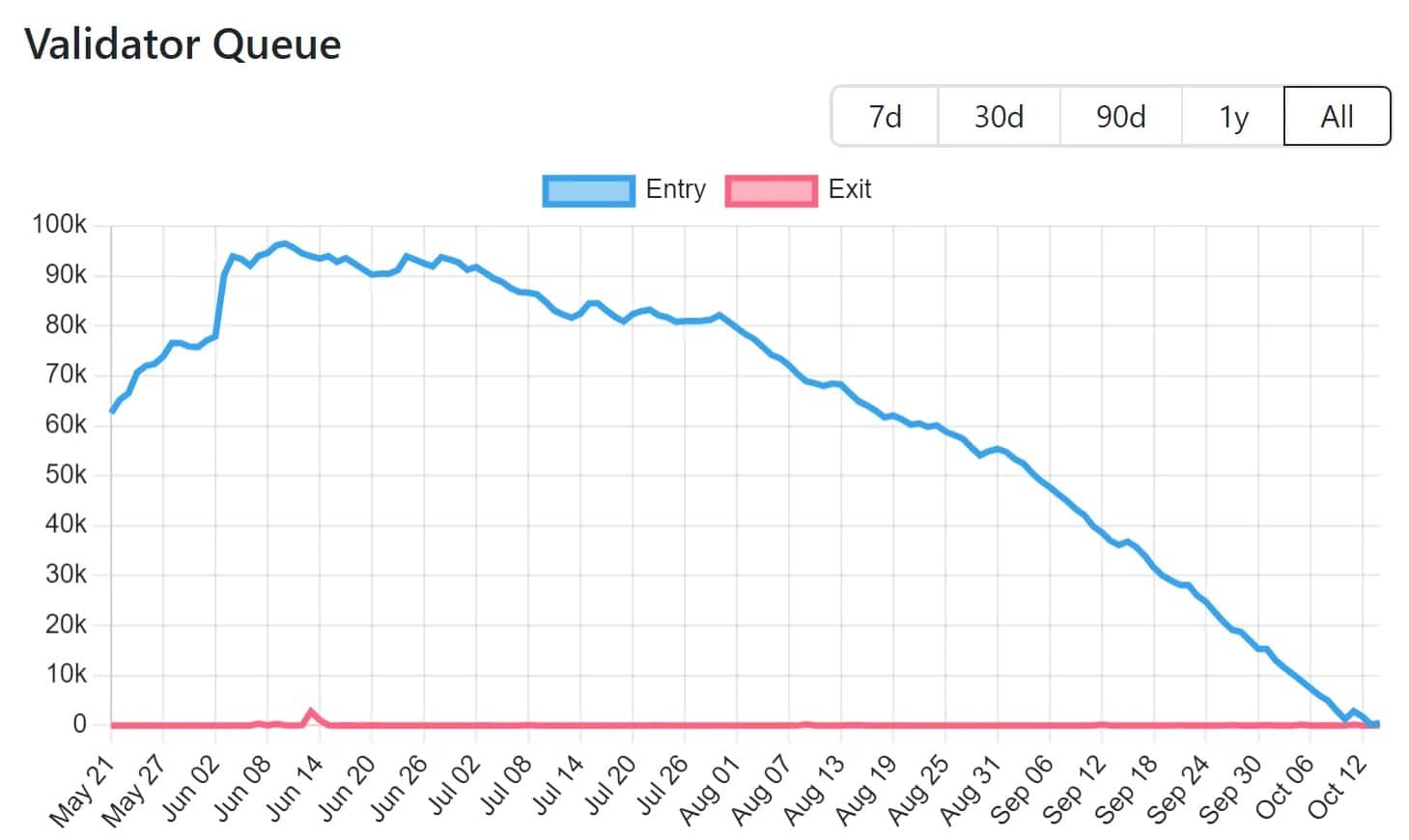

While it took over a month to become a validator on Ethereum (ETH) last June, it now takes just 2 hours. Let’s take a look at the latest important staking statistics.

The queue to become an Ethereum validator has fallen sharply

The success of Shapella last April meant that the queue to become a validator on the Ethereum blockchain (ETH) stretched over many days, even months. In fact, it takes a certain amount of time for the network to welcome new validators, at a rate of 13 per epoch, with an epoch generally lasting just over 6 minutes.

So a massive influx over a short period of time can create bottlenecks, which have since been resolved.

With a queue that peaked at 96,508 validators on June 10, representing more than 44 days of waiting, it now takes just over 2 hours with 251 validators waiting at the time of writing :

Figure 1 – Validator queue on Ethereum

At the same time, we can see that the queue to stop being a validator has never really been very long and this operation is now done instantly, given the fact that almost nobody wants to get out.

