The FTX affair is profoundly changing the relationship between users and centralized exchange platforms (CEX). The FTX affair is changing the way users relate to central exchange platforms (CEX), as they have been fleeing them massively for the past month in favour of more secure solutions

Users withdraw $2.9 billion from exchange platforms

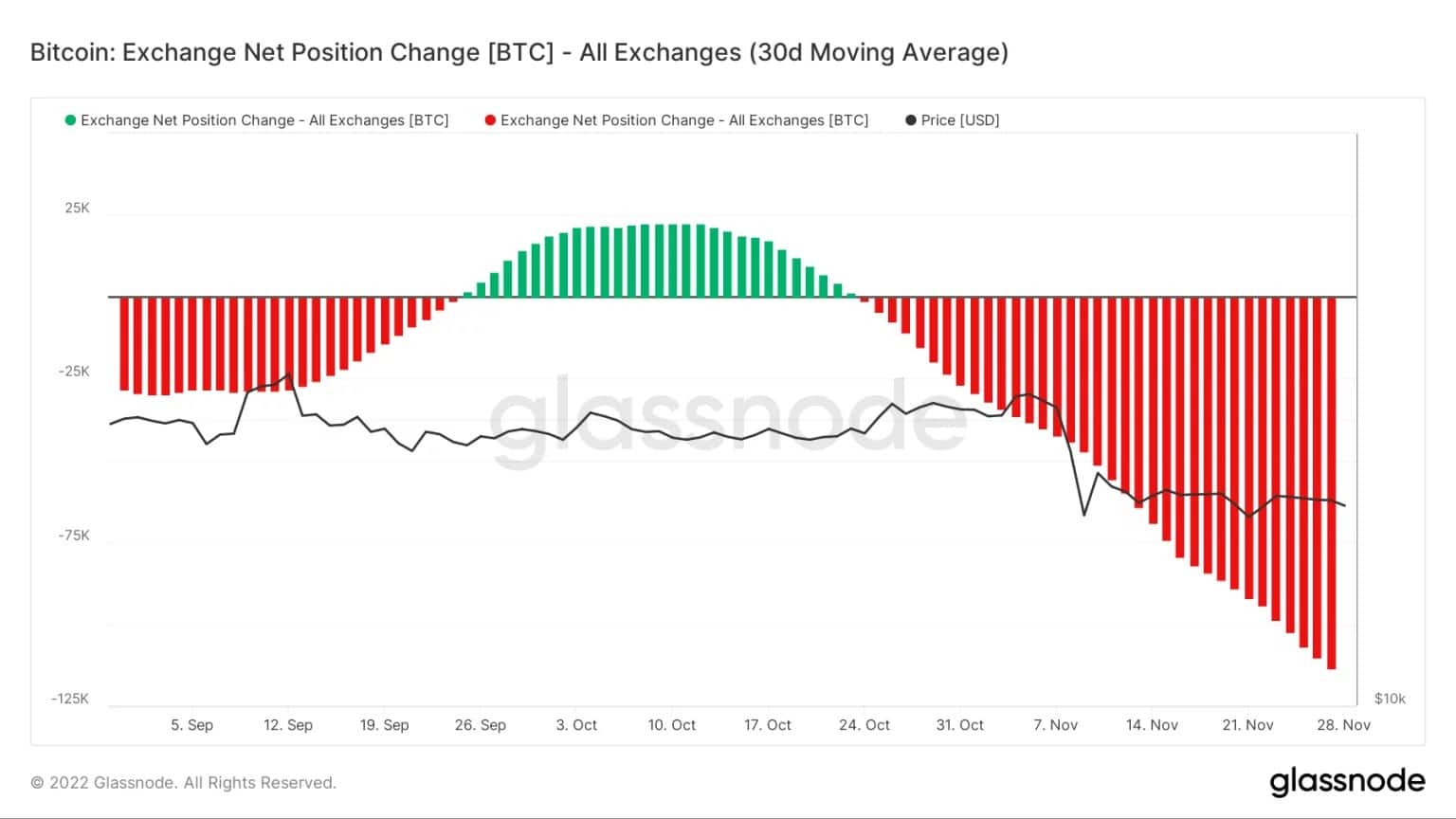

As we explained in the middle of the month, the exodus of investors from centralized trading platforms has begun. And the trend has only continued since then, according to a new report from Glassnode. The analysis firm has put a figure on withdrawals from CEXs over the month: the sum has reached $2.9 billion at current prices.

And the trend is accelerating: we see that more and more bitcoins (BTC) were withdrawn during the month of November.

