With its new Walletless feature, the RealT platform has just removed the last barrier preventing it from democratising real estate investment to everyone. From now on, it is possible to build up a real estate portfolio from as little as 50 dollars without worrying about using a digital wallet.

RealT: the promise of real estate investing for everyone

RealT is a growing tokenized real estate project. Its mission is simple: to take the best of real estate and the best of blockchain, to create a simple investment service accessible to all.

This is how the first platform was born that allows you to buy tokenised fractions of real estate, starting at $50. All this for an annual return of more or less 10% by greatly simplifying the administrative procedures.

With RealT, there is no need to go through a bank or a notary, the user experience is simplified to the point that it feels like making an online purchase on an e-commerce site. Subsequently, legal documents are sent by email, and can be directly signed electronically.

While the promise is beautiful, it had, at least until then, a small weakness for its democratization: the wallet.

And for good reason, if the use of the service turns out to be child’s play for someone already familiar with the blockchain universe, an investor who is a total stranger to it could find himself somewhat confused.

Since RealT tokens representing a fraction of real estate are delivered directly to the blockchain, this necessarily implied the configuration of a so-called “self-custody” address. This was the last hurdle for mass adoption, a hurdle now lifted with the arrival of “Walletless”.

Walletless, RealT’s new game-changing service

The power of Walletless to democratize RealT

To allow a smooth introduction of “no-coiners”, i.e. someone not yet familiar with the world of cryptocurrencies, RealT has set about implementing a walletless version of its service.

This version, called “Walletless”, allows a new user to skip the potentially daunting step of creating a digital wallet.

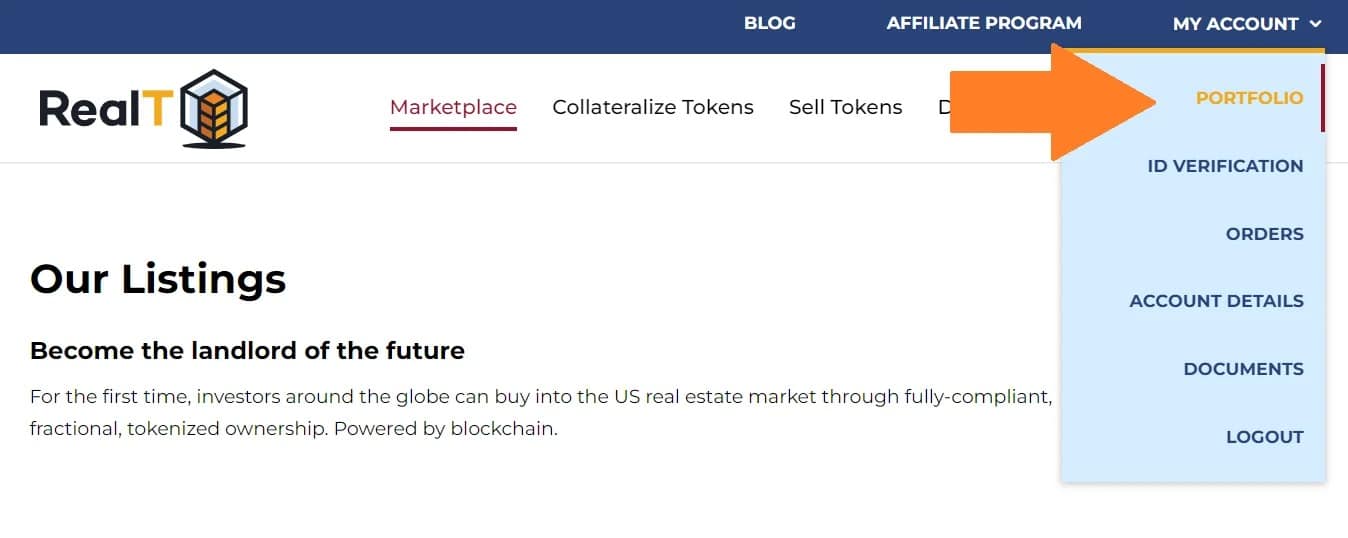

When signing up, the first steps are exactly the same as in our tutorial. This involves creating an account and verifying your identity. However, it is after this last step that this enhancement slips in, and to find it, you need to go to “My Account” → “Portfolio”.

Figure 1: Accessing your RealT portfolio

For new accounts, a choice will then be offered. As shown in the video below at 47 seconds, it is now possible to set up your account with or without a wallet:

With this new option, RealT is taking a big step towards including all investors in its services. Walletless allows you to start building your tokenized real estate portfolio, without bothering with the blockchain part. So it will be perfectly suited to someone with a real passive approach, more interested in the value proposition than the “tech”.

