The ERC-404 tokens represent a new experimental implementation, combining the features of the ERC-20 and ERC-721 tokens. Designed by 0xacme, a former Coinbase engineer, these tokens offer both liquidity and non-fungible features, opening up new possibilities for users. We explain what this novelty is all about.

ERC-404 tokens, a cross between ERC-20 and NFT

“ERC-404 is an experimental implementation mixing ERC-20 / ERC-721 with native liquidity and splitting.” These are the words used by 0xacme, a former Coinbase engineer – if his Twitter profile is to be believed – to introduce ERC-404 tokens, a chimera mixing ERC-20 and ERC-721 standards.

Let’s review a few basics before delving deeper into these new tokens, which have not gone through the traditional Ethereum path, i.e., have not undergone the traditional Ethereum Improvement Proposal (EIP).

Firstly, ERC-20 tokens are fungible. In other words, they’re entirely interchangeable: you can exchange one ERC-20 token for any other of the same ERC-20 tokens, and you won’t notice any difference. These are the classics, and the list of ERC-20 tokens is long: USDT, BNB, USDC, TRX, DAI, UNI, ARB, CRO, and many more.

ERC-721 tokens, on the other hand, are non-fungible: they are not interchangeable and have their own specific characteristics. Behind this technical term lie non-fungible tokens, more commonly known as NFT. It is precisely their non-fungible characteristics that define their rarity, and therefore their price.

In other words, the ERC-20 and ERC-721 tokens are diametrically opposed by design, and therefore not meant to be confused. And yet, 0xacme, the man behind these new ERC-404s, sees an advantage in mixing them.

“Although these two standards are not designed to be mixed, this implementation strives to do so in the most robust way possible while minimizing compromises. “

So, what’s the point of mixing ERC-20 and ERC-721?

What exactly are ERC-404 tokens and what’s in it for them?

To explain what ERC-404 tokens are in concrete terms, let’s take the example of Pandora, the first project to use this standard.

Pandora offers 10,000 ERC-20 tokens and 10,000 associated NFTs, called “Replicants”. Each ERC-20 token is associated with an NFT, and it’s precisely for this reason that the same number of tokens are available.

If you buy a PANDORA token on an exchange, 1 Replicant NFT will automatically be minted in your wallet. And if you decide to sell this PANDORA token, the NFT will be burned instantly.

The subtlety is that the NFT that will appear in your wallet will be randomly generated, and it can meet the following 5 rarity levels:

- Green boxes: around 39.45% of the supply;

- Blue boxes: approx. 23.44%;

- Purple boxes: approx. 19.53%;

- Boxes orange: approx. 11.72% ;

- Boxes red: approx. 5.86%.

At this point, 2 things should be understood: as an ERC-20 token, the PANDORA token will see its price fluctuate like a normal cryptocurrency, and will benefit from significant liquidity. The corresponding NFT, on the other hand, may turn out to be a digitally valuable object, depending on its level of rarity.

As Wil, our DeFi expert in our private TCN Research group, pointed out, there are 2 possibilities if you hold a PANDORA token (and therefore an NFT mint automatically):

“To put it simply, selling the PANDORA token will be faster (thanks to liquidity), but will generate less profit, while selling the associated NFT will require more patience, but will bring a greater gain. “

A mechanic that could bring arbitrage opportunities :

“This mechanic allows you to arbitrage by buying a PANDORA token that entitles you to an NFT. If it’s rare, you can resell it at a higher price on Blur or another platform. If not, you can sell it and then buy another token to generate another NFT. “

Fad or here to stay?

As we said at the beginning of this article, the ERC-404s are not EIPs.

In other words, they are “unofficial” tokens, and have not yet been audited. In other words, investing in this kind of token can be very risky.

And yet, PANDORA tokens and their associated NFTs are already trading at colossal prices. Launched at $1,542 on February 5, PANDORA tokens are trading at $24,000 at the time of writing. In other words, the token price has climbed by over 1,450% in just 3 days.

As for NFTs, their floor price is already 10.5 ETH, or almost $25,000 at the current Ether rate. The red box, the most expensive of the 5 rarity levels, is for sale at a minimum price of 11.34 ETH on the Blur platform.

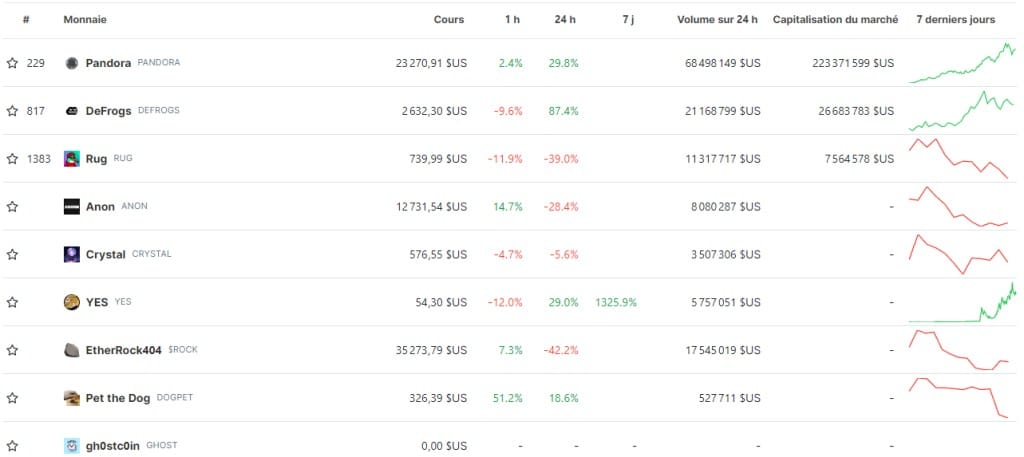

A craze which, of course, will not have escaped some, who have already launched their own ERC-404 collection (0xacme’s code being open source):

Preview of some of the projects created on Pandora’s ERC-404 base

At the time of writing, the PANDORA token has a market capitalization of $238 million, after only 3 days of existence.

A passing fad or a narrative future? It’s still too early to say, but let’s not forget that these tokens are not audited, and that venturing into this kind of investment is still very risky.