Non-fungible tokens (NFTs) are going through a difficult period, and Bored Ape Yacht Club (BAYC), one of the most prestigious collections, is also feeling the effects, as are Azuki. While Bitcoin (BTC) has shown renewed momentum since the start of the year, NFTs continue to face challenges, raising concerns about the future of some flagship collections.

The floor price of Bored Ape Yacht Club has fallen below 30 ETH

While 2021 will have been as complicated for cryptocurrencies as it has been for non-fungible tokens (NFTs), this correlation has been erased since Bitcoin (BTC) has rallied. Indeed, while the latter is now sailing above $30,000 – and posting an 87% gain since the start of the year – NFTs have not benefited from the crypto market’s momentum. Quite the contrary, in fact.

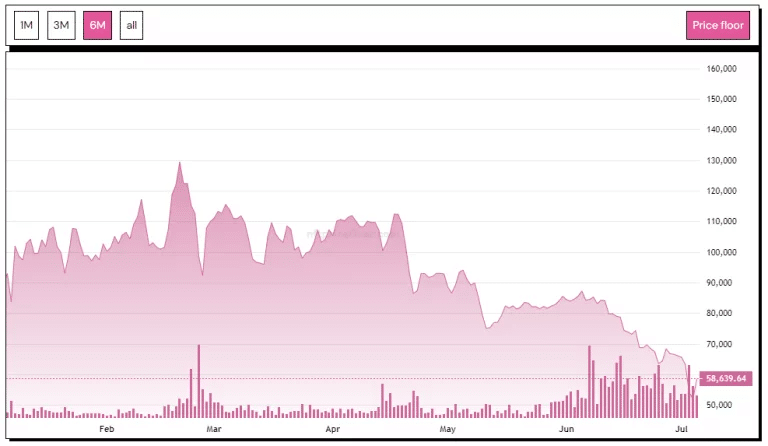

And this has not even spared the flagship collections of the non-fungible token ecosystem, generally referred to as “blue chips” in this respect. The Bored Ape Yacht Club (BAYC) collection, undoubtedly the most emblematic because of the sometimes staggering prices that some of its rarest coins have fetched, saw its floor price fall below the symbolic threshold of 30 Ethers (ETH) on Sunday, i.e. around $58,700.

Evolution of the floor price of the NFT Bored Ape Yacht Club collection over 6 months

The floor price is the most common metric used to measure the value of a collection. It is calculated on the basis of the average minimum price desired by sellers of the same collection in order to assess its trend.

By way of comparison, at their peak in April 2022, Bored Ape Yacht Club NFTs were trading at a floor price of 152 ETH, or around $429,000. In other words, this represents a drop of around 88% when you consider the price reached by the collection on Sunday.

Although NFTs are generally experiencing downward momentum, BAYCs have seen their price fall in part as a result of a massive sale by collector Machi Big Brother, who sold around fifty of his NFTs in the space of a few days. Using the Blur platform, he reportedly sold 19 BAYCs for $1.2 million in a single transaction.

Some observers have also noted that rapper Eminem’s BAYC (9055), which he acquired for $1.3 million in January 2022, is now worth just $60,000.

Azuki and other NFT collections also affected

Azuki, one of the flagship collections of the NFT ecosystem, is not to be outdone; a group of some of its owners recently got together to demand a refund of $40 million following the controversial drop of Azuki’s latest ‘Elementals’ collection.

On average over the last 30 days, the Azuki collection has seen its average price fall by more than 43%. This drop is even more edifying over the last 7 days, where the collection has lost 59% of its value, approaching the symbolic $10,000 mark.

We just had a “Black Weekend” for NFTs.

Floor prices for BAYC, MAYC, Azuki, Memeland Captainz and other PFPs fell 30 – 60%, accelerating over the weekend.

What caused all of the panic selling?

It all started with the Azuki Elementals mint.

The Azuki community spent $38M to… pic.twitter.com/AQp1tslNFJ

– Teng Yan ⛩ (@0xPrismatic) July 3, 2023

“This has been a “black weekend” for NFTs. Floor prices for BAYC, MAYC, Azuki, Memeland Captainz and other PFPs have fallen by 30-60%, and this fall accelerated over the weekend. […] This has triggered a sudden lack of confidence that has spread throughout the NFT communities: Are NFTs worthless / overvalued as everyone in CT is saying? “

According to Blockchain reporter Wu, more than 1,200 NFTs have been liquidated over the past 3 days, which is a record in the history of non-fungible tokens. Of these 1,200, more than 630 are Beanz NFTs, a parallel collection of Azuki.