Polygon (MATIC) is a protocol linking several scalability solutions for the Ethereum blockchain. It allows developers to quickly build a scalable custom blockchain compatible with the Ethereum Virtual Machine (EVM). Thanks to its Plasma-based technology, Polygon makes it possible to reconcile speed and security, without abandoning decentralisation. Let’s discover Polygon’s unique architecture, synonymous with great modularity

What is Polygon (MATIC)

In 2017, at the dawn of decentralised finance (DeFi), the question of the scalability of the Ethereum blockchain (ETH), i.e. its ability to process many transactions in a short time, began to be seriously considered. This is when the Matic Network protocol was born in India, the result of the work of three developers from the Bitcoin community.

In their research, the Matic Network team came across a publication by Ethereum co-founder Vitalik Buterin and Joseph Poon, co-founder of the Lightning Network, detailing a new scalability solution: “Plasma”. This solution is based on the duplication of a parent blockchain, which will be copied more quickly while maintaining security. The Plasma solution will form the basis of the Matic blockchain.

Matic Network will become Polygon in early 2021. More than just a name change, this redesign signals a shift from a single blockchain to an aggregator of scalability solutions for Ethereum. Any developer can therefore come and create a scalable blockchain.

Polygon (MATIC) logo

The different types of blockchains on Polygon

Polygon is a very modular platform offering great flexibility in consensus methods. Nevertheless, we can distinguish two main categories of blockchains:

Secured chains are in fact Layer 2. This category includes solutions from Optimistic Rollups, ZK Rollups, Plasma, etc. The security of these blockchains is maintained by means of a security service (SaaS).

This SaaS exists in two forms:

- Security is maintained through the parent blockchain using proof of validity;

- The blockchain is secured by a set of validators selected by Polygon in exchange for a fee (similar to the Polkadot parachains).

This SaaS option is perfect for young protocols that lack a large enough community to secure the blockchain. Projects that require increased security are also targets of this option.

Stand-alone chains are sovereign. They are fully responsible for their security (i.e. they have their own set of validators). Their degree of flexibility in the consensus method is therefore high. They are used in particular by companies or well-established protocols that require this level of customisation.

The general architecture of Polygon

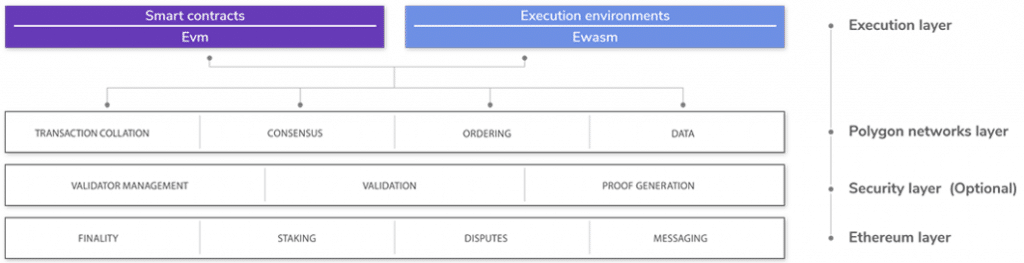

Any new scalability solution deployed on Polygon must respect a structure. This structure is divided into 4 modular and customizable parts:

-

The security layer contains a set of validators that secure Polygon’s blockchains for a fee. In particular, it hosts the SaaS validators and the services necessary for its operation. This layer exists in two forms: one running on a blockchain parallel to Ethereum (called meta blockchain) and one hosted on Ethereum directly.

These first two layers are optional, as a solution built on Polygon can decide on its sovereignty and its parent blockchain (Ethereum is widely prioritised today). The next two layers are mandatory.

- The Polygon layer contains all the blockchains that are deployed on it. Respecting this layer allows communication between all the solutions. It is on this layer that block production and local consensus are managed.

- The execution layer is responsible for the execution and coordination of transactions on Polygon blockchains. It is composed of two sub-layers:

- The execution environment (also called the EVM).

