Is Bitcoin’s recent rise to $35,000 enough to rekindle the flame of international investors? According to several pieces of data, web queries using the term “Bitcoin” have experienced a great deal of volatility over the past two weeks. We take stock of the situation, with a focus on France.

Bitcoin – A frivolous popularity in the short term

Recently, the world’s leading cryptocurrency returned to the spotlight by reaching the $35,000 mark, putting an end to several painful months below the $30,000 mark.

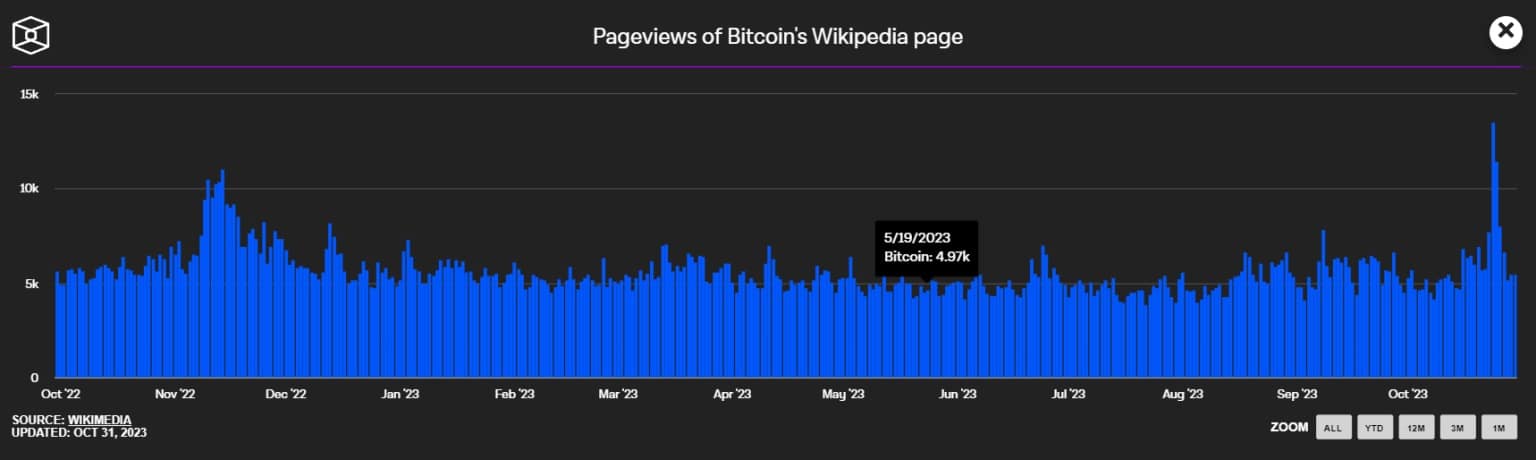

On this occasion, the BTC price gained in visibility both in the media and on the web. According to data gathered by our colleagues at The Block Data, the number of views on the Bitcoin Wikipedia page jumped by 140% between October 21 and 24, 2023.

Number of views on the Wikipedia page dedicated to Bitcoin

However, this craze for the king of crypto-currencies was short-lived, as evidenced by its number of views, which curled up around its original level of 5,500.

The same is true of Google Trends: after a surge in interest for the search “Bitcoin”, the number of queries on this term returned to its starting point. Bitcoin may be up +110% since January 2023, but it’s not yet time for a bull market.

However, with the Bitcoin spot ETF craze in the U.S. and Bitcoin’s halving scheduled for spring 2024, the trend could well be reversed within a few months.

What are the figures for France?

In the land of Voltaire and Montaigne, the king of cryptocurrencies is experiencing a very similar situation. Despite a free-fall in the number of Google queries since the previous bullrun, interest in Bitcoin spot ETFs is booming: the term “BlackRock”, designating the largest American company to deploy such an ETF in the US, is currently registering 4 times as many queries as the previous month.

As a reminder, a Bitcoin spot ETF is an investment product, initiated by traditional finance companies, which enables Bitcoin to be traded on an exchange at spot prices by investors. If applications for these ETFs are approved by the Securities and Exchange Commission (SEC) in the United States, a large amount of liquidity could flow into the markets, driving up the price of Bitcoin.

Google Trends also offers other data concerning its French users. For example, a map of the French territory shows where the term “Bitcoin” is the most searched for according to the total number of queries made:

Bitcoin popularity by region – Google Trends

Surprisingly, Corsica is the region with the most requests, with a score of 100. Next come Île-de-France, Provence-Alpes-Côte d’Azur and Alsace, with popularity scores of 98, 97 and 96 respectively.

Conversely, among the territories where locals are less interested in Bitcoin, we find the void diagonal regions such as Limousin and Burgundy, as well as those located in the north of France (Basse and Haute Normandie, Picardie, Nord Pas-de-Calais).

As a reminder, ADAN’s latest study, carried out in 2023 with the collaboration of KPMG, revealed that 9.4% of French people own cryptocurrencies. In total, no less than one French person in 7 has already owned a crypto, stablecoin or NFT.