As Bitcoin faces major technical resistance at $31,000, correlation factors will once again decide the next leg of the trend, making it possible to finally decide between the failure and end of a bear market below $31,000 or the acceleration of the annual uptrend towards $36,000. These correlation factors are acting in the wake of this week’s US inflation update. These correlation factors are acting in the wake of this week’s US inflation update

The fundamental key is the US dollar following this week’s inflation

How do we preserve the annual uptrend in the price of BTC, which has rebounded by more than 80% since last January, accompanied by a clear increase in the dominance of BTC? This is the question that I, as a technical-fundamental analyst, would like to answer.

Given the size of the $31,000 resistance level (probably the last string in the bearish camp’s bow, which has long been targeting $12,000), BTC needs the support of all its cross-asset factors if it is to have any hope of breaking through.

Of all the parameters that have a positive or inverse correlation effect on the bitcoin price, we should bear in mind that two have a very powerful and structuring impact on bitcoin’s underlying trend:

- The inverse correlation with the trend of the US dollar against a basket of major currencies;

- The inverse correlation with nominal and real interest rates on the credit market.

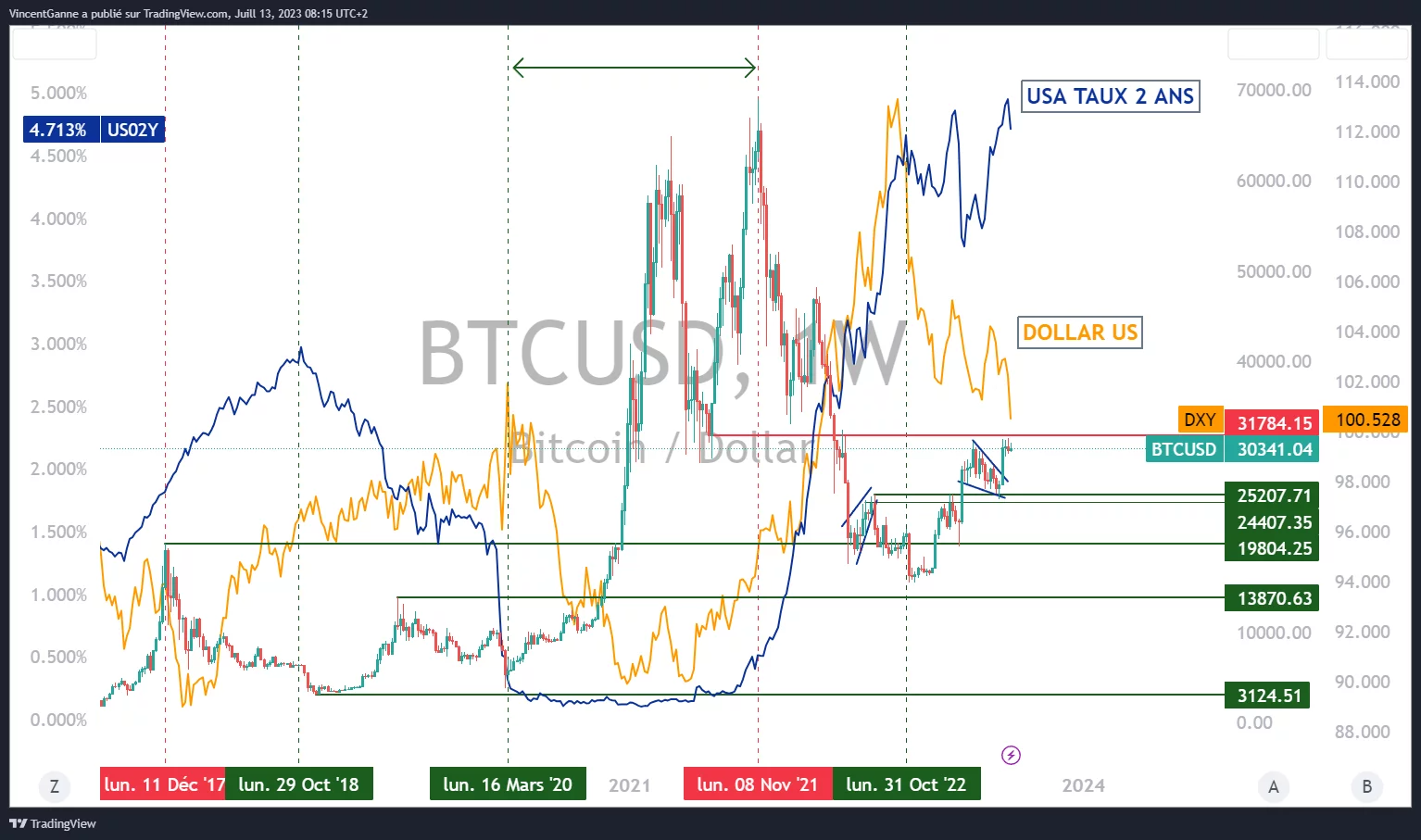

The first chart below illustrates this negative correlation, reminding us that it played a crucial role in triggering the bear market from November 2021 onwards.

