Animoca Brands, the pioneer and now undisputed giant of Web3 gaming, has announced the launch of a $2 billion investment fund through its co-founder, Yat Siu. The fund will focus on developing companies operating in the metaverse sector and strengthening the digital property rights of users of these virtual worlds

Animoca Brands bets big on the metaverse

With a valuation of over $5 billion, Animoca Brands is one of the leading players in the Web3 gaming space, thanks in part to its pioneering role in the ecosystem and its development of successful titles such as The Sandbox (SAND).

Today, Animoca Brands has decided to make a concrete shift towards the metaverse by announcing the upcoming launch of an investment fund entirely dedicated to this type of virtual universe under the name “Animoca Capital”.

According to Yat Siu, co-founder and executive chairman of Animoca Brands, the fund is aiming for $1-2 billion. No funds have been raised yet, but this should not be long in coming, as we already know that Animoca Capital should make its first investment next year.

In line with one of its last fundraising rounds of 75 million dollars, which was already focused on the metaverse, Animoca Brands wants to enhance the value of its users’ digital property rights, a sine qua non, according to the company, for the proper development of this ecosystem.

Yat Siu specifies that the fund will operate internationally without any geographical restrictions.

A global entry point for Web3 investment

According to the co-founder of Animoca Brands, this new investment fund could be an entry point for companies wishing to invest in Web3, since Animoca Capital will be oriented towards companies at a minimum stage of development:

“For many traditional investors, it’s safer to invest in companies that are in the growth phase up to an advanced stage. This is very different from investing in a seed startup, which has a much higher risk. “

He says Animoca Capital’s primary role will be to make various strategic investments to develop the Web3 ecosystem and create an “active market” rather than focusing on financial returns per se.

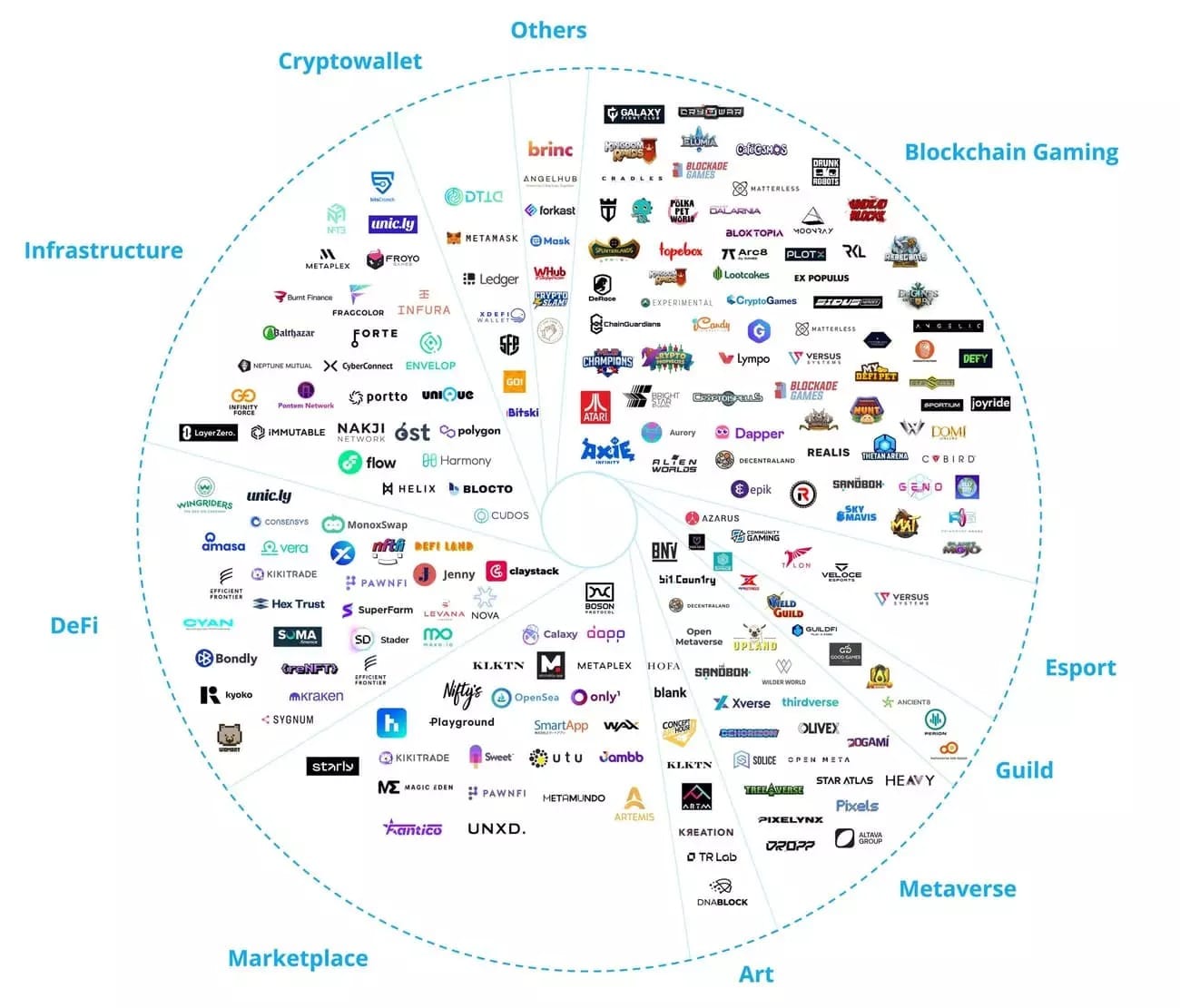

At the time of writing, the giant Animoca Brands has invested in over 340 different projects across a multitude of sectors, including MetaMask, Ledger, Magic Eden, Immutable, Dapper and Axie Infinity.

Overview of Animoca Brands’ investments in the Web3 universe

In parallel to the future arrival of Animoca Capital, which will therefore be oriented towards the development of the metaverse ecosystem itself, Yat Siu spoke of the “need” for a second fund that would be more dedicated to the role of investment vehicle in order to generate profit, without however revealing more.