GOAT is a French start-up offering to awaken your financial wealth using algorithmic trading on Bitcoin (BTC). Founded by experts from the worlds of traditional finance, big data and cryptocurrencies, GOAT provides a simplified solution designed to be used by everyone. How does GOAT work and what is its model?

GOAT, automated Bitcoin savings

GOAT is a Lyon-based startup, founded by Antoine Decourt and Geoffrey Dubus, which aims to democratize investment in an efficient and innovative way using Bitcoin, for both individuals and businesses.

Relying on big data and machine learning, GOAT offers everyone the chance to grow their financial assets in a completely transparent, simplified way, based on an innovative economy.

In this way, GOAT’s teams, made up of experts in both traditional finance and the cryptocurrency market, have succeeded in developing a cutting-edge technology that makes it possible to invest in Bitcoin at the most opportune times, based on current market trends and past fluctuations.

The tool developed by GOAT continuously analyzes market fluctuations to detect the most propitious moments for generating profit, and does so on a sound basis that contains no leverage strategies or other risky methods. What’s more, GOAT’s algorithmic trading is continually adjusted and updated, ensuring maximum market adaptability.

To ensure the security of its users and to offer an investment solution that fully complies with French law, GOAT is registered as a “Prestataire de services sur actifs numériques” (PSAN), a status issued by the French Financial Markets Authority (AMF), which attests to the transparency and seriousness of companies vis-à-vis users, regulators and banks.

GOAT also enjoys pioneering status in this field, as the company is the first to be registered as a PSAN as a digital asset portfolio manager.

This regulatory compliance enables them to forge partnerships with numerous investment professionals (wealth management advisors, family offices, investor networks) and to address a public more accustomed to traditional finance.

GOAT has chosen to offer a simplified, accessible interface, whether you’re an investor or a distributor. Thanks to their partnership with Tilvest, you can access their algorithmic trading solution in just a few clicks, as well as a dedicated customer area for monitoring your trading

Why has GOAT chosen to offer an investment based on Bitcoin?

It’s not for nothing that GOAT has chosen to take advantage of algorithmic trading: this tool, capable of reacting almost instantaneously, lends itself perfectly to Bitcoin’s volatility, well known for offering prime investment opportunities for seasoned traders.

Far from being a recent practice, algorithmic trading is widely democratized within the stock markets: almost 70% of stock market transactions worldwide make use of this trading method.

It’s also here that Bitcoin is, once again, an ideal asset for building up attractive savings. As the BTC market is still relatively young and therefore relatively unexploited, its capitalization, though significant, is still far from rivaling that of traditional markets.

This makes it de facto very competitive, as evidenced by its performance against other established markets:

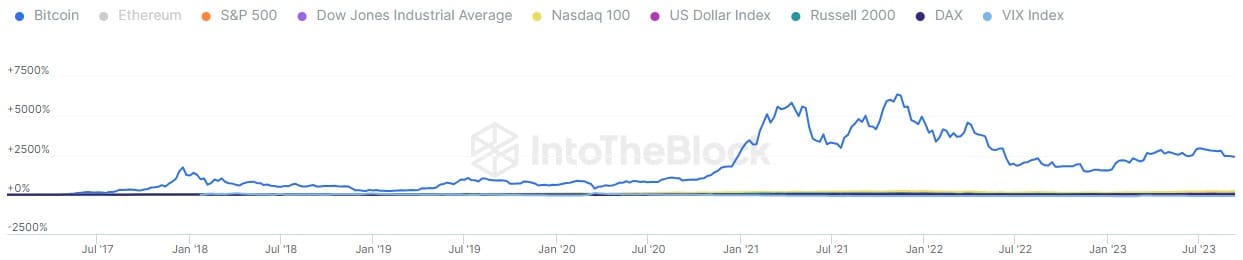

Bitcoin’s performance (blue) against the main Western indices

On this subject, we can also add that BTC is a precisely complementary asset to those long traded on international exchanges, such as gold, currencies, equities and even real estate.

