As the end of 2021 approaches, the top 10 most-capitalized cryptocurrencies look much different than they did twelve months ago. We take a look at the biggest gains over the period…

Cryptocurrencies: the biggest gains of 2021

2021 has been another eventful year for the cryptocurrency ecosystem. While interoperability has been the fashion – or at least the beginnings of it – that hasn’t particularly stopped altcoins from battling fiercely for investors’ attention and big money.

Between the explosion of non-fungible tokens (NFTs) and decentralised finance (DeFi), the emergence of a plethora of memecoins, and brief but intense enthusiasms for previously unknown altcoins, it has been hard to keep up at times. So which cryptocurrency projects have exploded in price in 2021

1. Shiba Inu memecoin (SHIB) (+59,206,373%)

Many will regret that the Shiba Inu memecoin takes the top spot in this ranking. However, the fact is: the ersatz Dogecoin (DOGE), which did not seem to have any particular interest at first, has exploded all records this year… And shown that when it comes to cryptocurrencies, unfortunately, it is still hype that reigns supreme.

Only launched in August 2020, the crypto-currency benefited from the sudden enthusiasm of the general public for its big brother Dogecoin (DOGE), itself boosted by Elon Musk who made it his hobbyhorse.

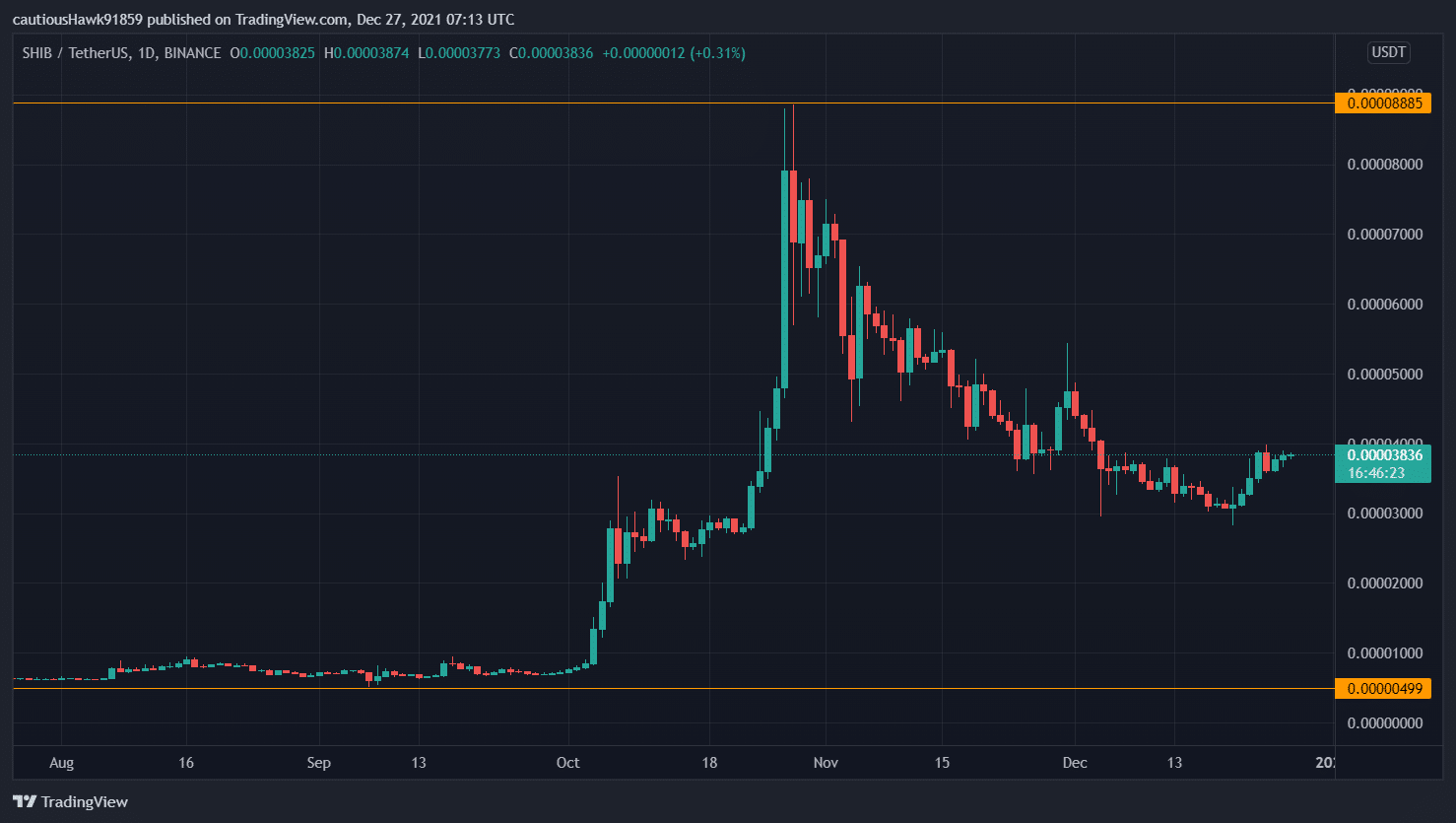

As a result, Shiba Inu has made it into the top 10 most capitalised cryptocurrencies, and its growth over the past 12 months shows a colossal +59,206,373%. This is even as the cryptocurrency reaches a price 55% lower than its record high last October. SHIB’s breakthrough had indeed been stratospheric, to the point of overtaking DOGE for some time:

SHIB price since summer – Source: TradingView, DOGE/USDT

Whether we mourn this progression or celebrate it, the fact remains: Shiba Inu was definitely one of the crypto-currencies that made 2021…

2. Terra (LUNA), the underdog of decentralised finance (DeFi)

2021 has also been the year of DeFi, and we’ve seen several projects battle it out in recent months. Among the latest to generate investor enthusiasm is Terra. The explosion of its token, LUNA, has been rather recent: the beginnings were visible at the end of November.

However, the decentralised finance project, which competes directly with Ethereum (ETH), which is still strangled by high fees, has not been idle. TerraSwap, its decentralised exchange, has a total locked value that recently exceeded $2 billion. The same is true for Anchor, a lending protocol that has attracted many users in recent weeks: the locked value on the project is now approaching $10 billion.

LUNA, the native cryptocurrency of the Terra project, has also exploded. Over one year, it has risen by +18,326%, with an all-time high (ATH) reached a few hours before writing this line, at over $103:

