As lending platform Celsius finds itself compromised since it shut down its withdrawal, swap and transfer services this morning, direct competitor Nexo has offered to buy back some of its receivables in exchange for a compromise. This comes at a particularly fragile time for the cryptocurrency ecosystem, and it may well be that Celsius will continue to sink.

Nexo wants to acquire assets held by Celsius

As the Celsius platform announced early this morning that it was pausing its cryptocurrency withdrawal, swap and transfer services, citing “extreme market conditions,” its direct competitor Nexo has expressed interest in buying some of its assets.

After what appears to be the insolvency of @CelsiusNetwork and mindful of the repercussions for their retail investors & the crypto community, Nexo has extended a formal offer to acquire qualifying assets of @CelsiusNetwork after their withdrawal freeze. https://t.co/JFtKTHRLcY

– Nexo (@Nexo) June 13, 2022

“After seeing what appears to be the insolvency of CelsiusNetwork and mindful of the repercussions for their retail investors and the crypto community, Nexo has made a formal offer to acquire CelsiusNetwork’s qualifying assets after their withdrawal freeze. “

Via an open letter (available on the quoted tweet), Nexo is offering Celsius, in broad terms, to acquire some or all of its committed receivables in exchange for, among other things, its customer database.

At the time of writing, the proposal has been rejected by Celsius, but will remain valid until 20 June.

Alongside its offer, Nexo has stated that its financial situation is risk-free, seeking to reassure the crypto community in the midst of a strong period of uncertainty. In an interview with CoinTelegraph, a Nexo representative said the company was one of the most transparent:

“[Nexo was] the first cryptocurrency lender to publicly disclose its real-time books of account last September, and we have invited all of our competitors and responsible cryptocurrency platforms to follow our lead. “

A Celsius decision not without consequences

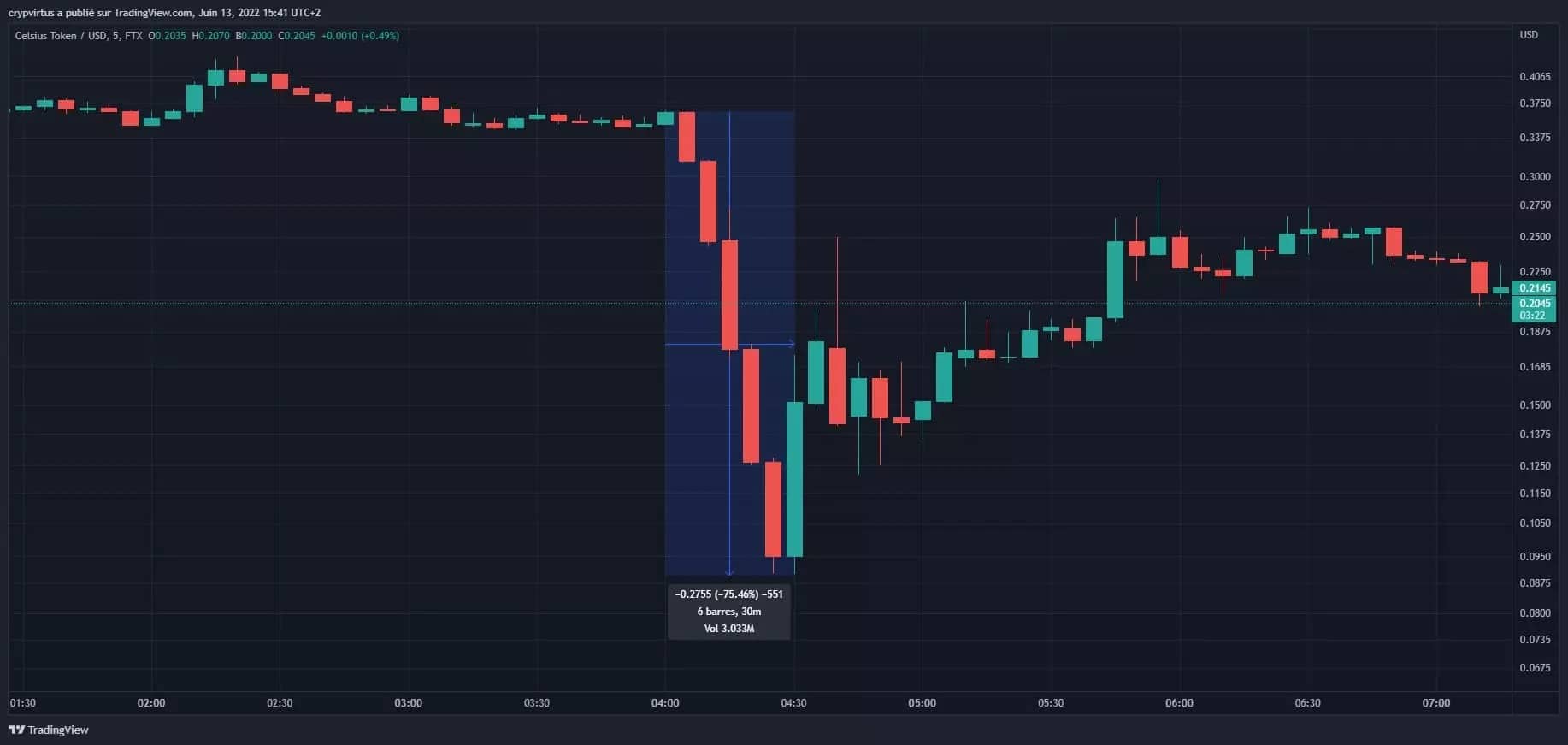

The market reaction to Celsius’ announcement was swift: within half an hour, the CEL token price lost more than 75% of its value, falling from $0.36 to $0.09. It then recovered slightly, with a current price of $0.2.

CEL token price on the morning of 13 June

Celsius is a platform that is all about generating returns on its customers’ investments. It does this by lending cryptocurrencies to businesses via deposits from its own customers, who are themselves rewarded for lending.

This is a similar model to Nexo or BlockFi, for example. This is also one of the reasons for Nexo’s strategic proposal, which is to distance itself from one of its main competitors.

However, it is a model that is far from being unanimously accepted, especially in the United States. Coinbase was forced to stop offering its lending service in the US following threats of legal action by the Securities and Exchange Commission (SEC).

Some Twitter users have not failed to compare Celsius’ recent position to the one that preceded the collapse of Terra (LUNA) or the Bitconnect Ponzi scheme, which is still being talked about more than 5 years later.