- The execution logic layer that defines the state of a particular Polygon blockchain. It is in the form of an Ethereum smart contract.

Polygon network architecture (Source: Polygon)

Polygon’s consensus method

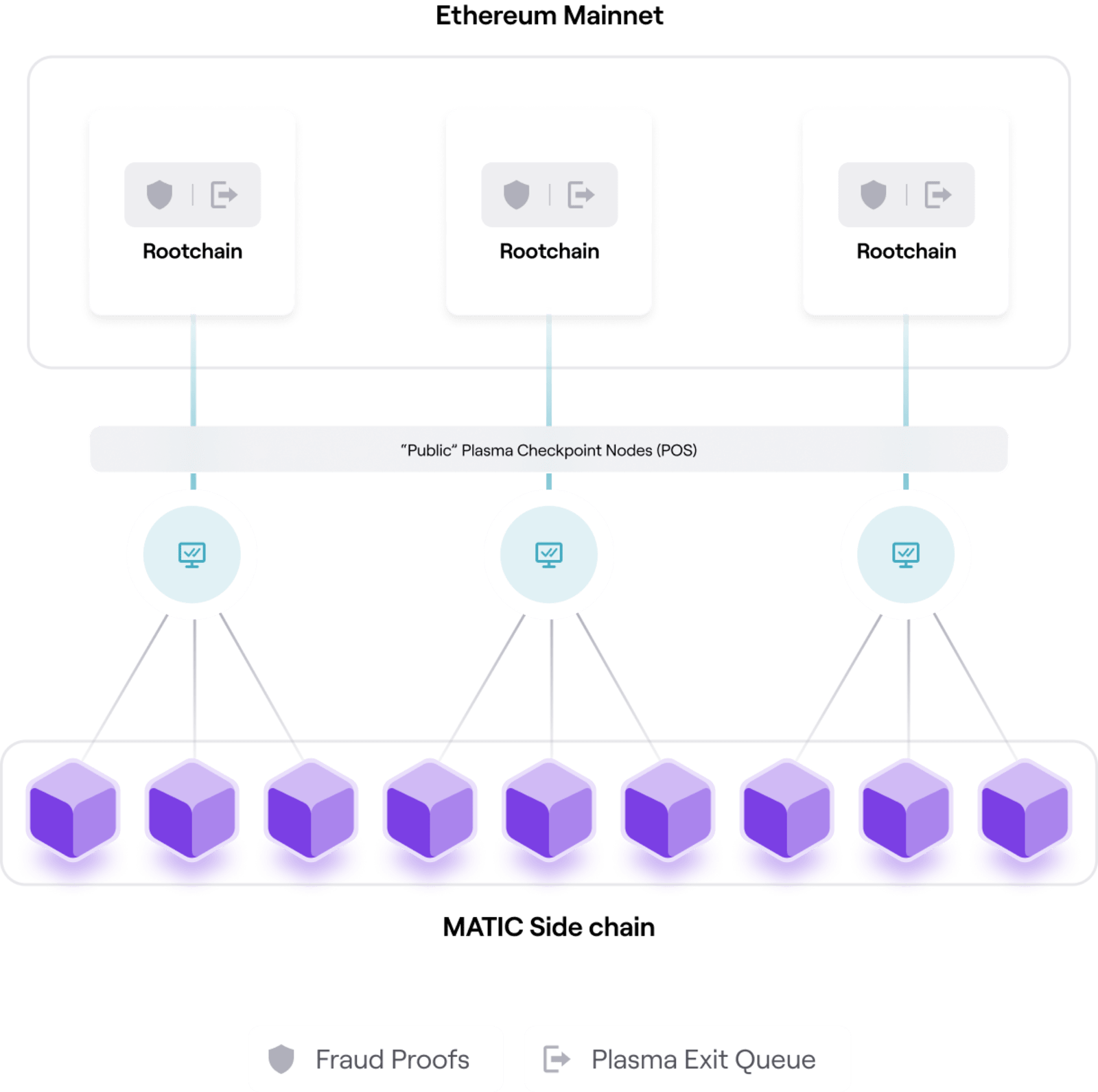

To enable the Polygon network to be fast without compromising security or decentralisation, the team designed a two-stage solution based on Plasma. The first, called Bor, is responsible for producing the blocks on the various Polygon blockchains. The second, Heimdall, is responsible for securing the global network with the help of the parent blockchain. These two stages are proof-of-stake (PoS) blockchains.