Indeed, these assets are far less volatile than Bitcoin and, more broadly, crypto-currencies, so they complement each other perfectly when it comes to building a solid investment portfolio.

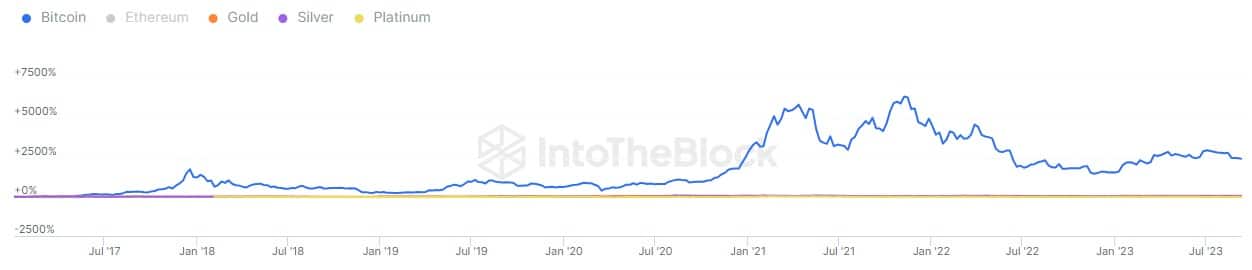

Performance of Bitcoin (blue) against precious metals since January 2017

This complementarity is also to be considered from another point of view: Bitcoin was designed to be a peer-to-peer exchangeable asset, i.e. totally independent of banks and the conventional financial system. This is why, thanks to its decentralized nature, it could be one of the best-performing assets in the event of a major crisis, alongside historical safe havens such as gold. In fact, it is already a good way of protecting against inflation in state currencies.

Finally, although the future is obviously impossible to predict, it is likely that Bitcoin will continue to appreciate in value over the long term, as has been the case since its creation. Indeed, BTC is designed to be issued in only 21 million units, which should mechanically drive up its price if demand also continues to rise. However, this is only hypothetical, as the past performance of an asset does not prejudge its future performance.

How does the GOAT algorithm work and how effective is it?

As we mentioned earlier, the Bitcoin market is volatile, and although this differs greatly from conventional financial markets, it also creates interesting trading opportunities provided the trader is reactive.

This is precisely what the algorithmic trading developed by GOAT is all about, using various technical indicators and past market behavior to capture profit quickly while minimizing risk, whatever the underlying trend.

How did GOAT design its algorithm?

GOAT’s algorithm is completely transparent: it is based on a modified moving average, then determines the best approach to the market by refining its strategy using the Average Directional Index (ADX) and Onbalance Volume (OBV) to measure the power of the move.

Relying on the Relative Strength Index (RSI) and Stop And Reverse (SAR), the GOAT algorithm will define optimal entry points for trading operations. To avoid adding unnecessary risk, GOAT uses no leverage.

To further enhance the trading experience and efficiency, GOAT has recently added an anchored VWAP (Volume Weighted Average Price) layer and a Volume Profile layer to effectively monitor the current position.

It’s worth noting the particularly interesting synergy between Bitcoin’s volatility and the algorithmic trading strategy designed by GOAT. As BTC is naturally subject to pronounced volatility, GOAT’s algorithm is perfectly suited to this, being configured to take profit quickly.

Indeed, it is designed to avoid taking too long an exposure to the market, which would ultimately prove risky. Positions taken by the GOAT algorithm range from a few hours to a few days at most.