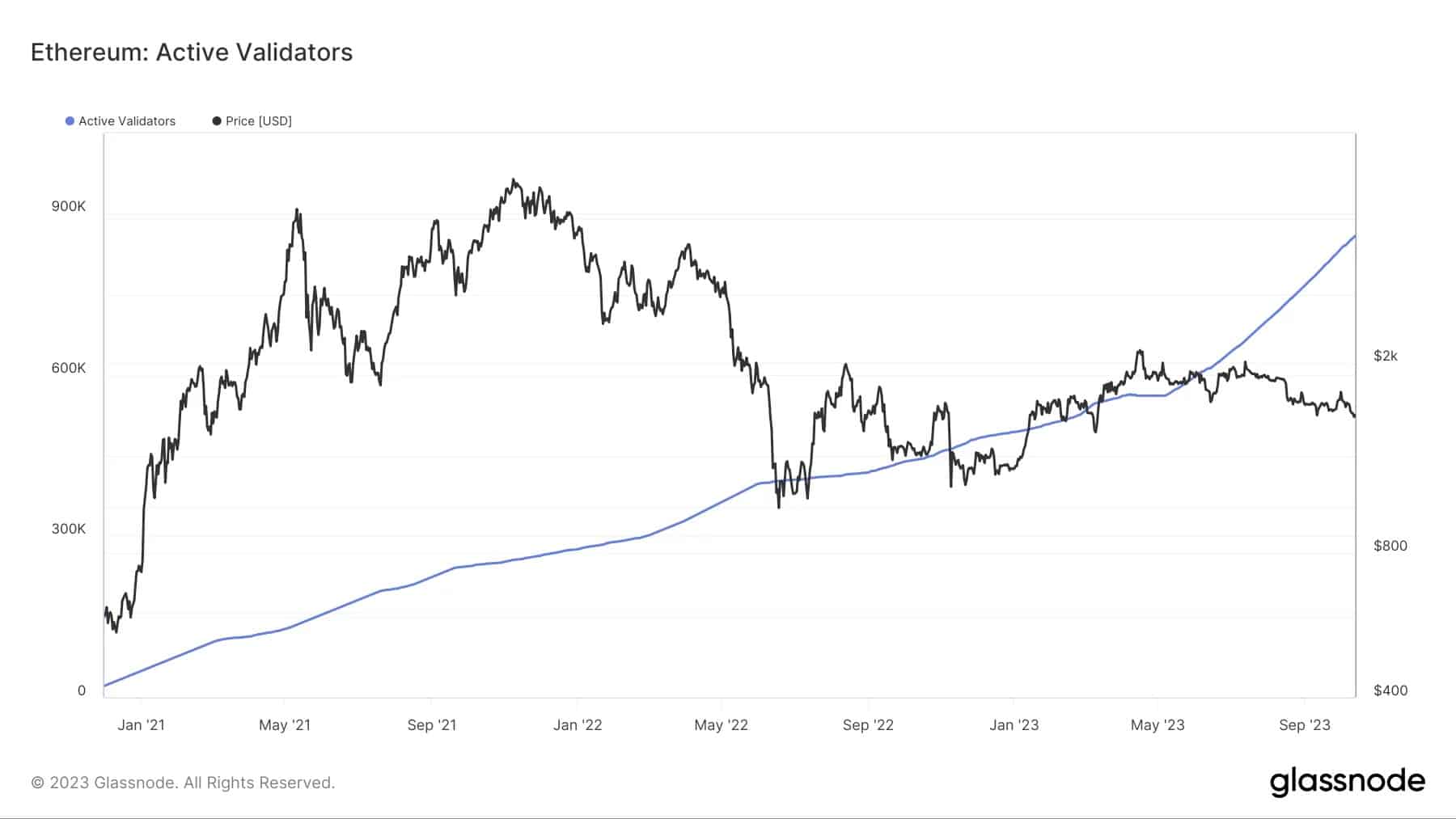

The number of validators has increased by 53% since Shapella

Since April 13, the number of validators securing Ethereum has seen an unprecedented increase. From 561,655 to 859,790, this represents 53% growth in 6 months:

Figure 2 – Increase in the number of validators (in blue) since the opening of staking on Ethereum

While the queue is shrinking, the number of validators has never fallen. Last August, we observed that 20% of existing ETHs were securing the blockchain, and this figure has now risen to 22.8%.