And it is precisely this week that the US dollar (DXY) and US market interest rates are feeling the immediate impact of updated US inflation figures. While the nominal consumer inflation rate (CPI) fell to 3%, the underlying version is still too high, but has finally taken a downward turn, falling to 4.8%. Thursday’s Producer Price Index (PPI) update should put downward pressure on the US dollar, with factory-gate price growth approaching 0 on an annual basis.

Whatever happens, it is essential, if not imperative, that the US dollar establishes a new annual low if bitcoin is to break through resistance at $31,000. As for market bond yields, they need to remain below the levels that triggered the US regional bank crisis at the beginning of March.

Bitcoin price in weekly data with the dollar trend (DXY) on Forex and the 2-year US bond rate

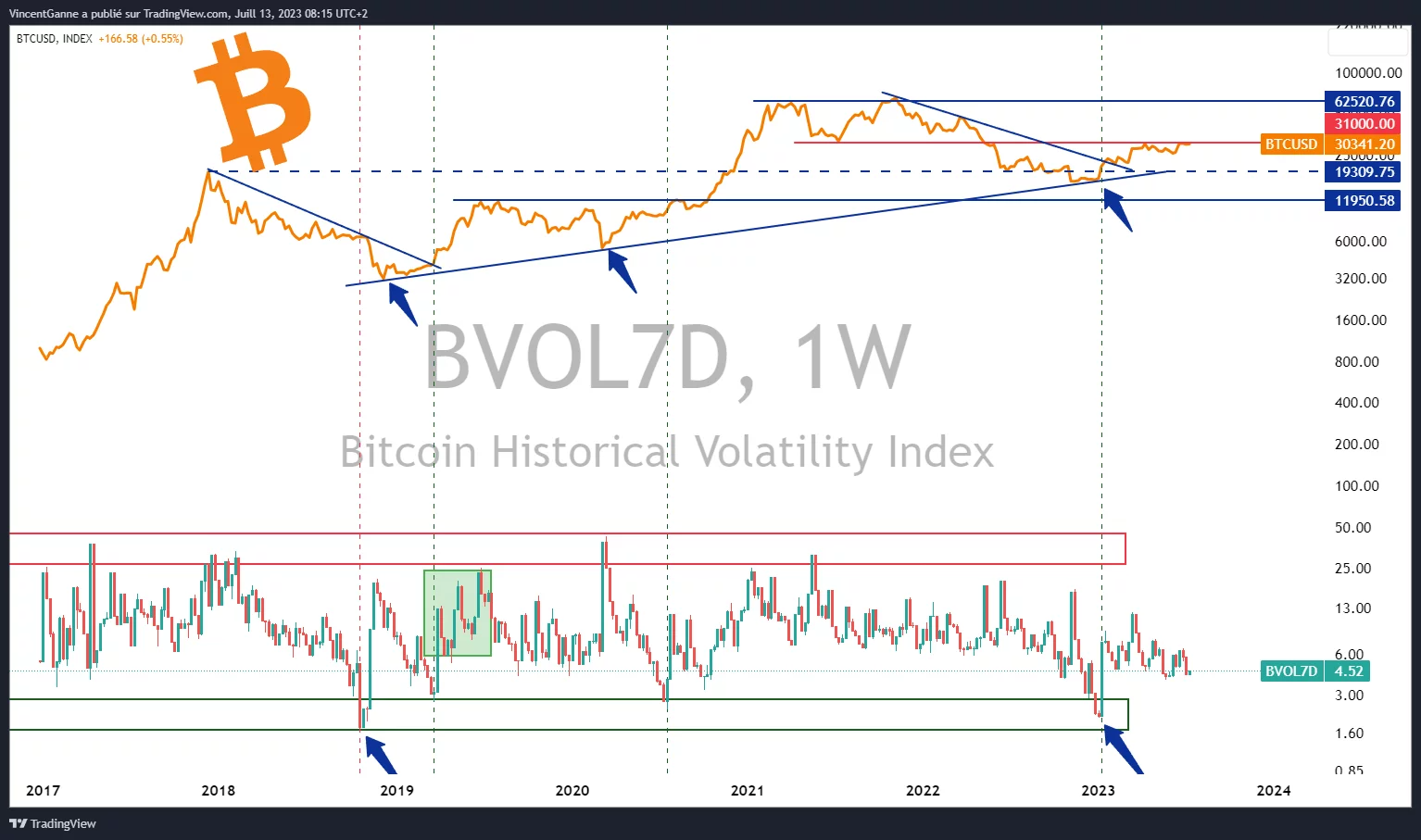

The decision will soon be made regarding the pivotal resistance of 31000 dollars

For the past 3 weeks, the proximity of the major resistance at $31,000 has been the dominant technical factor on the crypto market. Remember that this chartist hurdle represents the last valid argument of the permabear, those who live in the utmost frustration at not having seen their target of $12,000 reached in the wake of FTX’s bankruptcy in autumn 2022.

In order to break through such resistance, only a close on the weekly time horizon can constitute a breakout signal, which would then commit the $36,000 target, the highest selling liquidity in the market.

Bitcoin weekly closing price with measure of short-term volatility