The Walletless constraint

For someone wishing to exploit the full potential of RealT, however, Walletless should only be seen as a transitional stage.

Indeed, RealT’s other strength lies in a second platform dedicated to decentralised finance (DeFi), called RMM. In simple terms, it allows you to deposit your fractions of real estate as collateral in order to borrow liquidity. To understand the concept of collateral, those familiar with real estate may see it as a parallel to a mortgage: an asset that is pledged as collateral to borrow money.

This leverage can be used, for example, to buy new fractions of real estate tokenised with RealT, to further increase your return.

Of course, this is a completely optional step. It is perfectly possible to simply buy RealT tokens and let them work, and in this sense, the Walletless option is perfectly suitable.

Later, when you feel ready to take the next step, it will be possible at any time to claim your fractional real estate on a wallet that you have set up in parallel.

So, with Walletless, you can start investing in real estate today with as little as $50. Then, and only if you want to, you can learn the workings of the blockchain universe at your own pace, in order to take the plunge when you feel ready.

Dual authentication (2FA) as a security layer

For RealT Walletless users, dual authentication when logging into your account is mandatory.

This is a step that is increasingly used by various services such as banking applications or certain e-commerce sites. When you log in, you are asked for a short-lived code to validate access to the service. This code can be sent by email, by SMS, or via an application such as Google Authentificator or Authy for example.

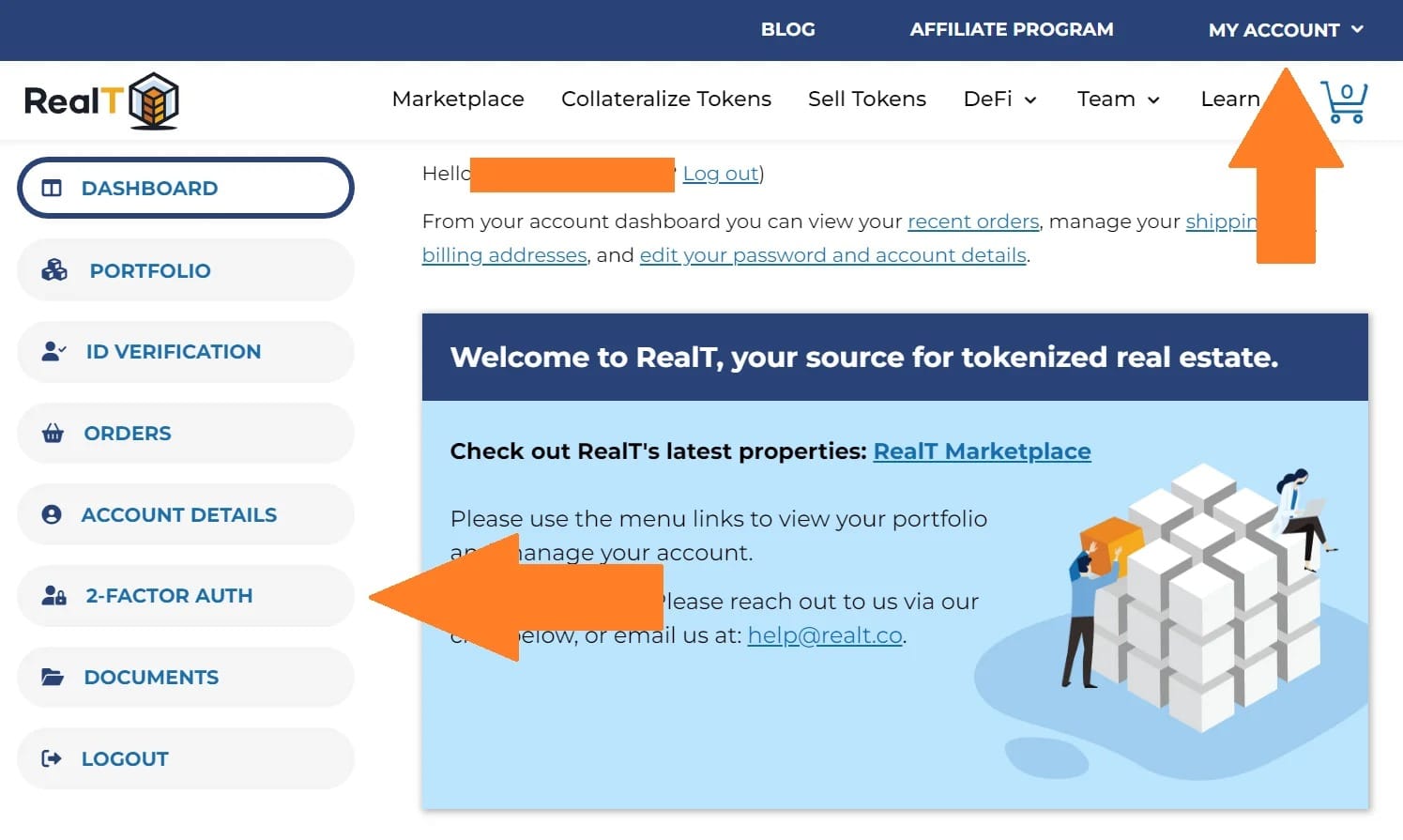

To configure your 2FA on RealT, go to “My Account” → “2-Factor Auth”:

