The Bank of France has made the news official: the Livret A rate will not be increased until next February despite rampant inflation and increases in energy costs. However, the rates of return now available for our cryptocurrencies are not more attractive or particularly hard to come by.

A rise in Livret A expected in February 2023

Against a backdrop of soaring inflation and with the onset of a difficult winter due to recent energy price rises, the Bank of France has decided to wait until next February to increase the Livret A rate to 3%.

Thus, the 55 million French citizens using the Livret A will have to be patient before seeing their investments in this form of savings take on additional value.

This decision may come as a surprise, as the Banque de France had the opportunity to raise the rate back in November. Indeed, since a decree dated January 2021, the governor of the central bank is able to propose a revision of the rates to the minister in charge of the economy during this period of the year if he considers that it can help to counteract inflation.

And yet, according to a Banque de France spokesman, the French will not see this rate revised upwards any time soon, particularly because of the revaluation of the latter two months ago:

I’m not sure if this is a good idea, but I’m not sure if it’s a good idea. The revaluation on 1 August was significant, even more so on the Livret d’épargne populaire. “

A second reason given is to encourage French households to consume, and not to encourage them to save. It will be remembered that when the Livret A rate was raised on 1 August, the savers concerned placed more than 4.49 billion euros in their Livret A over the month.

And yet, a better investment than crypto-currencies?

However, this 3% rate, while it will be a bit long in coming, is still higher than most rates currently offered in decentralised finance (DeFi). Indeed, even the most recognised DeFi protocols in the ecosystem currently have very low rates.

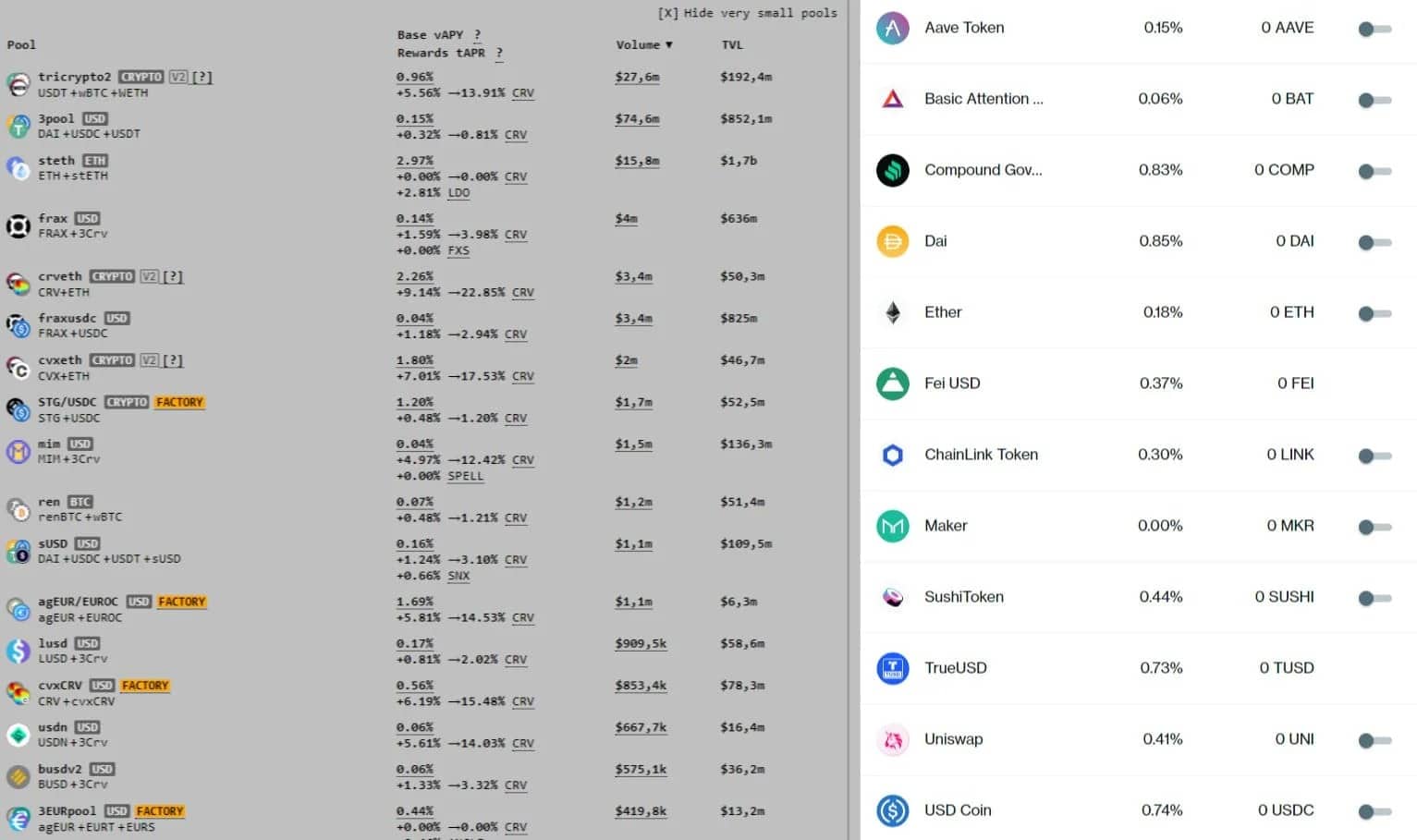

Examples of returns on DeFi protocols

It is also possible to grow your investments via centralized finance on registered cryptocurrency exchange platforms such as Kraken, Binance, or for example FTX, which offers 8% returns through its FTX Earn program. Other platforms also offer cryptocurrency savings, such as Coinhouse, which offers 5% returns on its crypto passbook

