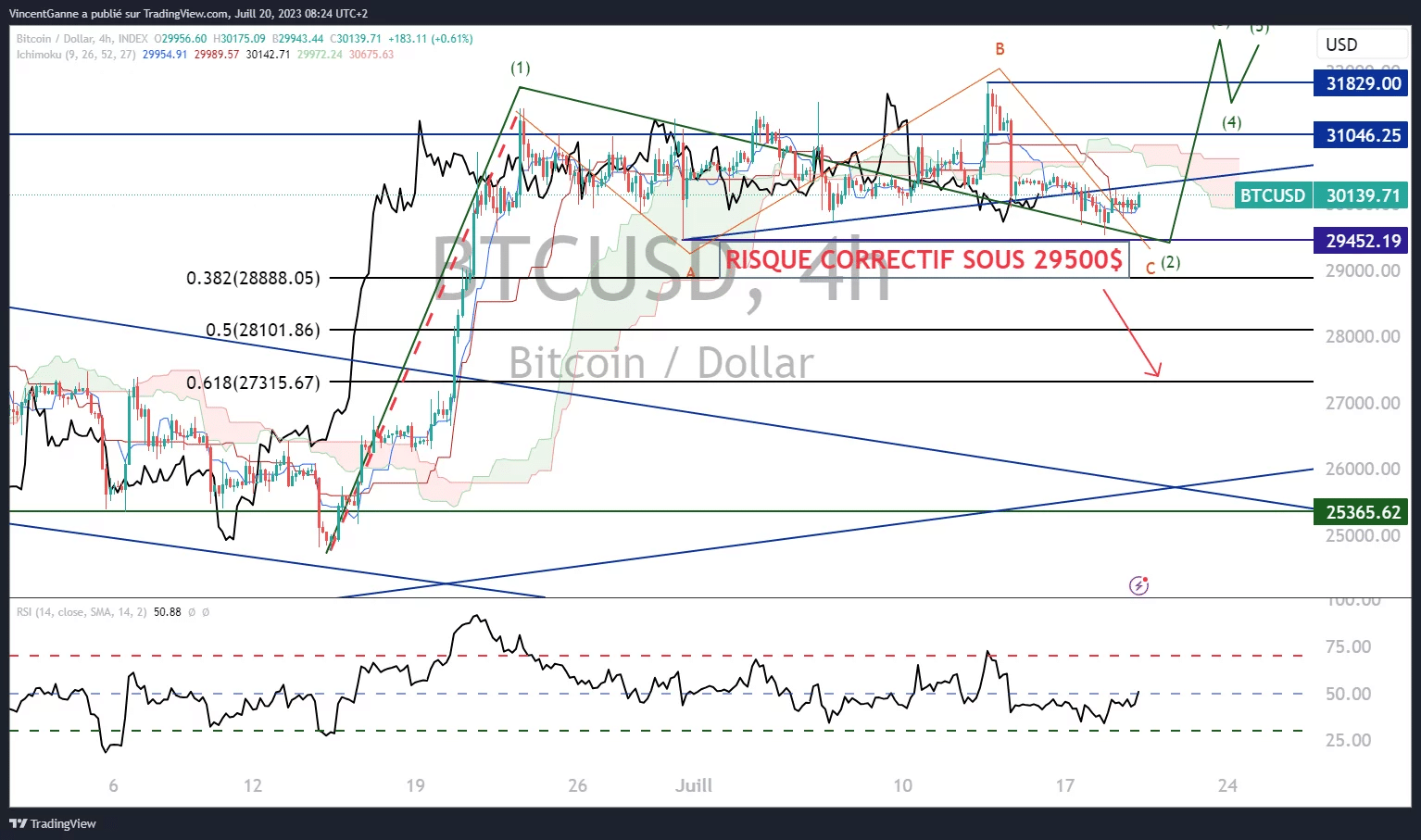

The crypto market currently seems to be completely disengaged from risky assets on the stock market and it’s hard to say whether or not this will be beneficial to the bitcoin price, which has been building a trading range for a month now below the extreme resistance of $31,000 and $32,000.

