In recent days, there have been rumours that FTX could sell a large number of tokens, including Solana’s SOL and Bitcoin (BTC). However, things aren’t quite that simple, and a potential sale of cryptocurrencies by FTX would actually have little impact.

Massive SOL sale coming from FTX?

On Monday 11 September, FTX management published a document listing the assets recovered by the bankrupt exchange, including cryptocurrencies and fiat currencies, as well as various properties associated with Sam Bankman-Fried’s fallen empire.

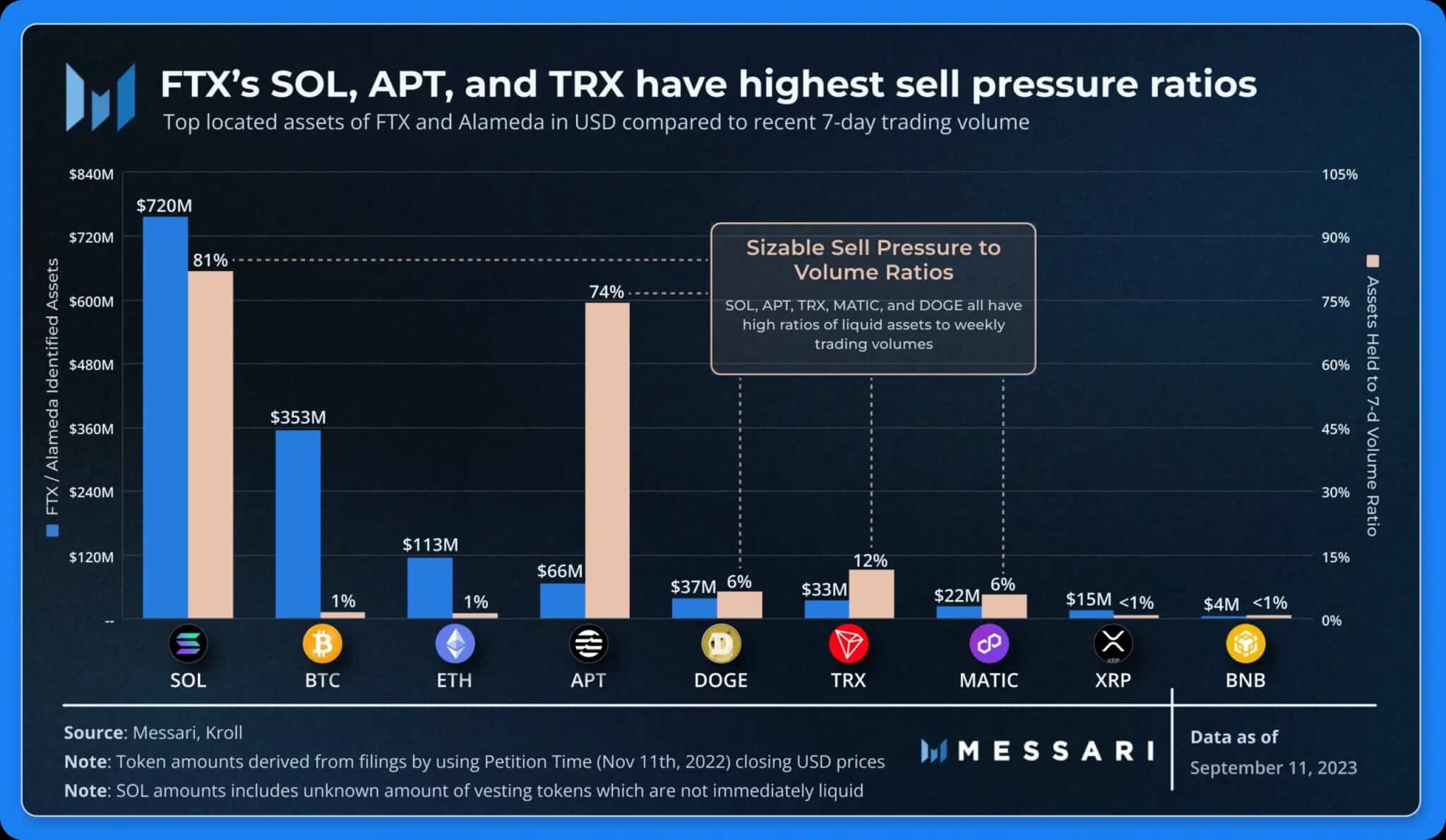

We learn that FTX has raised $7 billion in assets, including $2.6 billion in cash and $3.4 billion in cryptocurrencies, as at 31 August. That said, according to information as of 11 September (as prices have fallen) from Messari, FTX currently holds, among other things:

- $720 million of SOL ;

- $353 million of BTC;

- $113 million in ETH ;

- $66 million in APT.

Assets held by FTX (blue) and relative selling pressure versus 7-day volume (beige)

Let’s get one thing out of the way: FTX can in theory exert significant selling pressure on certain cryptocurrencies, including SOL, Aptos’ APT, Dogecoin (DOGE), Tron’s TRX or Polygon’s MATIC. However, in the case of SOL and APT, they are not fully liquid, as they are obtained gradually by FTX in accordance with the initial vesting period.

