Optimism will see its amount of outstanding OPs more than double in the next 24 hours with a major token unlock, amounting to more than $591 million in additional capitalisation. Will this event hurt the price of the asset?

Optimism: $591m of OPs to be unlocked

While Optimism, one of Ethereum’s (ETH) layer 2s, is about to see a huge token unlock of exactly 386,547,056.64 OPs, the asset’s price was down around 7% at the time of writing.

And with good reason: the number of tokens in circulation is currently just under 335.38 million, which means that the next 24 hours should see a doubling of this liquidity after the forthcoming unlocking.

When raising funds, the tokenomics of a project provide for periods of ‘vesting’ of their token, so that stakeholders do not sell everything at once. After that, releases occur over months and years, allowing them to take their profits if they wish.

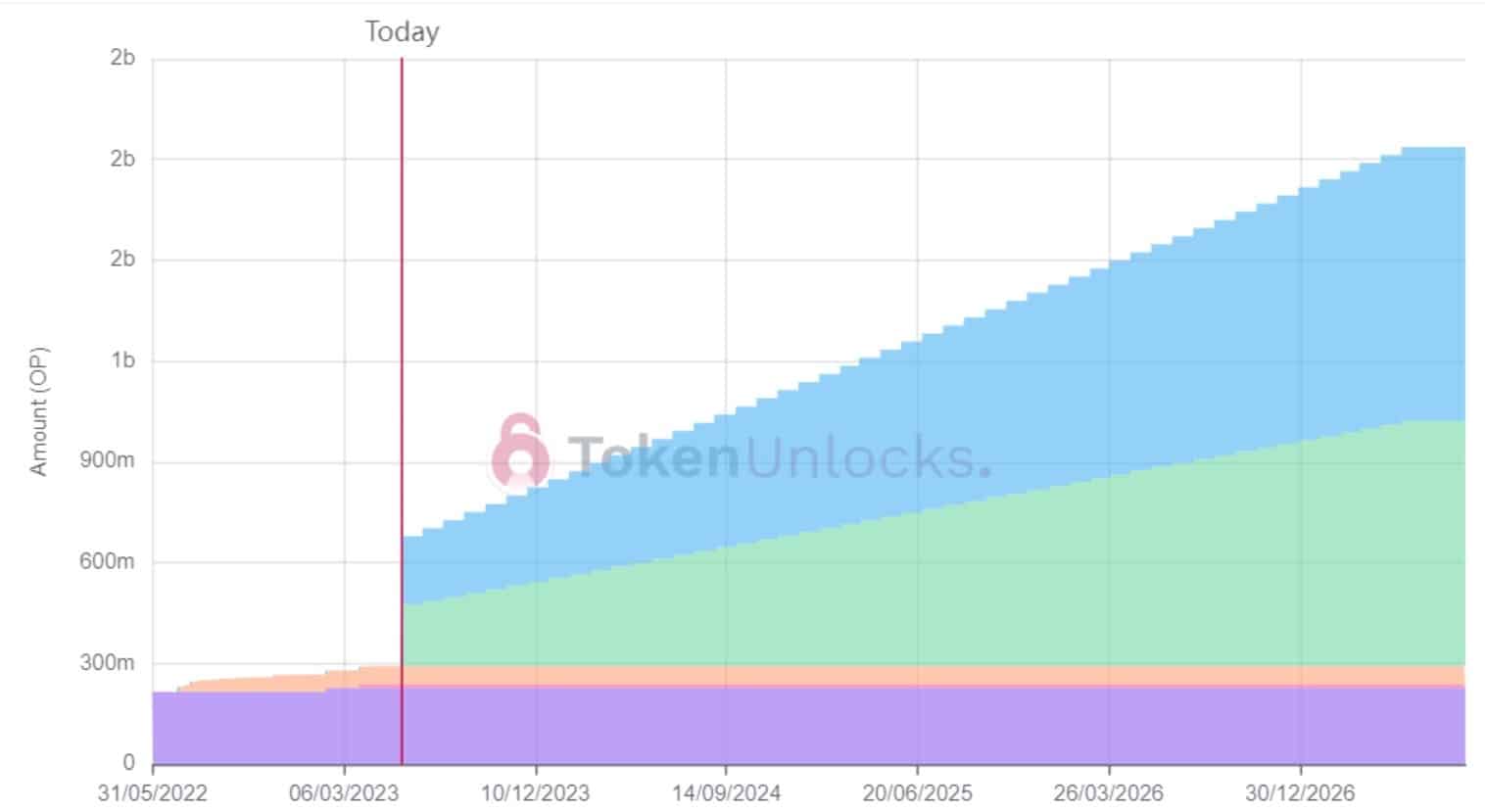

On the graph below, we can see the unlocking in progress and those to come. Of the amount we’re talking about today, 204 million OP are for the development team, and 182.5 million for investors :

Quantity of OP tokens about to be unlocked

This means that more than $591 million should be released at the current price of the asset. Based on this price, this would move Optimism from 90th to 44th place in the CoinGecko capitalisation rankings.

Will the price of OP collapse?

It is almost impossible to predict how the OP will behave when it is unlocked, as the financial markets can be so frustrated by a popular consensus.

An analysis by Unlocks Calendar estimates that with a daily volume of around $70 million, the market can hardly absorb such a large quantity of tokens. As an indication, current market depth shows that on Binance, $500,000 in volume is enough to drive the price down by 2%.

Optimism’s main investors are Andreessen Horowitz (a16z), Paradigm and IDEO CoLab Ventures, and their average OP acquisition price would be just over $0.24, giving a 530% return on investment.

Nevertheless, there are several factors to take into account. Firstly, unlocking tokens does not necessarily mean selling them. Even so, the players involved, and particularly the project developers, have no interest in causing the price to plummet.

Profits may be taken, however, and that would even be wise, but speculating on the extent of the movement to come is more of a gamble than an analysis.

Note, however, that the OP has already fallen sharply in recent months, losing more than 53% since its all-time high (ATH) of $3.28 on February 24. We cannot rule out the possibility that some of the news has already been priced in.