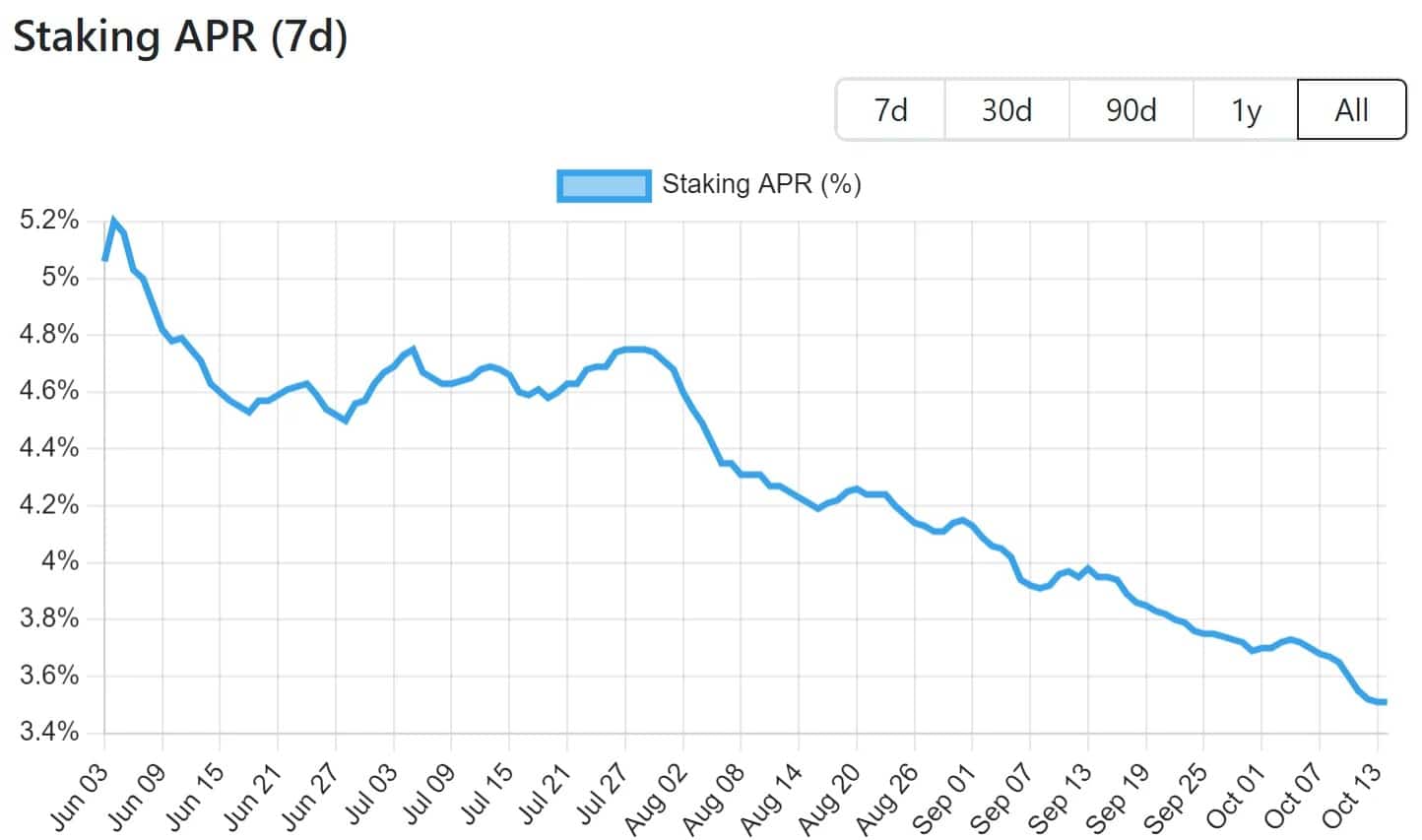

This increase mechanically drives down yields, as the share of new ETHs is constantly being shared between more new players.

As a result, while staking provided 5.2% APR on June 4, this annual yield has fallen to 3.51% today:

Figure 3 – APR on ETH staking in 7-day moving average

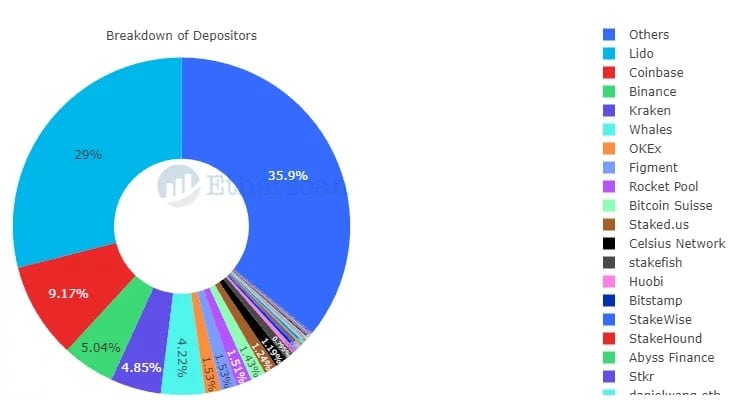

Furthermore, Lido continues to lead the way in staking by a wide margin, with 29% of the network’s validators. Centralized platforms such as Coinbase, Binance and Kraken share 9.17%, 5.04% and 4.85% of the market respectively:

Figure 4 – Distribution of Ethereum staking players

While the centralization of the network in the hands of a few players may be debatable, it will be important to monitor this development in the future.