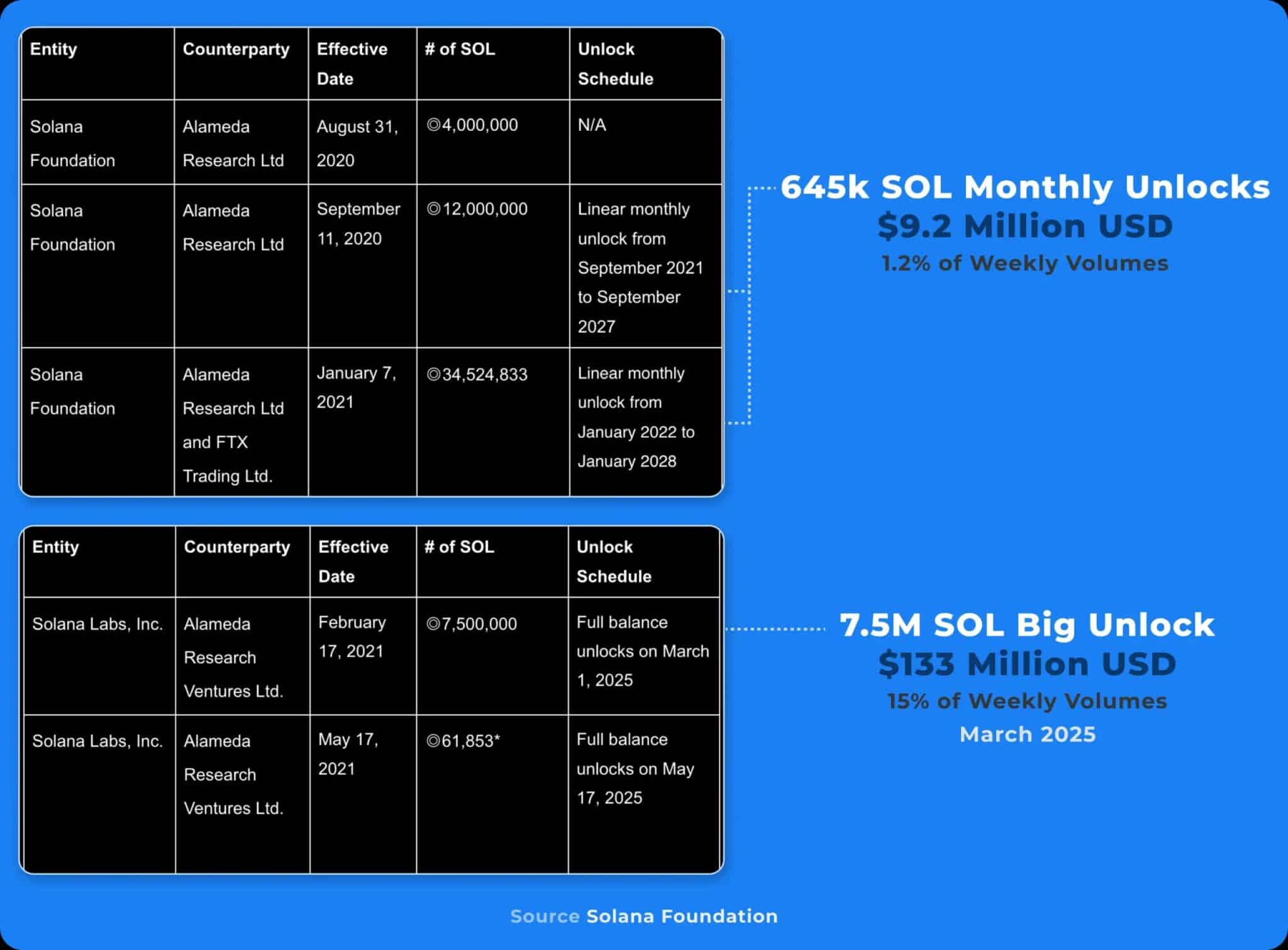

In other words, FTX acquires 645,000 SOL tokens per month, which is equivalent to around $11.5 million, or just over 1.2% of the token’s weekly trading volume. FTX therefore holds relatively few SOL tokens up to date, with the most significant vesting coming to an end in 2025.

This being said, during the last distribution, which will take place on 1 March 2025, selling pressure on Solana’s token may be momentarily greater as $133 million worth of SOL (at today’s price) will be given to FTX (via Alameda, in particular).

SOL token vesting schedule with Alameda and FTX

Nevertheless, and in particular because some crypto influencers contributed to the panic by claiming that FTX was going to “massively sell” all its supposed SOL tokens in the next few days, the price of Solana’s token fell, as did most of the altcoins held by FTX, such as MATIC and APT.

As a result, open interest on the derivatives markets for SOL and these altcoins exploded, particularly on short positions. The funding rate on the SOL was one of the lowest of the year, with the periods of mid-March and mid-June.

Evolution of the funding rate compared to the SOL token price (yellow)

So traders found themselves obliged to close short positions by buying more, which had the effect of pushing the SOL price up – briefly.

Ultimately, we will have to wait until tomorrow, Wednesday 13 September, to find out whether FTX will be allowed to sell its cryptocurrencies. If it does, it is extremely unlikely that FTX will sell its assets all at once, and in any case the volume of sales would be relatively small compared with the volume traded on a weekly basis on the market.