Entrepreneur Justin Sun has reportedly transferred $200 million in USDT and 5,000 Ethers (ETH) to the Huobi exchange, amid rumours of the platform’s insolvency. A Huobi spokesperson denied that the address belonged to Justin Sun, but on-chain data seems to indicate otherwise.

Justin Sun to Huobi’s rescue

While Huobi has been sailing in troubled waters ever since rumours of insolvency hovered over its head, Justin Sun could be bailing out the exchange’s coffers, which are already mainly made up of TRX, HT (Huobi’s token), BTCT (Tron’s Bitcoin), HBTC (Huobi’s Bitcoin) and USDD, Tron’s stablecoin, if we exclude Bitcoin.

Main cryptocurrencies of the Huobi reserve

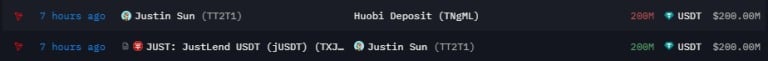

Effectively, as revealed by PeckShieldAlert, an address labelled as belonging to Justin Sun would have transferred USDT 200 million from JustLend, a decentralised finance protocol (DeFi) from Tron, to Huobi. At the same time, he also allegedly transferred 5,000 Ethers (ETH), or $9.14 million at the time, from one of his Ethereum addresses to Huobi.

PeckShieldAlert JustinSun labeled address on Tron withdrew 200M $USDT from JustLend and transferred it to Huobi JustinSun labeled address on Ethereum transferred 5, 000 $ETH (~$9. 14M) to Huobi pic.twitter.com/UusSEaooJA

– PeckShieldAlert (@PeckShieldAlert) August 8, 2023

Although it may seem harmless at first glance, a Huobi spokesperson has reportedly told CoinDesk that the address does not belong to Justin Sun (an article he himself shared on X). However, it has been identified as such by PeckShieldAlert, and also by Arkham. The Ethereum address is also labelled as belonging to Justin Sun by Etherscan

Meanwhile, observer Adam Cochran noted that the address that transferred $200 million “had a history of sweeps to Huobi” and therefore it was likely that Justin Sun “withdrew funds from the Huobi hot wallet, used the funds and then deposited through his deposit address to ‘show his resilience’. “

Huobi, new FTX?

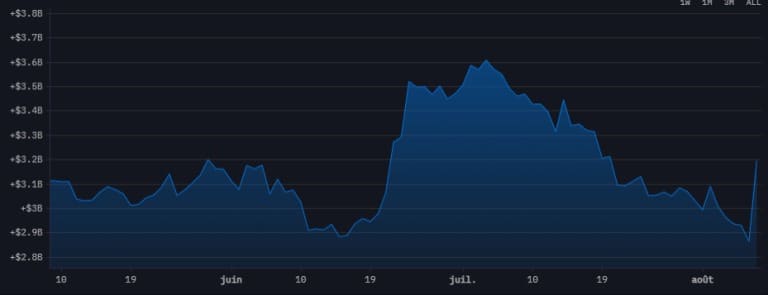

According to data from Arkham Intelligence, Huobi has a negative balance of around $2 million over the last 24 hours, while Justin Sun has sent around $210 million to the exchange’s deposit contract. This corroborates the Nansen data shared yesterday, which showed that the exchange had lost $33 million over 24 hours.

As we can see below, Huobi’s balance soared after Justin Sun’s recent deposit, whereas it had been in sharp decline since the beginning of July.

Huobi balance over 3 months

Outflows explained by recent rumours of the platform’s insolvency and the arrest of some of its executives. This, combined with the fact that, as Adam Cochran revealed, on-chain data seems to indicate that Justin Sun misappropriated client funds for personal gain.

For his part, he simply posted a message on X calling for “ignore the FUD”, a day after posting a simple “4”, thus imitating Changpeng Zhao, the CEO of Binance.

HT’s share price is fairly stable, however, falling by just 2.4% over the past 7 days.