Bor (or “MATIC Side Chain”) is a secondary chain (called child chain) copied from Ethereum. The creation time of a block is very low, thanks in particular to the few players who produce them (between 7 and 10). This layer is responsible for aggregating transactions into fast blocks.

Heimdall (or “Plasma Checkpoint Nodes”) is actually a set of validators (between 100 and 120), who wear a customs hat. Their role is to aggregate several blocks of the Bor chain into a single Merkle root (a transaction of several transactions). This then passes through a checkpoint where a fraud check is performed. This root is then sent to the Ethereum blockchain (the parent blockchain), where transactions are finalised.

Polygon Consensus Method (Source: Polygon)

The unique feature of this two-stage operation is that both layers use the same set of validators. The 7-10 validators that produce blocks on Bor are selected using the Peppermint method (from the Cosmos protocol) from the 100-120 validators in Heimdall. These are then responsible for producing blocks for a certain period of time (a ‘span’), before being replaced.

On Heimdall, the same Peppermint mechanism is used. A validator is randomly selected in proportion to the number of MATIC tokens in his possession. He must verify and publish the Merkle root on the Ethereum blockchain.

The Polygon ecosystem

Polygon’s ecosystem is flamboyant. This is particularly due to the proximity that the platform has with Ethereum, unlike other solutions like Avalanche or Polkadot which are not really close to it natively.

Polygon’s internal ecosystem

Inside Polygon itself, there are already 7 scalability solutions developed in the space of 1 year. Two of them are already usable at the time of writing (February 2022):

- Polygon PoS, the heir of Matic Network. It is still the most used blockchain in the Polygon ecosystem thanks to its age and its simplicity of use;

- Polygon Hermez, the first scalability solution implementing Zero Knowledge Proofs on Polygon. This is added when Polygon announces the acquisition of the blockchain from ZK Rollups Hermez in mid-2021.

Four other solutions are under development:

- Polygon Miden, a solution from ZK Rollups based on STARK technology, also under development by Starkware;

- Polygon Nightfall, a unique solution that combines Optimistic Rollups and ZK Proofs technologies. Developed in collaboration with EY, it is focused on the confidentiality of transactions;

- Avail, a scalable blockchain dedicated to availability and data flows;

- Polygon Zero, an ultra-fast blockchain from ZK Rollups for generating zero-disclosure proof of knowledge in record time.

A final solution has been developed by the core team: Polygon Edge, a Software Development Kit (SDK) that can be compared to a toolbox. It allows any developer to create their own scalability solution on Ethereum, fully compatible with the Ethereum Virtual Machine (EVM) and Ethereum tools. The consensus mode can also be chosen and changed very easily.

Polygon’s external ecosystem

Due to its complicity with Ethereum, its low fees and the use of EVM, Polygon has a very large catalogue of decentralised applications (DApps). There are currently more than 7,000 applications on its network. The vast majority of these applications are hosted on the Polygon PoS Chain.

Many mature DeFi applications have migrated to Polygon (or integrated in parallel with Ethereum) such as Aave, Curve or Uniswap. Others such as Quickswap, a fork of Uniswap, are native to Polygon.

There are also multiple applications linked to non-fungible tokens (NFTs) such as OpenSea, Unstoppable Domains, Decentraland and The Sandbox.

Polygon is also compatible with bridges such as Hop Exchange or Multichain. These greatly facilitate the transfer of assets between different blockchains.

