In the space of a week, the price of Bitcoin Cash (BCH) has doubled, rising by more than 110%. Is there any particular reason for this performance?

The price of Bitcoin Cash has been soaring for a week

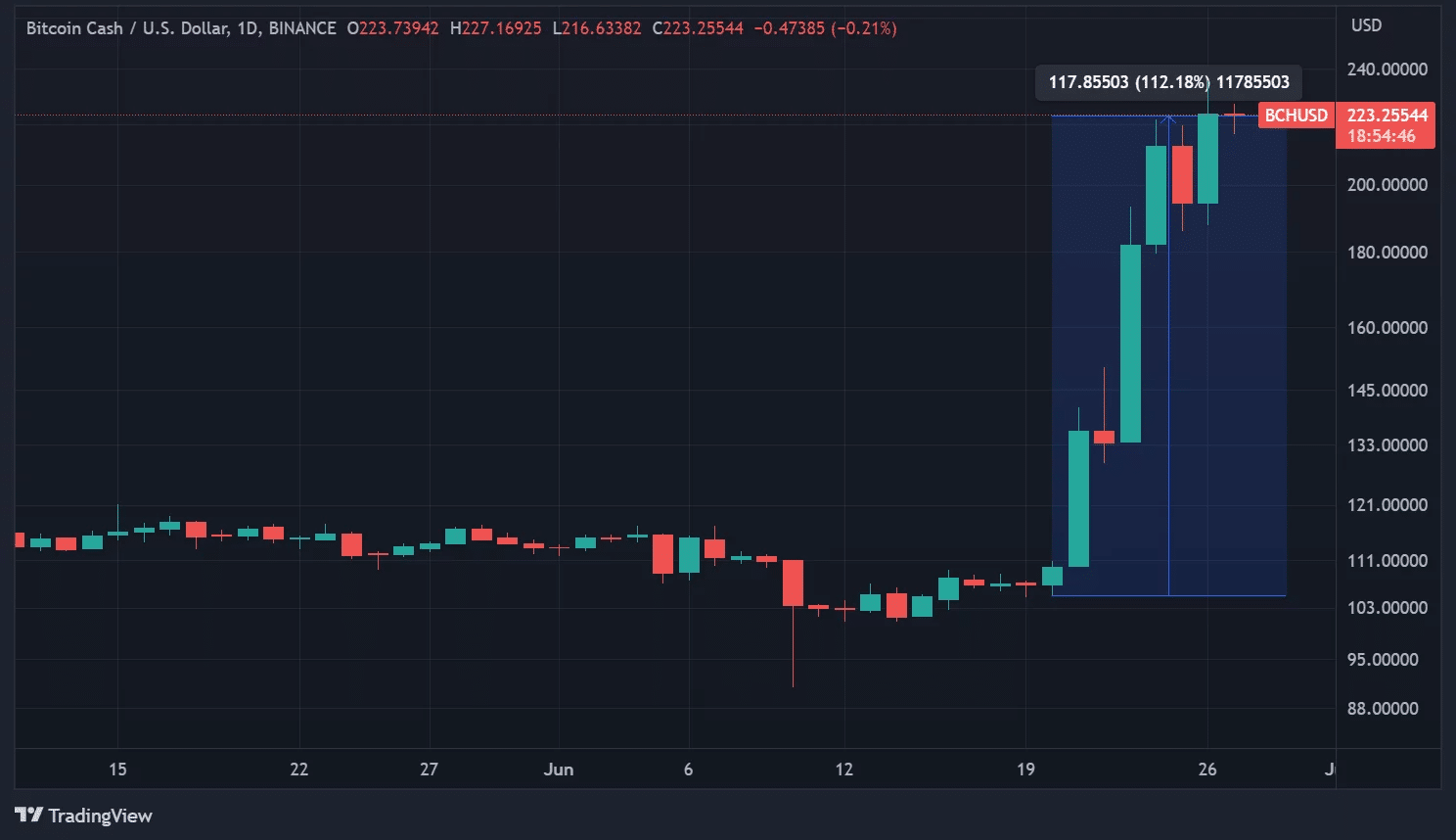

With the cryptocurrency market’s slight revival of energy around news of exchange-traded funds (ETFs) on Bitcoin (BTC), some assets are standing out more than others. This is particularly true of Bitcoin Cash (BCH), which is up by no less than 112% in one week at the time of writing:

Bitcoin Cash price

By way of comparison, over the same period, the price of BTC has risen by “only” 14%, even though it is in the spotlight.

Indeed, it is curious to note that there has been no particularly noteworthy news of late that could justify the BCH’s surge on its own.

However, the launch of the EDX Market platform for institutional traders may be food for thought, where the asset is present alongside BTC, ETH and LTC, but again, this is not a sufficient reason.

While this news may indeed bring liquidity to the market, it is important to put things into perspective. ETH is up 9% on the week, while Litecoin’s LTC is up nearly 16%.

A rise explained by its name

Another possible justification for the rise of Bitcoin Cash could also be found in its name: the presence of the name “Bitcoin”.

Uninformed investors could be confused into thinking that, with BTC at over $30,000 and BCH at around $220, this price could be a good deal. All it would take is for the asset to “catch up”, or at least partially, to generate a profit. Of course, such thinking is nonsense in terms of investment strategy, but it is a bias that is easy to fall into because of a lack of knowledge.

In fact, BCH has been losing ground to BTC ever since the 2017 fork, as some members of the Bitcoin community have pointed out:

Bitcoin Cash is “surging” https://t.co/gTbRwLKKFB pic.twitter.com/AhKGc3zXu1

– Pledditor (@Pledditor) June 26, 2023

Since last week, other Bitcoin forks have also seen their prices soar, albeit to a more limited extent.

Bitcoin SV (BSV) has risen by almost 50% and Bitcoin Gold (BTG) by 20%. While it may be tempting to allow oneself to be carried away by the fear of missing out (FOMO) during such movements, it is advisable to remain cautious and not to take any more risks than necessary with regard to one’s investment plan.