While the Federal Reserve Bank of Chicago (FED) has threatened Bitcoin Magazine over parody articles about its FedNow payment system, the media outlet has responded in an open letter. What’s its position?

The FED threatens Bitcoin Magazine

On Friday, our colleagues at Bitcoin Magazine informed their community that the Federal Reserve Bank of Chicago had sent a letter to the medium threatening legal action:

BREAKING: Federal Reserve threatens to sue Bitcoin Magazine in attempt to silence criticism of its FedNow service.

– Bitcoin Magazine (@BitcoinMagazine) November 3, 2023

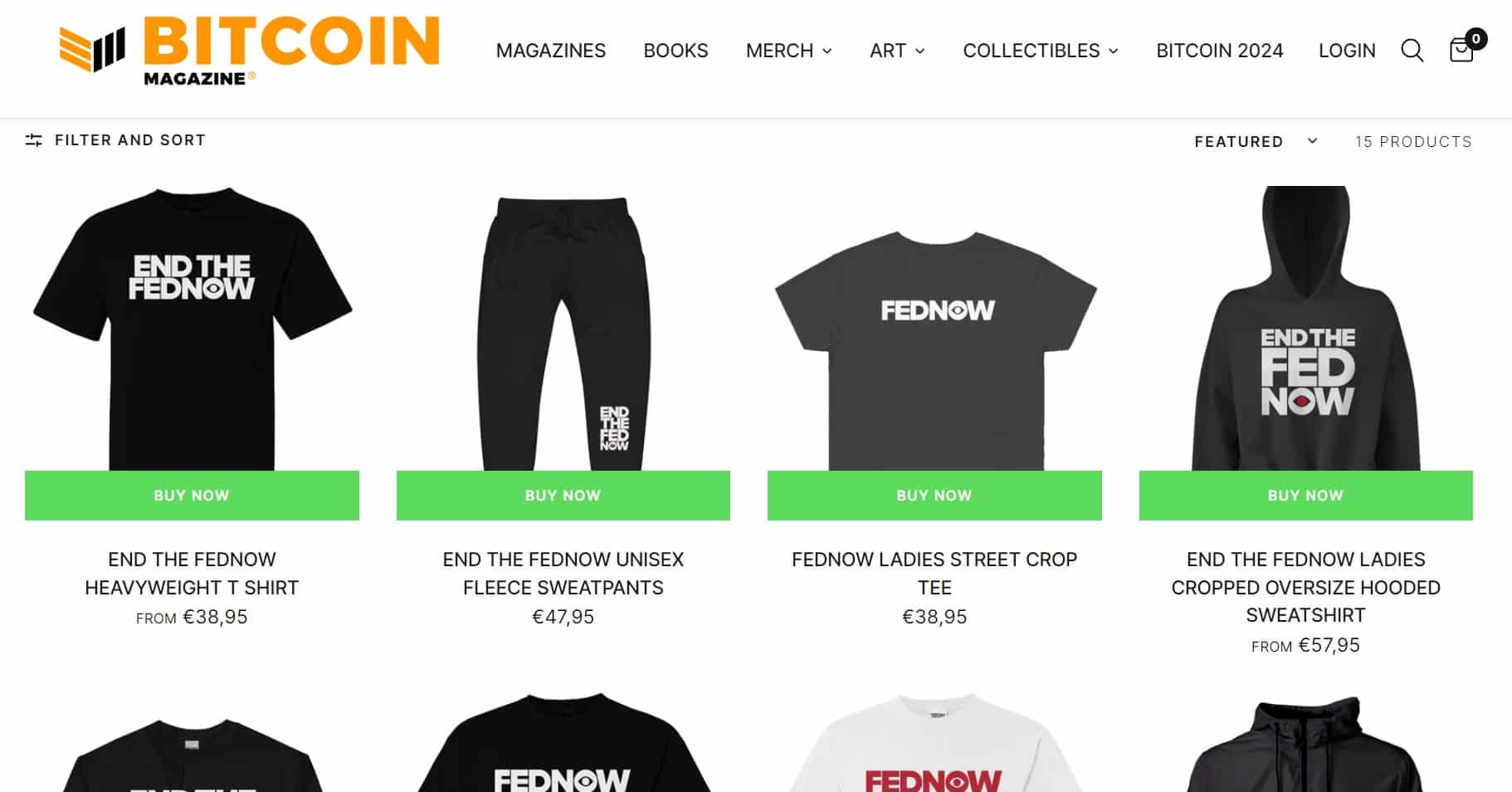

The subject of the dispute is Bitcoin Magazine’s parodies about FedNow, the FED’s payment system launched last June. More specifically, the problem concerns items on the website’s online store, which are accused of damaging the service’s brand image:

Parody FedNow items marketed by Bitcoin Magazine

Faced with these threats, Marc Goodwin, the magazine’s editor-in-chief, responded to the American agency with an open letter. Far from being intimidated, he even suggested that the FED “send a parcel of goods to one of the 12 Federal Reserve Banks”.

Taking the irony a step further, he asked the FED not to hesitate to make him a “list of coveted items”, so that Bitcoin Magazine could do its “part to ‘stimulate’ the economy”.

A categorical refusal to cooperate

After this light-hearted introduction, Marc Goodwin adopted a more serious tone, categorically expressing his refusal to accede to the FED’s request, going so far as to openly criticize the latter’s methods.

The editor-in-chief refers to the First Amendment of the U.S. Constitution to justify the media’s right to express its position against a service deemed a threat to the “freedoms of American citizens”.

He criticizes the FED’s policies, which in his view are responsible for galloping inflation since the COVID crisis:

“Have you seen the FED?

Have you seen the state of the working class today? Perhaps you’ve already forgotten how Fed policy led directly to mismanaged bond portfolios at regional banks across the country, such as Silicon Valley Bank, Signature, Silvergate or First Republic? “

In addition, while the Federal Reserve had argued its position by considering that the online store could mislead consumers by associating Bitcoin Magazine with the real FedNow service, the media goes further by bouncing back on this point:

“We have no interest in sowing confusion, error or deception. It’s more like the job of those charged with telling the market they wouldn’t raise rates after massive monetary expansion, then raising them faster than at any time in U.S. financial history. “

To conclude this response, Marc Goodwin indicated that the Bitcoin Magzine teams were looking forward to defending their rights in court. All that remains now is to wait for the FED’s reaction, to find out whether they intend to call their bluff or carry out their threats.