According to the Defi Llama website, which lists the largest decentralised applications on each blockchain, Polygon ranks 8th in terms of total locked value (TVL) at the time of writing.

The tweet below provides a non-exhaustive overview of the Polygon ecosystem.

More and more projects are coming to Polygon Is Polygon the 1 Layer2 Ecosystem now? pic.twitter.com/uf6vP7qemc

– Coin98 Analytics (@Coin98Analytics) September 2, 2021

What are the roles of the MATIC token

The ERC-20 MATIC token is the native cryptocurrency of the Polygon platform. It is what is known as a utility token, i.e. a token that is purchased for the purpose of accessing services.

Like ETH on Ethereum or BTC on Bitcoin, MATIC tokens are used to pay fees on all blockchains that make up the Polygon network. These fees vary depending on the scalability solution used, but remain minimal.

MATIC tokens can also be delegated to validators in order to secure the Polygon PoS Chain. On this Proof of Stake (PoS) Blockchain, the first 120 validators (ranked by number of locked MATICs) are rewarded in proportion to the number of tokens in their possession.

In the near future, the MATIC token will also be used in the Polygon DAO. This initiative comes with the aim of decentralising the governance of Polygon.

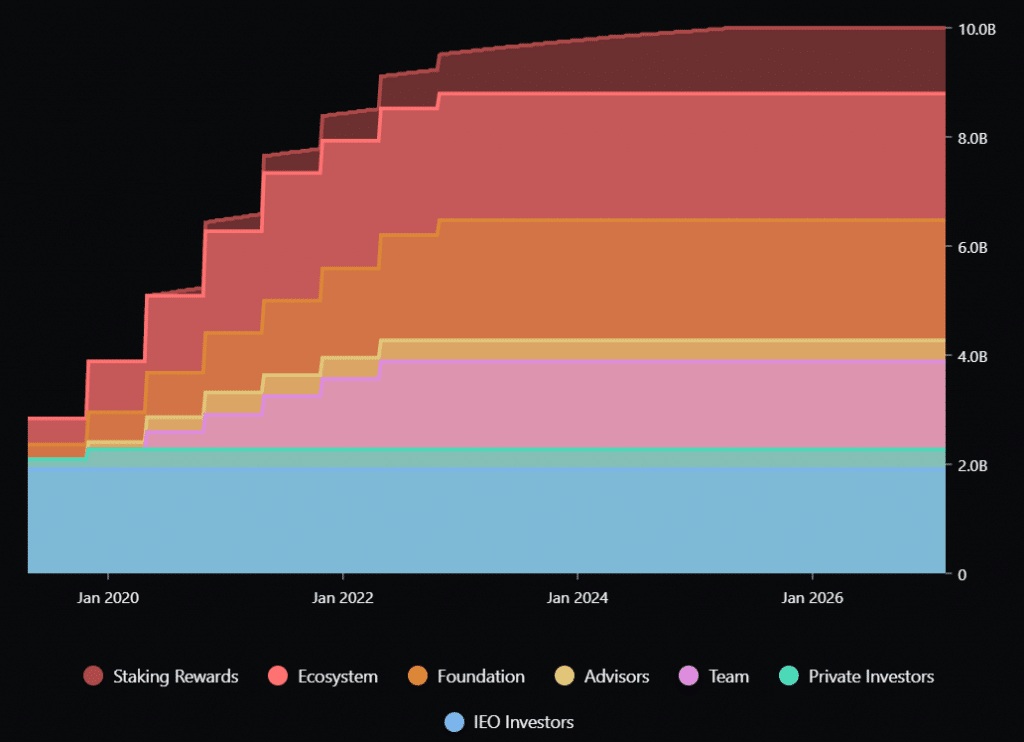

MATIC is currently an inflationary cryptocurrency, which allows for the payment of delegators and validators. However, the maximum number of tokens is set at 10 billion units. All MATIC tokens will be in circulation by mid-2025.

