The use of Arbitrum and Optimism scalability solutions has grown significantly since the beginning of the year. This shows the importance of layer 2 as a scaling tool for Ethereum

Arbitrum and Optimism are seeing increased adoption

In its latest quarterly report on Ethereum (ETH), Messari highlighted the weight that layer 2 Arbitrum and Optimism have on network activity.

As a reminder, the objective of these layers 2 is to increase the performance of layer 1, Ethereum in this case, by reducing transaction costs. Thus, the transactions produced on Arbitrum and Optimism are then anchored on Ethereum, via a smart contract.

Pending the implementation of sharding, this is currently the most relevant solution for increasing scalability.

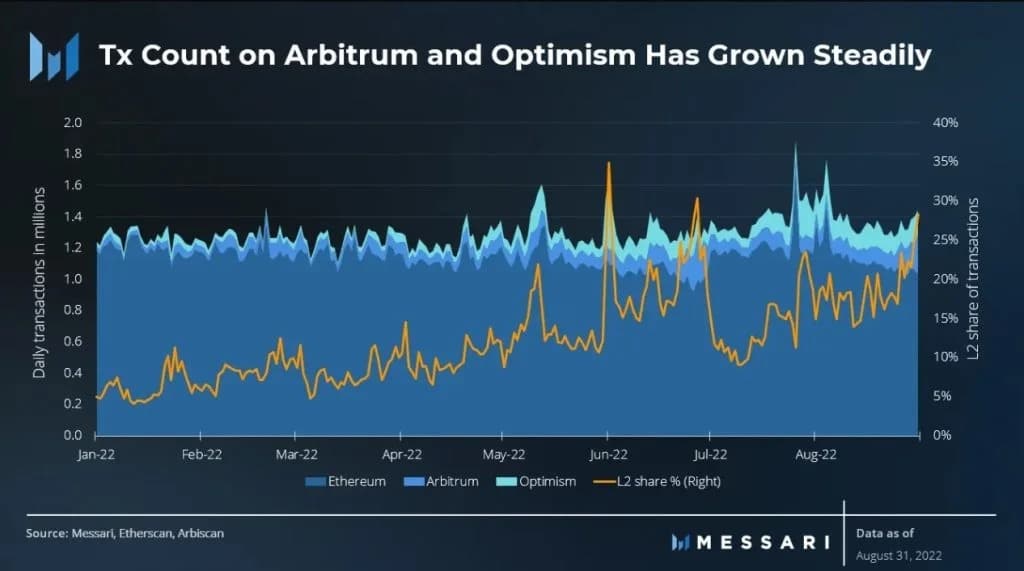

Thus, the third quarter of 2022 saw the average daily transactions of Arbitrum and Optimism rise from 39,000 to 115,000 and 41,000 to 142,000 respectively between January and August. Ethereum, on the other hand, averaged 1.2 million daily transactions, a 6% increase since Q2.

These data allow us to estimate that, on average, transactions on these two layers 2 represent 21.4% of the activity of the Ethereum ecosystem as a whole. In order to follow the evolution of this data, the report has put this comparison in perspective in a day to day evolution:

Evolution of transactions on Arbitrum, Optimism and Ethereum

The orange curve is a sawtooth pattern, but it fully expresses the growing importance of these scaling solutions.

A much more measured financial weight

While Arbitrum and Optimism have shown a great deal of growth in usage over the past few months, their financial importance is quite different.

At the time of writing, the total value locked in (TVL) is $942 million and $834 million respectively, according to DeFi Llama. For both layers 2, this is more than 30 times less than on Ethereum, which records 30.6 billion dollars.

Apart from the bear market, which has purely wiped out a lot of capital, we can point out some interesting points. Since November, the TVL of Arbitrum has been divided by 2.7, while this factor is 3.6 for Ethereum. On the Optimism side, the TVL has simply increased by 2.5 times over the same period.

Thus, despite the crisis, layer 2s are proving more resilient, even outperforming the layer 1s to which they are attached. Although this growth can be attributed to their youth, it may also demonstrate a real market demand.

As for a lower TVL, it should be kept in mind that large wallets favour Ethereum. Indeed, the weight of the cost of a transaction is more measured for this category of investors, for whom liquidity is much more important.

In fact, Arbitrum and Optimism will be preferred by smaller wallets, or at least by players who want to make many transactions at lower cost. On the other hand, one should not make the mistake of seeing these layer 2s as competitors of Ethereum. On the contrary, they are there to act in symbiosis with this blockchain.