Through a statement, Coinbase announced that swaps from Tether’s USDT to Circle’s USDC would now be free on its platform. It also touted its stablecoin to promote stability and security. An admission of weakness, considering the USDC’s significant loss of market capitalization in recent times?

Coinbase highlights its USDC

Coinbase, one of the world’s largest exchanges, issued a statement on December 8 urging its users to switch from USDT stablecoins to the USDC

Switch to a trusted stablecoin: USD Coin (USDC). Now convert Tether (USDT) to USDC with zero fees.https://t.co/OObSqNWdpj

– Coinbase (@coinbase) December 8, 2022

In the same press release, Coinbase announces that its users will now be able to swap their USDT for USDC without any fees. This is an aggressive marketing move, but motivated, according to Coinbase, by a concern for “stability and confidence”. Also, we can read:

” […] The events of the last few weeks have tested some stablecoins and we have seen a flight to safety. We believe the USD Coin (USDC) is a trusted and reputable stablecoin. […] We will continue to work to provide our customers with safe and responsible ways to hold and grow their cryptos. “

Stablecoins are cryptocurrencies whose role is to track the price of a stable asset such as the US dollar or the euro in order to provide stability to their holders and the market. To learn more about these important crypto-currencies, read our page on stablecoins.

According to the exchange, the USDC is backed at a 1:1 ratio by cash and short-term US Treasury bills, both held in regulated financial institutions, all of which are audited monthly by Grant Thornton LLP.

A sign of panic for Coinbase

First of all, let’s remember that Coinbase is closely linked to the USDC. Indeed, the exchange is itself the originator of CENTRE, the consortium to which Circle, the issuing company of the USDC, belongs. So, such an effort to highlight its USDC appears to some as an admission of weakness:

Not a good look. Also looks desperate.

Makes me trust USDC a little less tbh.

– Byzantine General (@ByzGeneral) December 9, 2022

” This doesn’t look good. And it looks desperate. It makes me feel a little less confident in the USDC, to be honest. “

This announcement should be seen in the context of various news items that have occurred recently that may have had a deleterious effect on the USDC. Firstly, Binance announced in September that USDCs sent to its platform would be automatically converted into BUSD, its own stablecoin, which has been gaining ground in this market section.

Also at that time, Circle had frozen wallet addresses linked to Tornado Cash without even receiving an order from the authorities, which some said revealed a certain zeal on the part of the company.

At the same time, Tether, the USDT issuer, made a 90-degree turn to increase its transparency as much as possible, including hiring one of the world’s largest auditing firms and completely eliminating its share of commercial paper to secure USDT.

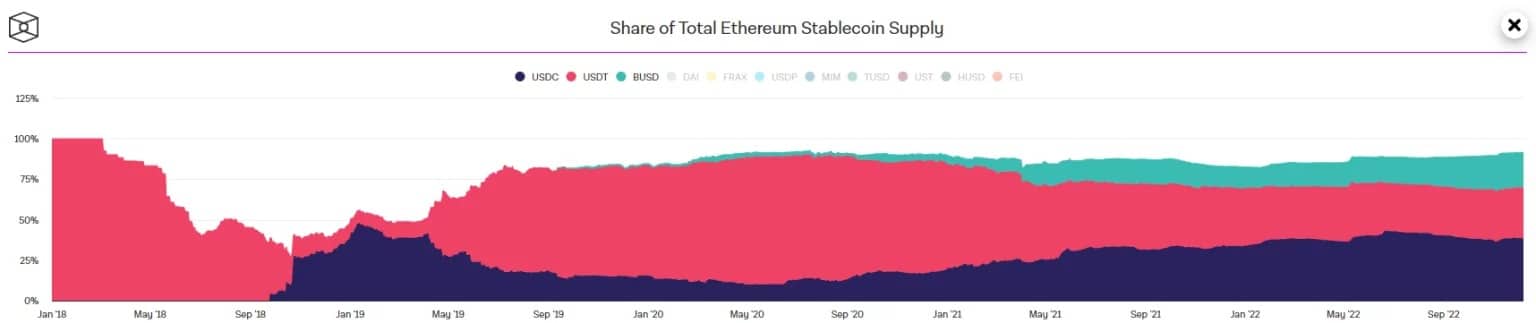

Share of total stablecoin supply in circulation, with USDC (blue), USDT (red) and BUSD (green)

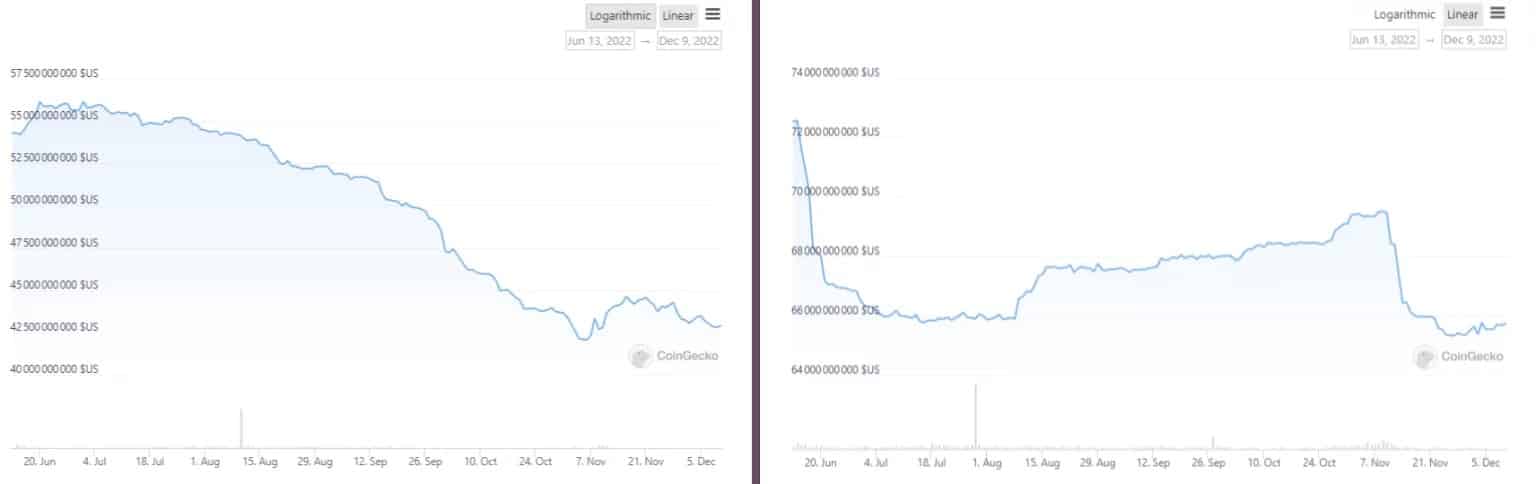

Indeed, Circle’s USDC has suffered severely from these events, with its market capitalisation falling from just over $56 billion in July to $42 billion currently, a drop of $14 billion.

Over the same period, Tether’s USDT capitalisation has fallen from $72 billion to $65 billion, a drop of $7 billion.

Market capitalisation of USDC (left) and USDT (right)

The historic conflict between the 2 stablecoins continues, but Binance’s BUSD, while quiet, remains one to watch given its growing role in the stablecoin market.