MATIC tokens in circulation over time (Source: Messari)

In January 2022, the Polygon PoS Chain integrates Ethereum’s EIP-1559, introducing the burn mechanism on every transaction. With the maximum MATIC tokens set at 10 billion units at its inception, it will become deflationary by mid-2025.

Polygon’s fundraising

Polygon’s first fundraising comes in April 2019 in its Initial Exchange Offering (IEO) on the Binance Launchpad. During this IEO, 1.9 billion MATICs are offered for sale at $0.00263 each, raising a total of $5 million.

At the same time, Polygon conducts a private fundraising in which 209 million MATICs are sold to private investors such as Coinbase at $0.00079 each. 171 million MATICs are also sold at $0.00263 to early adopters. During this private fundraising, $615,000 is accumulated by the Polygon team.

In May 2021, well-known American investor Mark Cuban added Polygon to his website listing all his investments. In addition to buying MATIC tokens, Cuban says he regularly uses the Polygon blockchain and plans to integrate it into his Lazy.com NFT platform.

Polygon last raised funds in early February 2022. In this round, the Polygon team announced that it had raised $450 million from a number of venture capital funds. Participants include SoftBank, Sequoia Capital India and Alameda Research. In this round, MATIC tokens were sold to investors at an undisclosed discounted price.

Polygon’s team and partners

The team behind Polygon

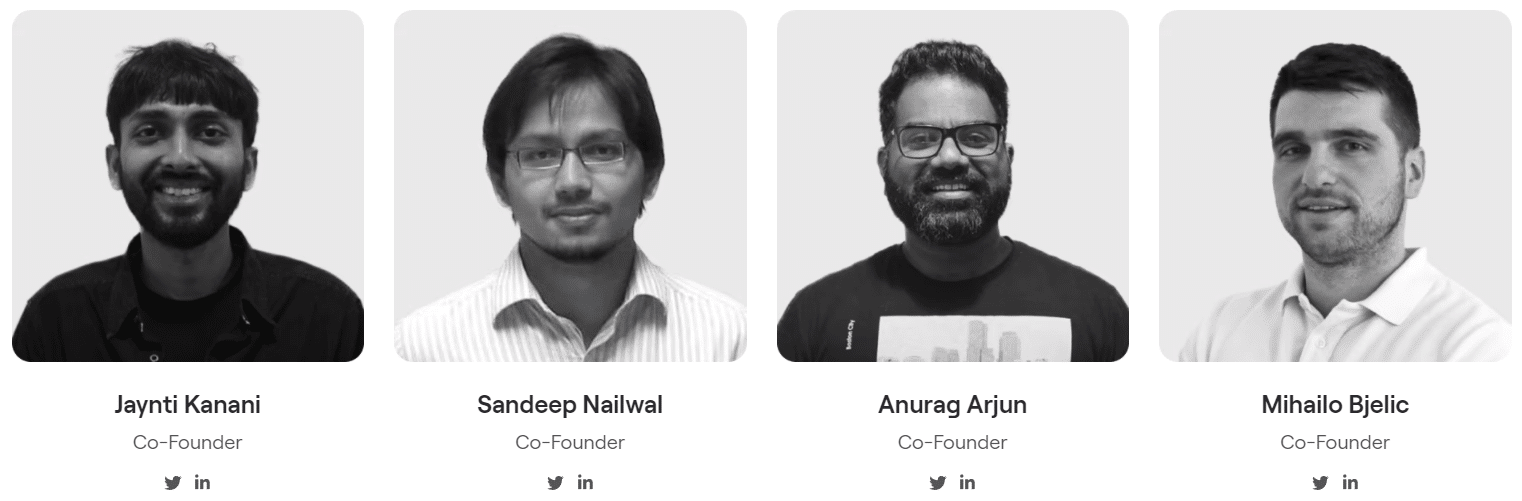

It was in 2017 that Jaynti Kanani, Sandeep Nailwal and Anurag Arjun, three Indian developers, founded Matic Network. Then very active members of the Bitcoin community, the trio looked into the Ethereum blockchain desperately seeking a scalability solution for it.