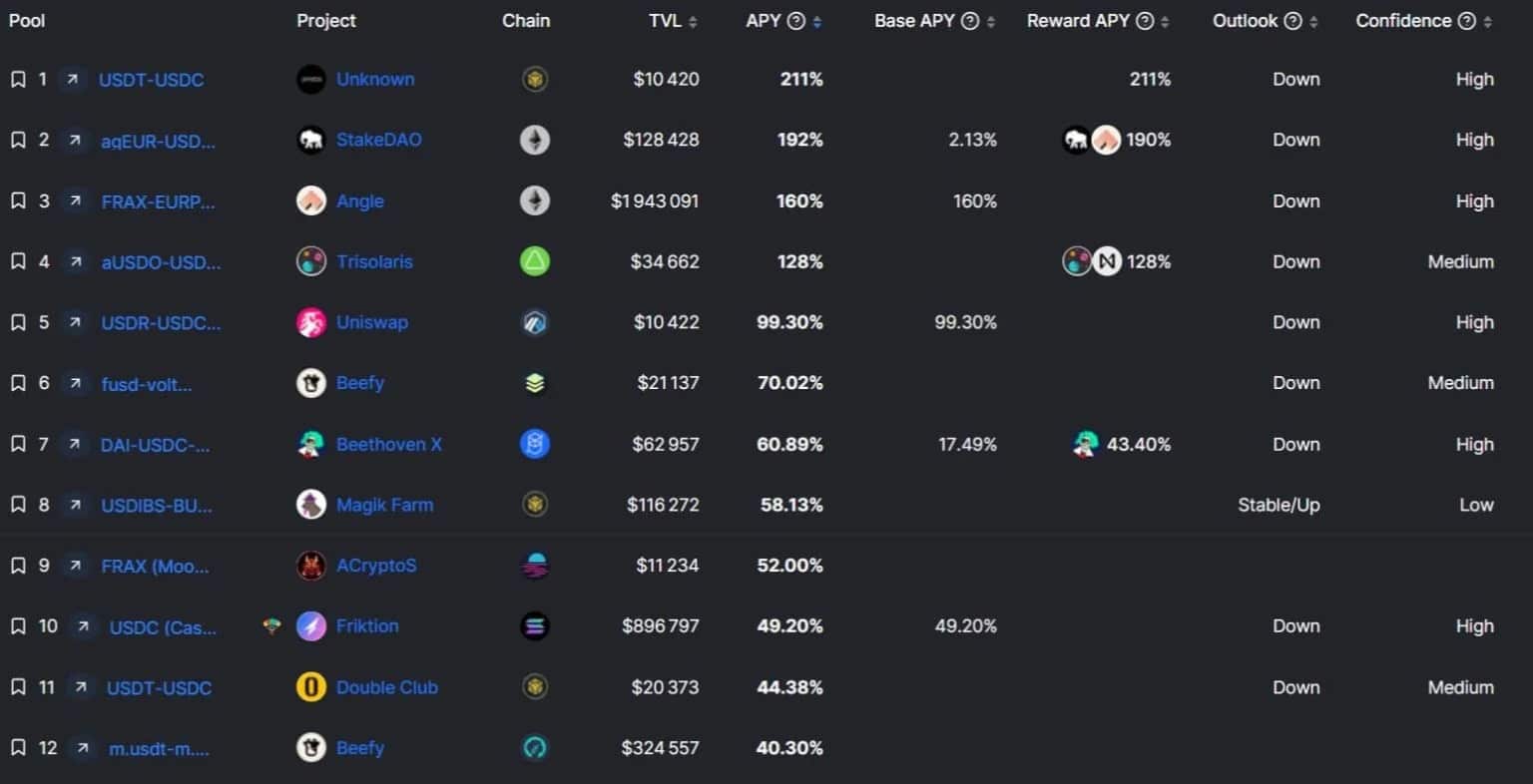

However, in these tough times, solutions like DefiLlama’s pool ranking can help you find great returns quickly, especially for stablecoins which are a great safety net during times of market uncertainty.

The most stable APYs (returns) are usually on the liquidity pools with the highest total locked value (TVL). Indeed, most of the time, the pools with the most attractive compound returns usually have a low TVL:

Ranking of pools in descending order of APY on DefiLlama

Naturally, the greater the capital contribution to a pool, the more the proposed APY will mechanically decrease:

Ranking of pools in descending order of TVL on DefiLlama

With the cryptocurrency market highly correlated to the traditional financial market and its share of uncertainties, it is becoming increasingly difficult to find safe and attractive return solutions. Some projects are still not well known to the general public, and sometimes some cryptocurrency investment strategies can be confusing because of the manipulations involved.

Through our private group at the Grille-Pain, you can benefit from synthesized information and daily market analysis to help you invest intelligently while saving time. Our analysts are specialised in decentralised finance and can help you generate passive returns through step-by-step methods and feedback from their experience in the ecosystem