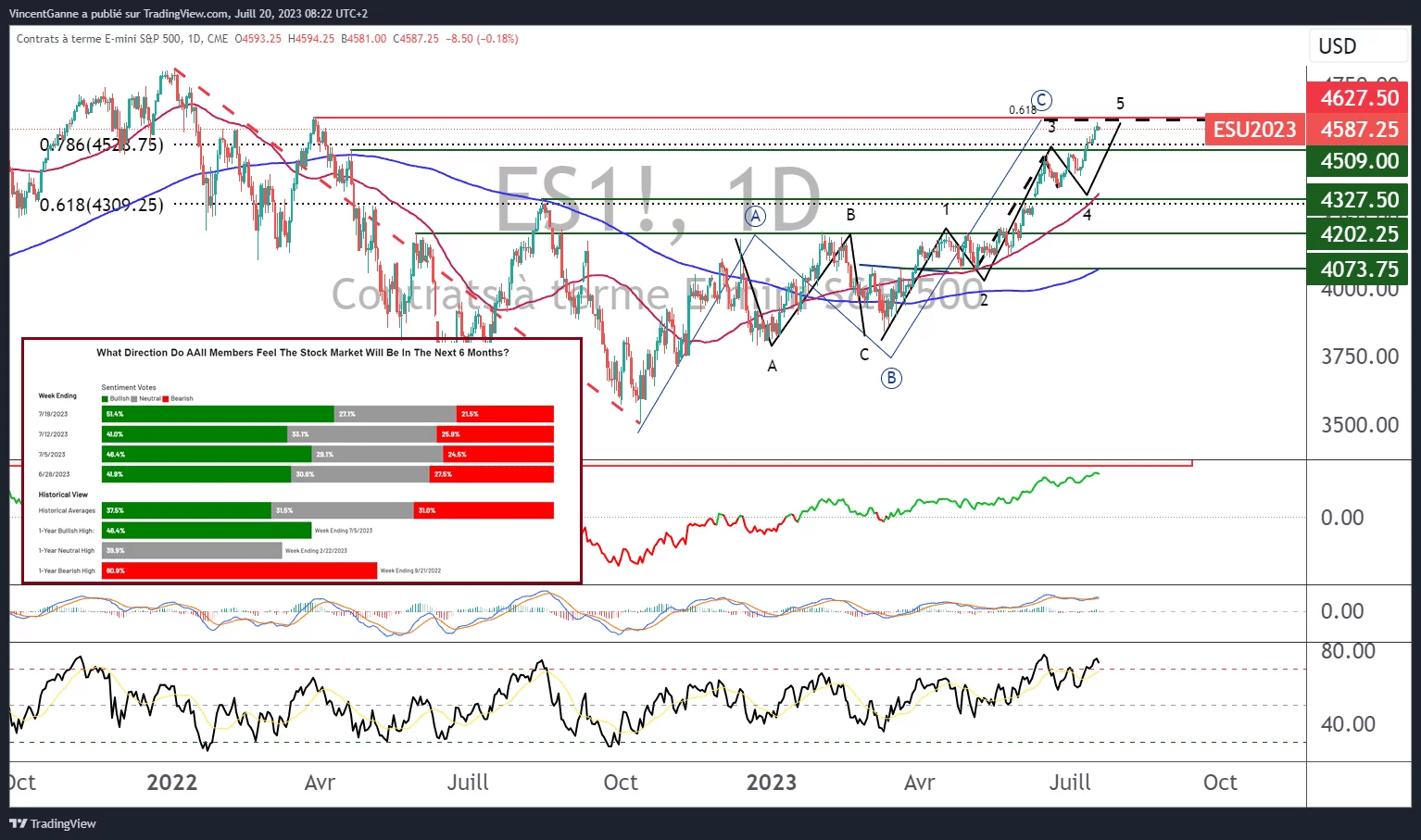

The US equity market and technology are in a situation of massive overbought

“Be careful bitcoin don’t miss the boat, or you’ll expose yourself to a powerful backlash!” That’s exactly the sentence I could say to the BTC if he were a conscious person, I’d give him this warning because he’s currently taking a major risk.

For a month now, the crypto market has been stable under major resistance, having benefited from the bullish impetus generated by the news surrounding the bitcoin ETFs applying for approval from the SEC, the US stock market regulator.

Other asset classes developed very marked trends over the past month, as summarised below:

- The US equity market approached its all-time highs, set in December 2021, with the S&P500 index now in contact with major resistance at 46,300 points;

- The pool of retail buyers, according to AAII data, is now filled to the brim (see the inset at bottom left on the first chart below);

- The S&P 500 Technology sector index has even set new all-time highs, smashing past the December 2021 highs (imagine in equivalent terms, that’s a $70,000 BTC) and is massively overbought;

- The US dollar hit a new annual low against a basket of major currencies, with new highs on the EUR/USD and GBP/USD rates;

- Interest rates failed to recover to the levels that triggered the banking shock in March.

All the trends I’ve described above should have allowed bitcoin to break through resistance. It is now a matter of time for BTC, and time is on its side.

With the FED funds rate set to rise again next week and the GAFAMs releasing their quarterly results, bitcoin must be aware that it will no longer have the support of its usual correlations.

So if it continues to procrastinate, it will be subject to the risk of a correction.

Graph produced with the TradingView website and which reveals the Japanese candlesticks in daily data for the S&P500 stock index, as well as the latest positioning of US retail traders according to data from the American Association of Retail Investors (AAII)

Bitcoin price to make its technical decision imminently

Now back to the bitcoin price analysis and the main chartist thresholds to watch:

- The major resistance at $32,000 is well known and remains the dominant chart factor;

- The short-term technical pivot is at $29,500;

- If this support is broken, the market will correct towards $28,000;

- Intermediate resistance at $30,500 would have to be breached to restart the rally.

The technical choice of BTC will be made between this Thursday, July 20 and the decision of the FED on Wednesday, July 26.

Graph produced with the TradingView website and which displays the intraday Japanese candlesticks (H4) for the bitcoin price (BTC/USD)