LUNA’s price rise over the year – Source: TradingView, LUNA/USDT

However, it remains to be seen whether this breakthrough is sustainable, as it is relatively recent. But it proves once again that decentralised finance projects are still very much on the agenda.

Solana (SOL), an Ethereum competitor with big teeth

Among the myriad of crypto projects that define themselves as “Ethereum killers,” some manage to generate considerable enthusiasm. This year, this has been the case with Solana, which has seen its SOL token explode.

The project showed in 2021 that it was playing on the same field as its competitors. Its NFT ecosystem has started to attract attention, and to be integrated on large platforms such as FTX… To the point of having to dismiss some amateurs deemed troublesome for the project. And the DeFi sector is not left out. At the beginning of December, the total value locked up on Solana’s decentralised finance projects exceeded $15 billion for the first time.

There were other signs that Solana was catching on. In November, the asset manager Grayscale announced the creation of a fund based on the SOL cryptocurrency… And thus the arrival of a new wave of institutional investors. In addition, the Solana blockchain has been integrated into browsers natively: Brave and Opera in particular.

The rise in the SOL price was therefore not entirely a surprise. Over the year, the crypto-currency took +14,911%, with an all-time high of nearly $260 reached in early November:

The SOL price explosion from January to December – Source: TradingView, SOL/USDT

Will the Solana project then be the one to really threaten an Ethereum hegemon? The coming months will tell us, as its competitors are also in the starting blocks…

A great year 2021 for cryptocurrencies

That’s it for the top three winning cryptocurrencies of the year. It should be noted that 2021 was beneficial for most major projects. In the top 3 most capitalised cryptocurrencies, the king Bitcoin (BTC) is thus up +92% over the year. However, it has been overtaken by Ether (ETH), which is in great shape, with a jump of +538% over the last twelve months. For its part, Binance’s BNB has also made strong progress despite the emergence of competitors: it has risen by 1,531% over the same period.

One also only needs to look at the evolution of the total capitalisation of cryptocurrencies to be convinced of the enthusiasm that has carried the projects into 2021. On 1 January 2021, the total capitalisation was “only” $756 billion. It now exceeds $2.5 trillion…

Growth in total cryptocurrency capitalisation – Source: TradingView (USD)

So we hope that 2022 will be just as beneficial for the sector as a whole.