Although the NFT market is at half-mast, innovations continue to pour in from the corporate sector. OpenSea has just unveiled Deals, its new service offering the possibility of exchanging non-fungible tokens on a peer-to-peer basis, all with no transaction fees levied by the platform. This new feature is being deployed as part of its commercial battle against the Blur platform, the rising star of the NFT market.

Peer-to-peer NFT exchanges

Since their popularization in 2021, the majority of non-fungible token (NFT) acquisitions have taken place in the following way: an individual offered his or her NFT for sale at a fixed price or in the form of an auction, with cryptocurrencies as the currency of exchange.

However, NFT marketplace OpenSea has just launched a new feature to offer new possibilities to its users: Deals.

Introducing Deals: offer your NFTs for theirs, securely on OpenSea.

https://t.co/bTciJLUWDK pic.twitter.com/KR2MLbi7jh

– OpenSea (@opensea) July 20, 2023

In concrete terms, a Deal on OpenSea corresponds to a peer-to-peer exchange of NFTs. So, if two users wish to exchange NFTs, OpenSea acts as an intermediary to secure the transaction between the two parties. Note that a Deal can contain up to 30 NFTs in a single transaction.

If this functionality develops on other marketplaces dedicated to NFTs, it would represent a real asset for developing certain key Web3 sectors, such as video games. Instead of exchanging their virtual items in NFT format using cryptocurrencies, gamers will be able to trade their items directly with each other, thus removing a barrier to entry.

However, since several NFTs can have different values, OpenSea has added an option to include WETHs in these new transactions. Thus, one OpenSea user is able to pass on his 8 Azuki NFTs and a further 25 WETHs to obtain an NFT from the Bored Apes Yatch Club (BAYC) collection, provided the second user accepts the offer.

In this way, OpenSea continues to develop by offering new features to its loyal users, at a time when its legitimacy is being called into question by the meteoric growth of the Blur platform.

OpenSea & Blur – The battle for a market on a downward trend

As I write these lines, the NFT market is at half-mast: transaction volumes have been falling for several months on marketplaces, while the weekly average price for buying NFTs from the BAYC, Azuki and CryptoPunks collections have fallen by 80%, 82% and 95% respectively since their previous ATHs.

Against this backdrop, the Blur platform has come into its own with the Web3 community. In direct opposition to OpenSea, it has attracted the crowds thanks to its two key assets: BLUR’s airdrops, its native token, and the absence of fees levied on transactions.

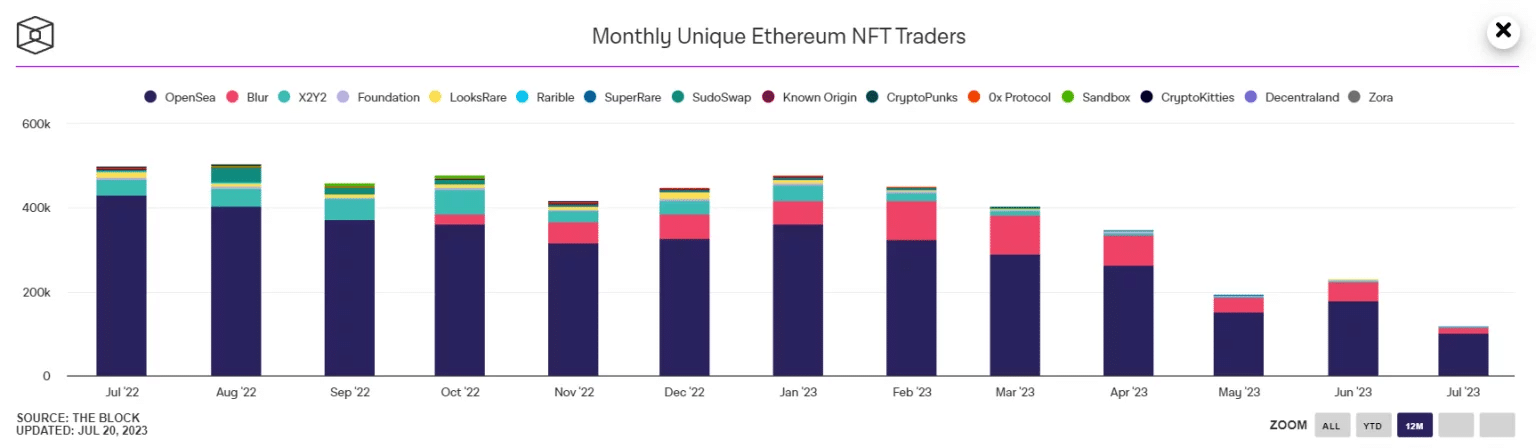

To date, Blur has the highest transaction volumes on the NFT market, while OpenSea has the highest number of monthly users:

Number of unique users using NFT marketplaces on Ethereum

After a first airdrop of BLUR tokens in February 2023, platform users are expecting a second airdrop, explicitly announced on the marketplace’s website. Will this be enough to convince NFT collectors in the long term? Time will tell.