The panic in the cryptocurrency markets over the weekend has seen Bitcoin’s (BTC) dominance of other cryptocurrencies fall. Altcoins are actually showing smaller drops: a notable trend?

Bitcoin’s dominance declining

Bitcoin’s dominance, i.e. the share of total cryptocurrency capitalization it represents, had already been trending downward during the year. While it accounted for more than 70% of the total market cap in January, it was overtaken by altcoins at the beginning of the year. By April, Bitcoin’s dominance had passed the fateful 50% mark: altcoins have since accounted for more than half of the total cryptocurrency market cap.

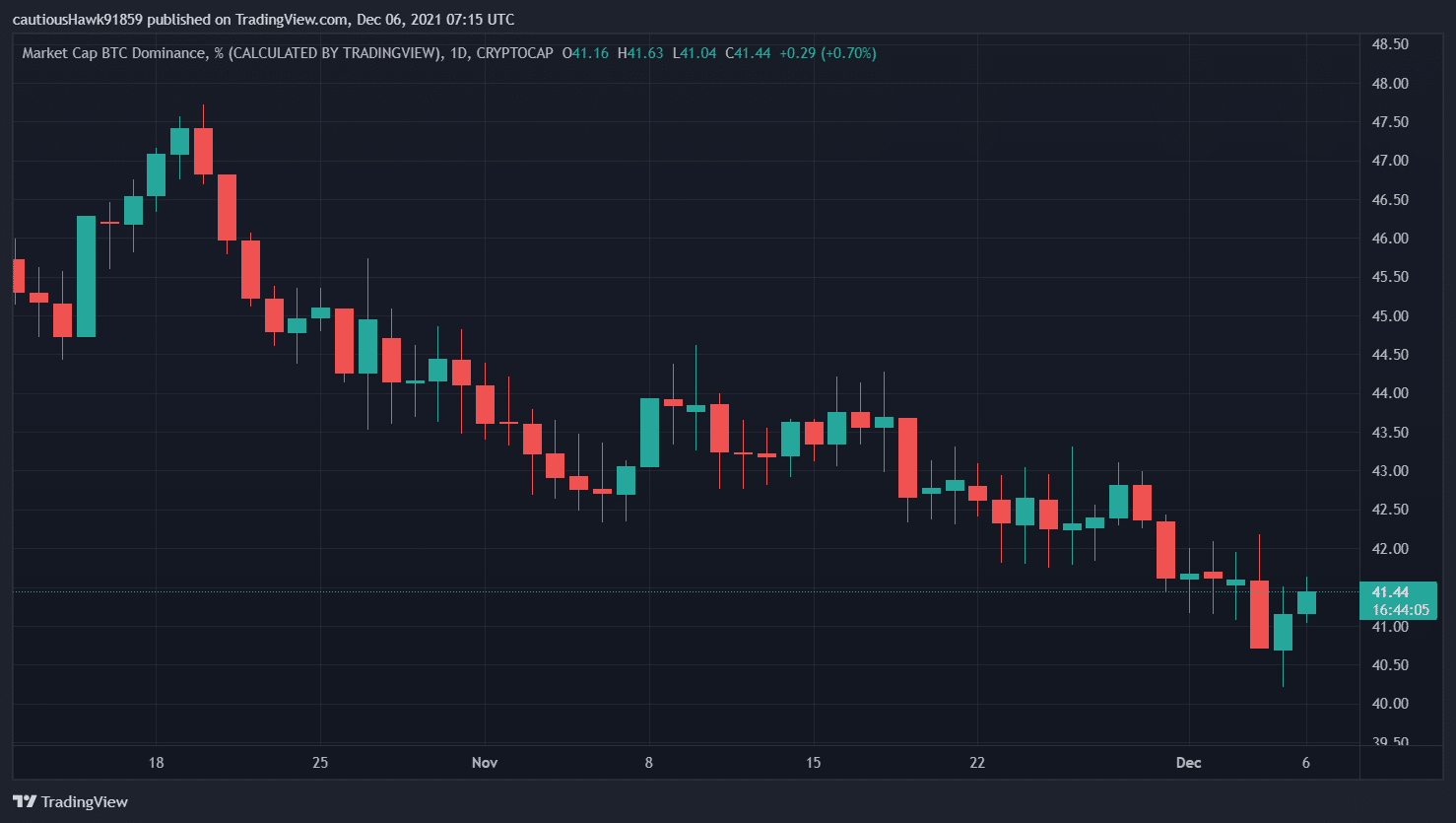

And the recent price drop has only accelerated the trend. The numbers vary depending on the data aggregators, but dominance is said to be around 40% currently, after falling continuously since late October

Percentage dominance of Bitcoin (Source: TradingView)

According to CoinGecko’s data, this percentage has reached 38% this morning. BTC’s capitalization still hasn’t climbed back above $1 trillion, although the price has partially recovered from its big scare

