a portion of users’ transaction fees.

Compatibility with Ledger and other wallets

Once the Reunit beta is live, the team will look at compatibility with hardware wallets such as Ledger. This will add an extra layer of security