The European banking sector’s main stocks are plummeting on the stock market, as concerns grow about the risks of contagion following the collapse of Silicon Valley Bank. It’s the first time in history that a company has been able to make a difference in the lives of its employees and their families.

Major bank indices are falling

Concerns about contagion risks are intensifying on Wednesday, March 15, after Silicon Valley Bank’s woes. Despite a short-lived respite yesterday, on the sidelines of the US Federal Reserve (FED) Chairman’s remarks, European markets fell sharply again today.

“Calm down. Calm down, and look at the reality […] the French banking system is not exposed to the Silicon Valley Bank”. Despite a reassuring speech by Bruno Le Maire, the French Minister of the Economy, investors feared a cascade of bankruptcies following the collapse of SVB.

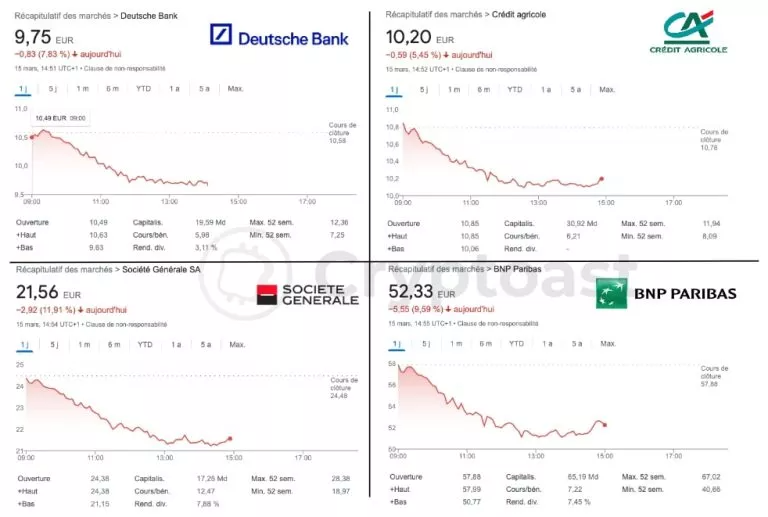

However, Europe’s major banking stocks were indeed shaken. At the time of writing, BNB Paribas and Société Générale are down 9.59% and 11.9% respectively. Germany’s largest bank, Deutsche Bank, is down 7.83% today. The Euro Stoxx Banks Index is down 6.84%.

Europe’s main banking indices at 3:55pm, Wednesday 15 March 2023

Some observers see Bitcoin (BTC) acting as a safe haven against the failure of banking institutions. While this view is not shared by the majority, the fact remains that the market’s leading cryptocurrency printed 20% in the space of 3 days, immediately following the announcement of SVB’s collapse and the start of contagion fears.

As our financial markets expert analyst, Vincent Ganne, points out to TCN Research subscribers, the $25,000 threshold is an important pivot to cross and consolidate to definitively mark the return of the bull market. In parallel, the $19,800 support – former ATH – has been perfectly held:

“In weekly data, what we see is that the essential was preserved, it was the 19,800 dollar chart boundary. “

Credit Suisse worried

To return to the main topic of this article, the sharp increases in central bank interest rates over the past year or so, which are designed to fight inflation, have undeniably slowed economic activity and weakened banks.

At the moment, the real fear lies with Switzerland’s second largest bank. Credit Suisse’s share price has plummeted to 1.56 Swiss francs, marking a new all-time low following an announcement this morning that had a devastating effect.

The Swiss bank’s main shareholder, the Saudi National Bank, said it was unable to provide further financial support:

We can’t because we would exceed 10% (of the capital). It’s a regulatory issue “

The risk of contagion cannot be ruled out, but it should not have an inordinate impact. Indeed, the situation of Credit Suisse has been known to many banking institutions for years. As a reminder, the share price has fallen by almost 98% since 2009. Other European banks have been reducing their exposure to Credit Suisse for several years.

The emergency doors are slowly closing for Credit Suisse. If the situation does not improve in the next few weeks, it would appear that only the state can help. This is a possibility that cannot be ruled out, as the bank plays such an important role in the country’s economy.