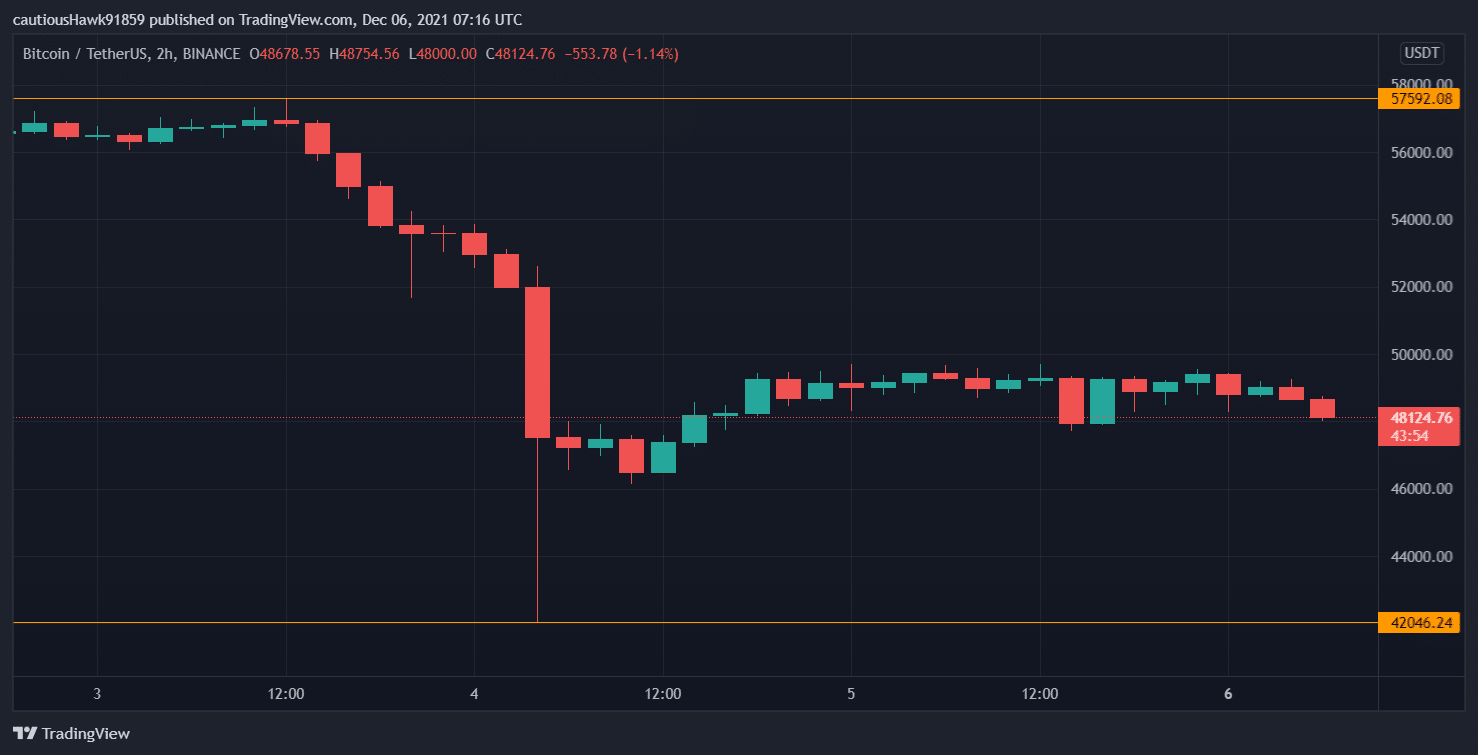

Bitcoin price partially recovers from its fall (Source: TradingView, BTC/USDT)

The price of BTC is indeed $48,200 this morning, with a capitalization of $914 billion. The $50,000 mark appears to be the cryptocurrency’s new short-term goal.

Altcoins are doing (slightly) better

What has caused commentary during the sharp fall in Bitcoin’s price is that some altcoins seem to have partially decoupled from BTC’s price movements. This has been the case with the Ethereum ETH price, which is “only” falling -3.9% over the week (compared to -15.2% for BTC currently).

It is also worth noting that Solana’s SOL lost -5% over the same period, while its peers are posting double-digit falls. Special mention also goes to Terra’s LUNA, which has the audacity to rise +24.3% over the week, ignoring the bloodbath.

A sustainable trend

It’s a trend that seems to be starting to emerge with BTC’s latest price moves: altcoins would be less subject to the moods of the largest cryptocurrency. This suggests that their value propositions are now more distinct in the minds of investors than they have been historically.

This is an interpretation found in a recent report from Messari, which explains that BTC and ETH are not viewed with the same eye… But that a “flippening” is still not about to happen:

The probability of a flippening in 2022 is perhaps 20%. […] If ETH manages to overtake BTC, it will not be because it is a superior currency, but rather because the market values the most unique computing platform … and its growth potential, over digital gold.

This is still notable, however, and that it shows that the queen of cryptocurrencies has moved away from Ethereum and its bevy of “killers.” We will continue to watch the trend in the coming months.