French startup Morpho Labs, creator of the decentralized lending and borrowing protocol Morpho, recently introduced Morpho Blue, its latest innovation in decentralized finance (DeFi). Morpho Blue, a trustless protocol, introduces a new approach to decentralized lending using isolated, autonomous vaults free from external intervention.

Morpho Labs unveils new product: Morpho Blue

Morpho Labs, the French startup behind the decentralized lending and borrowing protocol Morpho, has just unveiled Morpho Blue, its latest innovation in decentralized finance (DeFi). As a reminder, Morpho is a platform that sits on top of leading protocols such as Aave or Compound to offer optimized rates to its users.

To put it simply, Morpho Blue is a new protocol in its own right, without trust, bringing a whole host of new features to bring a new layer of flexibility to the DeFi market thanks to innovative implementations.

1/ Today, we unveil Morpho Blue

A trustless lending primitive that offers unparalleled efficiency and flexibility.

It will serve as a new base layer for decentralized lending.https://t.co/UMMLHtWAdm pic.twitter.com/gUXdOfHBhU

– Morpho Labs (@MorphoLabs) October 10, 2023

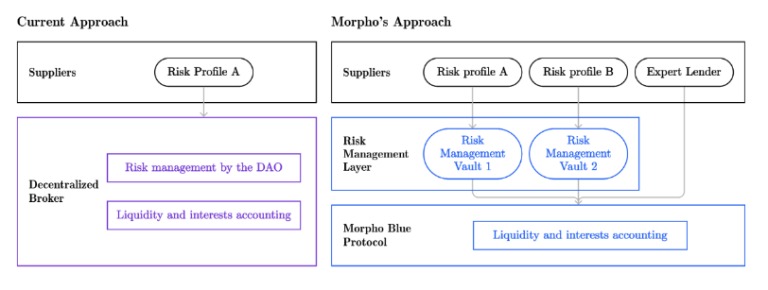

Morpho Blue aims to reinvent the way decentralized lending is operated. Instead of the traditional liquidity pools usually offered on DeFi markets, which are sensitive to the decisions of their respective decentralized autonomous organization (DAO), Morpho Blue proposes a new approach with an isolated, autonomous safe system with no external intervention.

According to Morpho Labs, its basic Morpho solution is limited by the current design of the loan pools with which we are already familiar. Aside from the problem of DAO dependency, liquidity pools are often subject to inefficient collateralization factors, charge protocol management fees, and impose a pre-established cryptocurrency list.

How does it work?

According to the Morpho Labs presentation, Morpho Blue enables the deployment of isolated loan markets with maximum flexibility:

“Morpho Blue enables the deployment of minimal, isolated loan markets by specifying a loan asset, a collateral asset, a liquidation LTV (LLTV) and an oracle. The protocol is trustless and designed to be more efficient and flexible than any other decentralized lending platform. “

The very essence of Morpho Blue lies in the fact that it cannot be modified. Non-scalable, it is designed to solve the bottleneck problem attributable to DAOs, which must constantly make changes to the design of their underlying protocol.

What’s more, as Morpho Blue is totally autonomous and non-upgradeable, this singular approach enables it to offer more attractive rates than those usually offered by lending protocols. Morpho Blue is also much more economical: it could reduce gas consumption by around 70% compared with conventional decentralized solutions, according to the project teams.

Illustration of the difference between the current liquidity pool approach (purple) and the Morpho Blue approach (blue)

Finally, it’s possible to deploy liquidity pools on Morpho Blue for any cryptocurrency, whether for lending or borrowing, with full customization of risk settings. Morpho Blue is also suitable for Real-World Assets (RWA) and institutional markets, according to the release.