Binance has unveiled an index built on the top 10 biggest cryptocurrencies on the market. From November, it will be possible to set up a DCA on this new product, similar to an ETF in principle.

Binance presents its Top 10 crypto index

With its new “CMC Top 10 Equal-Weighted” index, Binance now tracks the performance of the 10 most capitalized cryptos in the market.

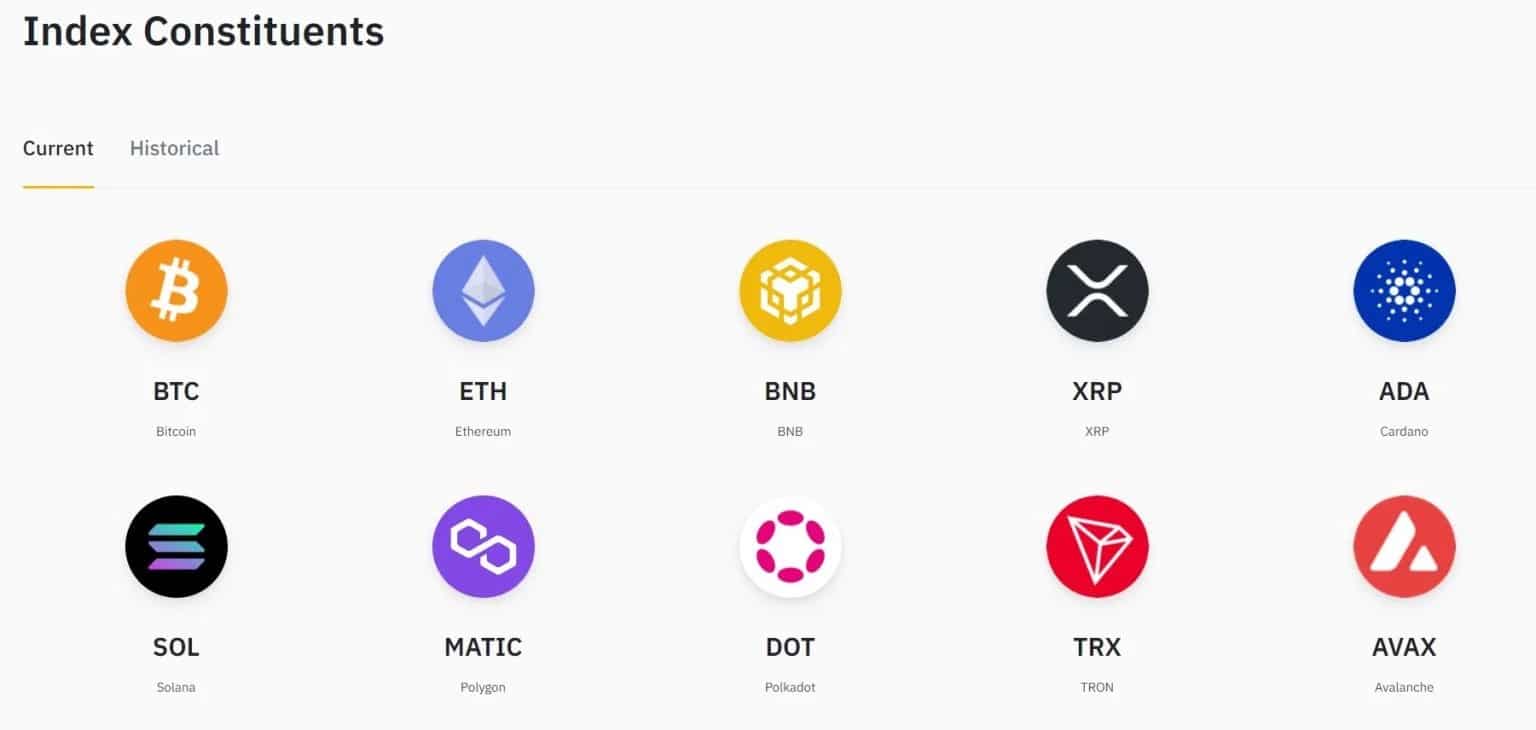

This new index is called Equal-Weighted, which means that each of the assets that make up the index has the same importance in the overall price. In this case, each of its components weighs 10% of the price. At the time of writing, the CMC Top 10 is worth about $1,000 and includes the following crypto-currencies:

Composition of the Binance CMC Top 10 Equal-Weighted Index

The constitution of this tracker is bound to change as the market evolves, and it requires a few conditions to be met in order to be included. Therefore, stablecoins backed or not by a fiat currency, as well as “memes coins” like DOGE or SHIBA are not eligible. In addition, an asset must be listed for at least 30 days on Binance and CoinMarketCap.

In a way, the CMC Top 10 index is similar to an Exchange Traded Fund (ETF), although it is different in its technical and legal construction. Its composition will be rebalanced on the last Monday of each month. In addition, its trading date starts on 22 September and its price is updated every minute.

A simple tool for investors

From November, Binance will allow direct investment in this index, thanks to its “Auto-Invest” product. The latter allows to implement an investment strategy based on the Dollar Cost Averaging (DCA), directly on Binance. It is thus possible to buy crypto-currencies at programmed intervals, with the BUSD or USDT stablecoins in one’s account.

This product, coupled with this new index, can therefore be a relevant investment vehicle for someone who wants to diversify their portfolio in a simple and automatic way.

Moreover, Binance does not plan to stop there, and has already announced that new indices will arrive as early as 2023, without specifying their composition for the moment.

In addition to Auto-Invest, this and future indices are to be integrated into other exchange products, although Binance has not yet specified which ones. In this way, the platform continues its policy of offering a variety of solutions, allowing anyone to invest in cryptocurrencies in a simple and accessible way.