FTX case prompted users to withdraw their funds from centralized exchange platforms

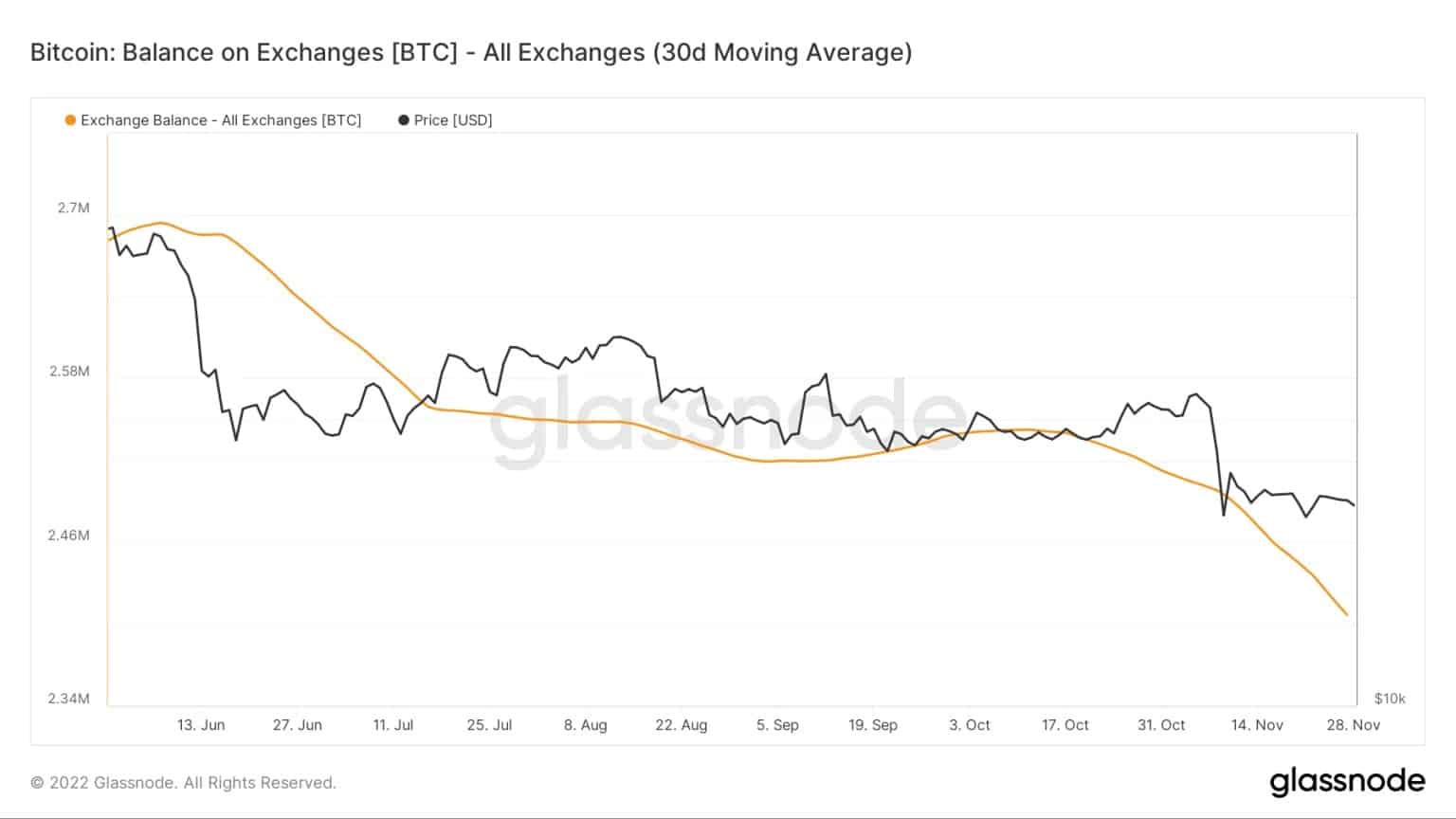

Bitcoin outflows are the highest recorded in 4 years. The trend was already in retreat for users, but this has been confirmed since October:

Number of bitcoins (BTC) on exchange platforms

For its part, the price of BTC continues to live after having suffered successive consistent falls. Stuck at around $16,500 last week, it took a new dive last night and is trading around $16,100 this morning.

A paradigm shift

All this shows that the prevailing ideology that the “big” platforms were too massive to collapse was wrong. Just as in the traditional banking sector, no entity seems to be immune: a lesson investors have learned at considerable cost in recent weeks.

The fallout from the affair is likely to be far from over, but already a real paradigm shift for the ecosystem is taking shape. The rush to cold wallets like Ledger’s is no coincidence: users want to regain control of their cryptocurrencies for fear of having them blocked.

For some, the considerable damage done to the industry’s reputation is a small disaster in itself. For others, it is a purge to return to decentralised ideals more in line with the origins of the cryptocurrency. Which interpretation will prevail? The ecosystem is learning the lessons of its biggest crisis, and that will take some time.