This week, government officials from Brazil and Argentina will meet in Buenos Aires to discuss a proposed common currency for the region. The aim of this currency is clear: to increase trade on the continent while reducing the influence of the US dollar.

A future common currency in South America

Brazil and Argentina, the two biggest economic powers in South America, have ambitions to create a new currency that could extend to the various states in the region. To implement this project, discussions are scheduled this week between the two countries at a summit in Buenos Aires: a programme is to be drawn up to develop this monetary tool in the years to come.

The objective of this currency is to increase trade between South American countries while reducing dependence on the US dollar for international trade. Initially planned to be bilateral, Argentinean Economy Minister Sergio Massa says the initiative is now open to discussions with neighbouring countries.

It will be decided to study the parameters necessary for the creation of a common currency, which includes everything from fiscal issues to the size of the economy and the role of central banks. […] It is Argentina and Brazil that are inviting the rest of the region. “

If an agreement is formally reached between the region’s two major powers, the new currency will not be rolled out for years of discussion and debate: according to Sergio Masse, it took Europe 35 years to develop the euro. In addition, Brazil will have time to test and disseminate its own central bank digital currency (MNBC) before this common currency appears.

Major geopolitical issues

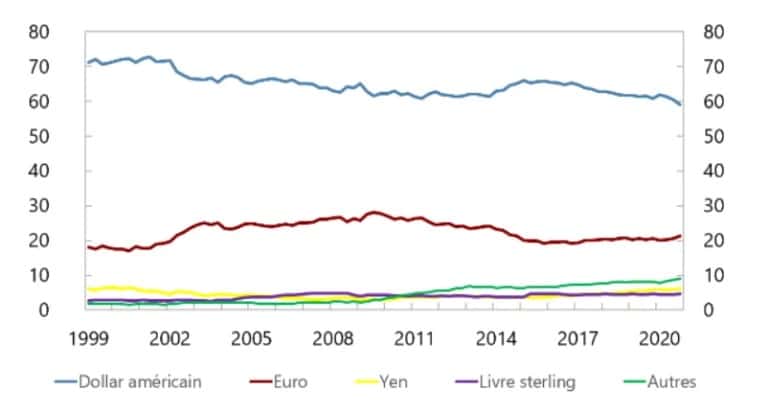

The creation of a new currency for this region of the world is not insignificant. While in 2002, the dollar represented 70% of the foreign exchange reserves of central banks, this rate has decreased over the last twenty years until it reaches 59% in 2020. In other words, states around the world are gradually moving away from the US dollar to reduce the impact of US policies on their economies.

Figure 1 – Graph showing the share of major currencies in the foreign exchange reserves of the world’s central banks, 1999-2021

As the economy of a single country is not strong enough to cope with the hegemony of the US currency, some states have the ambition to create geographical areas gathering countries around a common or single currency. As a reminder, while a common currency is circulated alongside national currencies, a single currency permanently replaces the currencies of the territories included (such as the euro).

The currency planned by Brazil and Argentina will initially be a common currency, operating alongside the Brazilian real and the Argentine peso. According to Spanish economist Alfredo Serrano Mancilla, this common project is an opportunity for South and Central American countries that want to be more economically independent from the US:

“The monetary and exchange rate mechanisms are crucial. […] There are opportunities today in Latin America, thanks to its economic strength, to find instruments that substitute the dependence on the dollar. This will be a very important step forward.

It should be noted that South and Central America are pioneering regions in the search for monetary and financial independence: in September 2021, El Salvador adopted Bitcoin (BTC) as a legal tender alongside the US dollar, provoking the displeasure of the US, the IMF and the World Bank.