Based on the success of Shapella, Ether (ETH) prints 10% in 24 hours and surpasses $2100. Let’s take a look at ETH withdrawals and deposits for staking and the potential impact on the cryptocurrency’s price.

Ether flinches from Bitcoin (BTC) dominance

On the back of an extremely bullish Asian session (again), Ether (ETH) has printed 10% higher over the past 24 hours. At the time of writing, ETH has broken through $2,000 resistance and is trading for about $2,115.

Ether (ETH) price rise over the last 24 hours

According to TradingView data, Ether’s market share has climbed to 19.8%. This represents an increase of more than 1.1% over the past 24 hours. Note that since the beginning of 2023, ETH’s capitalization weight has increased by about 7%.

For now, Bitcoin (BTC) still dominates the market at 47%. Although this dominance has declined by 1% following the Shapella update, it is still up a healthy 13.6% since the beginning of 2023. Over the same period, the cryptocurrency boss has printed an 80% increase and surpassed the $30,000 mark.

As a reminder, the Shapella update is a major update to Ethereum that has been highly anticipated by the ecosystem. It follows The Merge, which took place in September 2022 and marked the transition from Proof of Work to Proof of Stake. Successfully operated this Thursday, April 13, Shapella now allows validators to recover ETH locked in the blockchain for several months.

$2.2 billion of ETH ready to land

For many observers, the release of about 18 million ETH to the market (or $36 billion) through Shapella was likely to cause the price of Ether to fall sharply. Let’s see what the on-chain data can tell us about this.

According to TokenUnlocks, the total amount of Ether that has been confirmed to be withdrawn (in other words, the validator status has changed to 0x01) is over $2.3 billion. Indeed, 1.1 million ETH are now in the queue to leave the network.

Regarding validators, about 380,000 have initiated an Ether withdrawal. Only 21,000 have requested to withdraw all of their 32 ETH, while 358,000 only want to access their staking profits.

Over the next 12 hours, it is estimated that 43,720 ETH will be available for withdrawal, or $92 million. That would be $184 million per day. At this rate, it would take almost 2 weeks to process the entire queue.

Deposits vs. withdrawals, who wins?

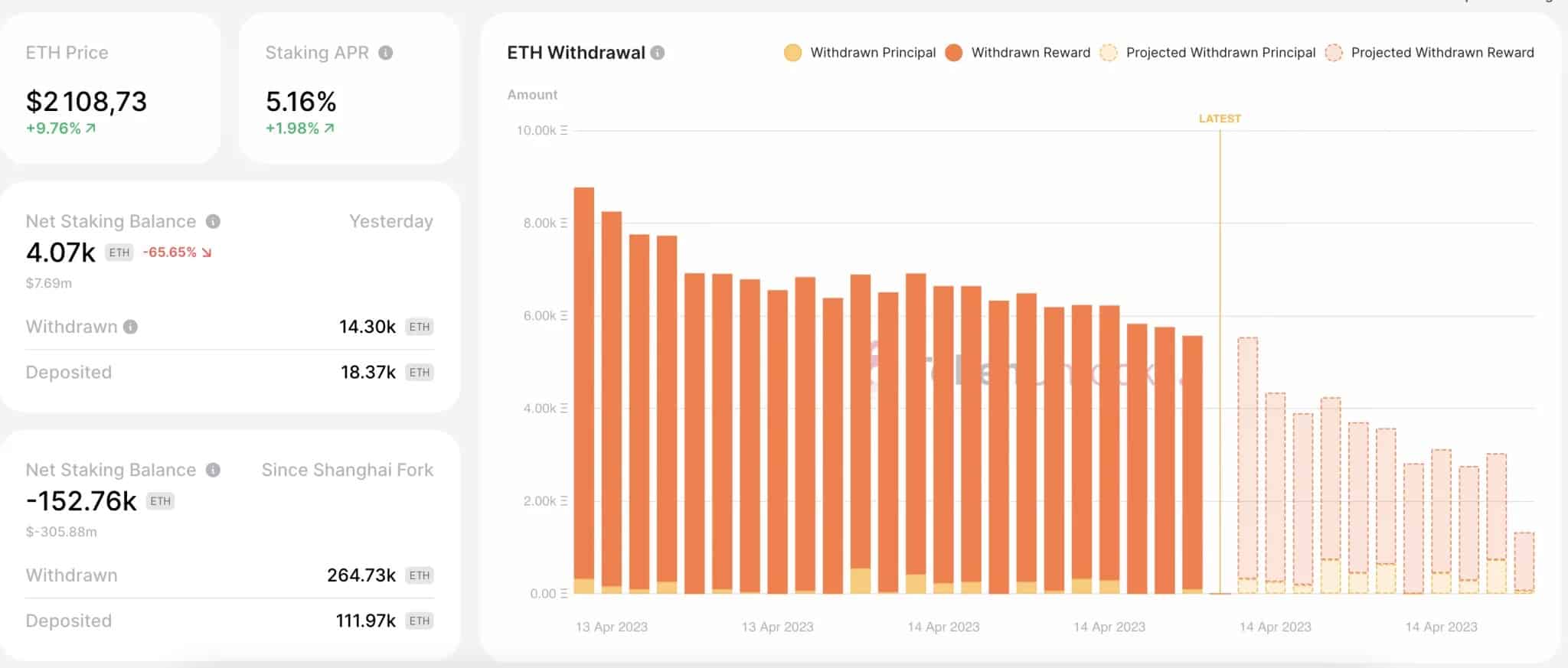

Looking at the day of April 13, the net staking balance (the difference between the total amount deposited and withdrawn) was positive by over 4,000 ETH. In fact, 14,300 ETH were withdrawn from the network and more than 18,370 new coins were added in staking.

Nevertheless, the net balance of staking since the deployment of the Shapella hard fork is about -140,000. Ether withdrawals amount to 265,000, while deposits account for less than half of that, or 111,000 ETH.

Note, however, that the majority of ETH pending withdrawals are from staking rewards. This means that the vast majority of validators do not want to close their node and continue to believe in the future of the Ethereum network.

Ether staking dashboards on the Ethereum network

At the time of writing, only 15% of Ether in circulation is used for staking, which is much less than the main Proof Of Stake blockchains. Nevertheless, the Shapella update should motivate users to contribute to the security of the network and to lock their ETH.