In the wake of the USDR stablecoin depeg this week, one person traded what was previously worth over $131,000 for almost no USDC. How could this happen?

Depeg of USDR stablecoin results in error at $131,000

This week, a stablecoin named Real USD (USDR) suffered the loss of its dollar peg, and is now trading at around $0.53.

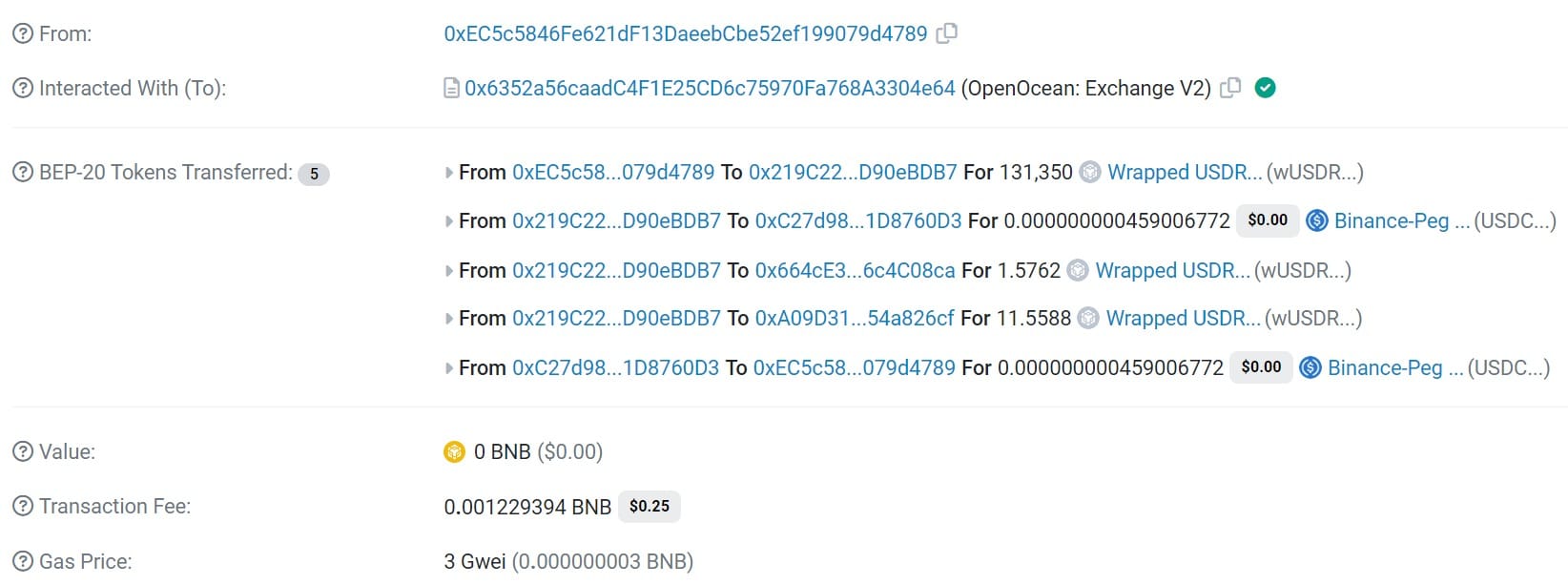

In what could be a panic reaction, one investor exchanged what was until recently worth $131,350 for dashes of USDC, as shown in the transaction below:

Trade of wUSDR for USDC

For its part, the X Lookochain account identified that a bot capitalizing on Maximal Extractable Value (MEV) had used this error to successfully arbitrage at $107,000:

Due to the decoupling of the stablecoin USDR, this guy accidentally swapped 131,350 $USDR for 0 $USDC while panic selling $USDR

And a MEV bot successfully arbitraged $107K.https://t.co/FHOJtaGcSDhttps://t.co/IYtoqar29N pic.twitter.com/USLF1qkVDK

– Lookonchain (@lookonchain) October 12, 2023

The cause of this disastrous result for the person behind the first transaction may lie in the illiquidity of the token exchanged. USDR is natively present on Polygon (MATIC), and we can see here that it’s a version packaged on the BNB Smart Chain: wUSDR.

It’s a safe bet, then, that the pool used on OpenOcean, the decentralized exchange (DEX) used for this transaction, contained no liquidity to allow trading at the right ratio, resulting in a very large slippage.

To avoid such a setback, it’s a good idea to pay close attention to the minimum quantity received announced when trading on a DEX. Ideally, you should also use liquidity aggregators such as Paraswap or 1inch, which are designed to find the best rate for a trade.

What’s next for the USDR?

First of all, it’s worth noting that USDR is powered by the Tangible project, and stablecoin is supposed to be collateralized in a mixed way, with both real-world assets (RWA) and DAI for example. Nevertheless, 12 million DAI were claimed against USDR on Wednesday morning, leaving the stablecoin treasury with a high proportion of illiquid assets, leading to panic and a 50% fall.

After the events, Tangible shared a plan of action to try and get its protocol users out of this predicament, nevertheless, the project also indicated that the fate of its stablecoin was sealed:

“That said, Tangible’s future will not include Real USD. We’ll share a full post-mortem once we’ve had a chance to unpack the last 24 hours. The USDR will be obsolete once the redemption process shared above is complete. We tried something new with Real USD, but there were too many attack vectors in the design. “

While such a depeg had no real ecosystem-wide consequences, this episode serves as a reminder that it pays to diversify your stablecoin reserves too, while reasonably limiting your exposure with regard to projects that have yet to prove their resilience.