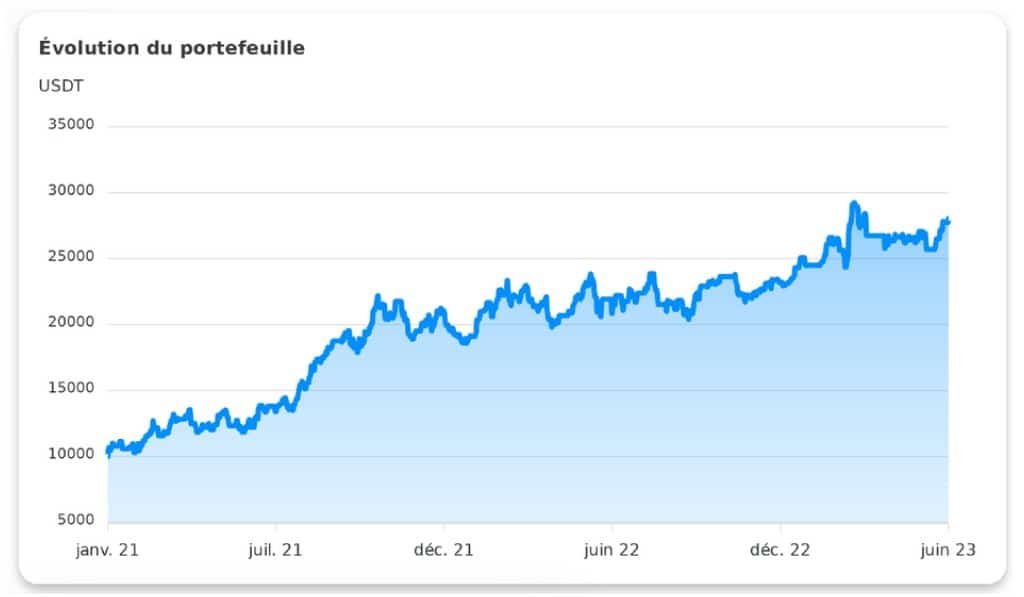

Here’s an overview of performance on a GOAT trading account from January 2021 to June 2023:

Performance of a portfolio managed by GOAT from January 2021 to June 2023

To get a visual idea of what this means, here’s the evolution of the portfolio in question. We can see that with a starting capital of $10,000 in January 2021, the GOAT trading algorithm will have generated around $17,700 in profits from that date to June 2023.

Thus, in our example, the portfolio managed by GOAT now holds $27,700 in USDT, compared with an initial $10,000, representing a gain of 177%.

In parallel, an investor who had simply bought $10,000 worth of Bitcoin on January 1, 2021 and held it until June 2023 would have seen his performance lag behind that of the GOAT-managed portfolio. While the GOAT wallet would have accumulated more BTC, a simple holder would simply have seen his wallet gain 5.2% over the same period.

How to use the GOAT algorithm

To offer its algorithm in a transparent and secure way, GOAT is working with Tilvest, a major French crypto player regulated by the AMF. This partnership enables GOAT to offer a tailor-made trading portfolio that is simplified and accessible to all.

So, after a meeting to define your investment objectives and ensure that your profile matches their offer, it will be possible to take advantage of their trading algorithm in just a few clicks.

Our opinion and conclusion on the GOAT product

GOAT presents itself as an innovative and transparent solution for those wishing to invest and save in Bitcoin efficiently. Founded by experts in traditional finance and cryptocurrencies, this Lyon-based startup has developed a cutting-edge algorithmic trading system that takes advantage of the volatility of the BTC market, offering attractive investment opportunities while minimizing risk.

The decision to focus on Bitcoin is a wise one, as this asset is proving complementary to traditional investments, and offers significant long-term growth potential. As we explained earlier, although BTC’s volatility can be high, GOAT’s algorithm enables us to take advantage of Bitcoin’s volatility by reducing risk as much as possible.

It is this risk management, coupled with the ease of use of its trading algorithm, that makes GOAT a solution suitable for individuals of all levels, as well as wealth management advisors, who may be led to turn to this type of product to offer efficient returns while maintaining controlled exposure.

GOAT is a company registered as a Digital Asset Service Provider, and is therefore regulated by the Autorité des Marchés Financiers.

In short, GOAT offers a compelling opportunity for those wishing to invest in Bitcoin in an intelligent, automated way. With its skilled team, advanced technology and convincing results, this platform stands out as a promising choice for investors looking to maximize their Bitcoin investment without having to scour the market or immerse themselves in complex trading strategies.

Finally, on the strength of its good results in 2022 and convincing growth, GOAT aims to consolidate its pioneering position and become market leader in France. The company has therefore decided to open up its capital and is currently raising funds from a number of investors.