Ark Invest, headed by Cathie Wood, recently sold $5.26 million worth of Coinbase (COIN) shares via its Ark Fintech Innovation Fund ETF. The move, surprising given COIN’s steady rise in share price this year (over 250% since January 2023), comes on top of other recent sales on its part. Here’s an update on Ark Invest’s movements:

Ark Invest disposes of over $5 million in Coinbase shares

Ark Invest, Cathie Wood’s ETF company, has sold $5.26 million worth of COIN shares in US cryptocurrency exchange Coinbase. A decision that may have come as a surprise to some, as Coinbase’s share price has been on an almost constant upward trend since the beginning of the year, with an increase of over 250% since January 1, 2023.

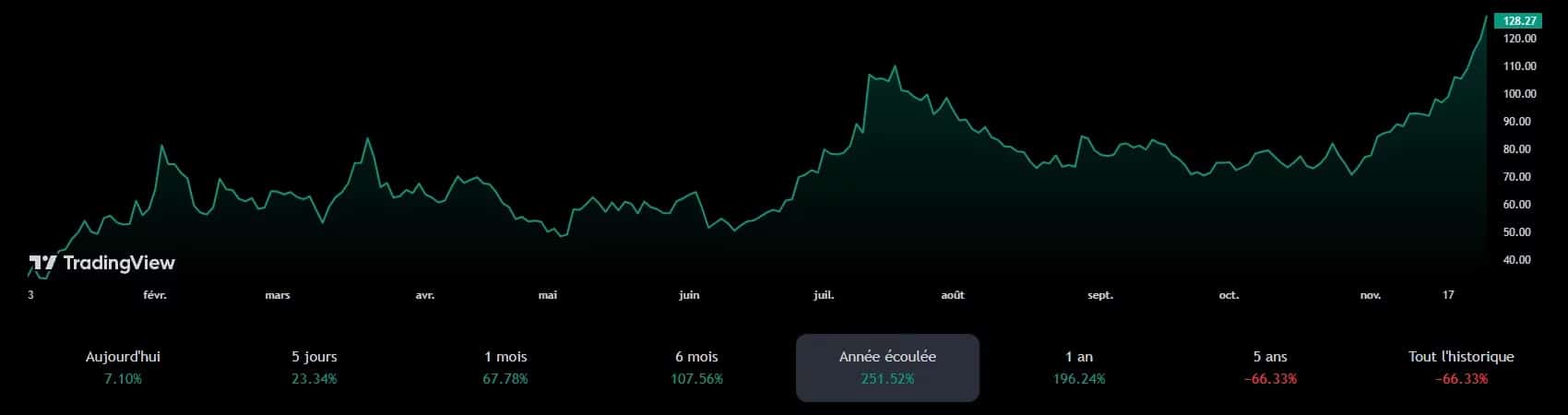

COIN share price evolution since the beginning of 2023

The sale took place through the company’s Ark Fintech Innovation Fund ETF, which sold 43,956 COIN shares at a unit price of $119.77 on the Nasdaq exchange. Coinbase’s share price has continued to rise since then, trading at $128.27 at the last market close.

This is their highest price since April 2022, shortly before the collapse of the Terra ecosystem (LUNA).

Ark Invest had previously sold 53,000 COIN shares last July via its Ark Next Generation Internet ETF, when they were trading at around a hundred dollars. Ark Invest’s latest transaction is noteworthy in that it enabled it to purchase 143,063 Robinhood shares for around $1.2 million.

Last Friday, Ark Invest had already added $780,000 worth of HOOD shares to its Ark Fintech Innovation ETF. On the same day, Cathie Wood’s company also decided to sell $2.8 million worth of shares in the Grayscale Bitcoin Trust.

For the first time in 2 years, the discount of the GBTC – incidentally the world’s largest crypto fund – recently fell below the symbolic threshold of 10% compared with the net asset value (NAV) of the asset it is supposed to replicate, namely Bitcoin.

Evolution of the GBTC versus its NAV, Bitcoin

The GBTC is now on an almost continuous upward trend since its lowest discount of almost 49% at the beginning of the year. This is due to the progress made by Grayscale, its parent company, which is making considerable headway with its project to convert the Grayscale Bitcoin Trust into a cash Bitcoin ETF.

Indeed, the SEC has recently opened up to dialogue with Grayscale, to the extent that the company’s general counsel has publicly stated that “it’s no longer a question of if there will be [an ETF], but just when. “