During their research, they came across a publication by Ethereum co-founder Vitalik Butherin and Joseph Poon, detailing a scalability solution called “Plasma”. This was later enhanced by Jaynti Kanani and a team of developers into “More Viable Plasma”, the technical basis of the future Polygon PoS Chain.

In early 2021, Mihailo Bjelic, a Serbian developer, joined the Indian trio and together they co-founded Polygon Technology, the successor of Matic Network. With this redesign, many well-known developers like Anthony Sassano and investors like Mark Cuban join Polygon’s advisory board.

Part of the Polygon team (top: co-founders – bottom: advisory board) (Source: Polygon)

According to their official LinkedIn, Polygon Technology has over 230 people regularly contributing to Polygon and its growing ecosystem.

Polygon’s partners

As the most widely used Ethereum scalability solution, Polygon has many, many partnerships. In particular, we can distinguish the two stablecoin giants DAI and USDC who are integrating the Polygon network in 2018 and 2020 respectively.

In order to build a decentralised finance ecosystem, the oracle network Chainlink chooses Polygon in 2020 to be the first blockchain other than Ethereum to receive its valuable decentralised data streams.

In 2021, with the growth of NFTs and blockchain games, Polygon announces a partnership with the famous video game and console company Atari, becoming the platform of choice for its blockchain activities. In the same year, partnerships were formed with OpenSea, The Sandbox and Unstoppable Domains to deploy these protocols and make them more efficient.

The two data query giants The Graph and Google BigQuery also announced a partnership with Polygon in 2021. This collaboration aims to provide developers with a tool to analyse the Polygon PoS Chain simply and quickly.

AU21 Capital is also announcing the creation of a $21 million fund in 2021 in collaboration with the Polygon team. It will provide financial assistance to developers who wish to build on Polygon.

Many other partnerships have been concluded by Polygon since 2018 and can be seen on their dedicated news page.

How to buy MATIC cryptocurrency

The MATIC token is one of the top 20 and is the most popular Ethereum scalability solution utility token. As a result, it is available on all major exchange platforms such as FTX, Coinbase, Kraken, Crypto.com, but also Binance, its IEO platform, where liquidity is the highest.

Explanations for buying MATIC on Binance

- Register with Binance ;

- You will receive an email and will need to click on a link to verify your account;

- Deposit funds on the platform;

- Click on the Market menu and search for the MATIC/USDT pair;

- Now all you have to do is buy MATIC for the amount you want;

- Congratulations You are now in possession of MATIC tokens!

Notes and opinions on the Polygon and its MATIC token

Driven by the ambition to create an Internet of scalable blockchains, the Polygon project shows itself as a serious ally of the Ethereum blockchain, in a period where blockchains that are technically superior to it are multiplying.

Thanks to its proximity to Ethereum, many developers have decided to launch Polygon and its proof-of-stake blockchain. Its ecosystem is now one of the most mature thanks to the migration of recognised protocols like Aave or Uniswap to Polygon.

2021 was a flourishing year for blockchain and its token MATIC. Its TVL jumped by more than 18,000% from January to December 2021, reaching the value of $4.5 billion at the end of February 2022. The MATIC token has also risen sharply over the same period, from $0.02 in January 2021 to over $2.5 by the end of the same year, a x125.

The aggressive buyout and expansion policy since the change from Matic Network to Polygon has resulted in the creation of 6 new scalability solutions. These have been added to the original Polygon PoS chain in just one year.

However, this new policy has its disadvantages. It is often preferable to focus on one solution that can be developed further. Expansion may offer more solutions, but these often lack technical depth.

This is especially true when competing teams develop their own unique scalability solution. We can name Starkware (ZK Rollups), Optimism or Arbitrum (Optimistic Rollups), among others.