Figure 2: Accessing the 2FA on RealT

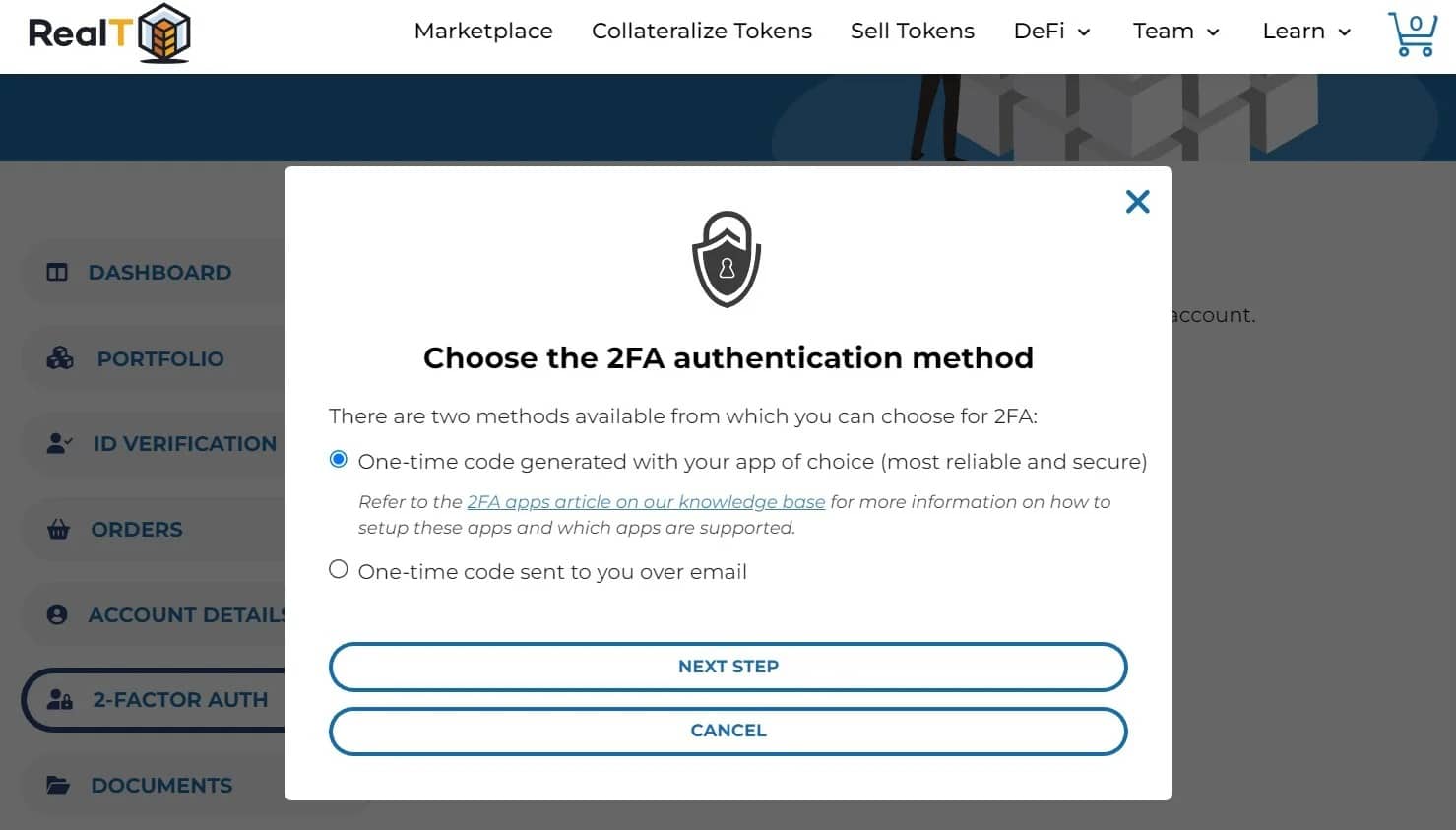

RealT then offers you two options: authentication by an application or by email. For the second option, you will simply need to confirm your email. However, authentication by application will be more secure and this is what RealT recommends:

Figure 3: Choosing the 2FA identification method on RealT

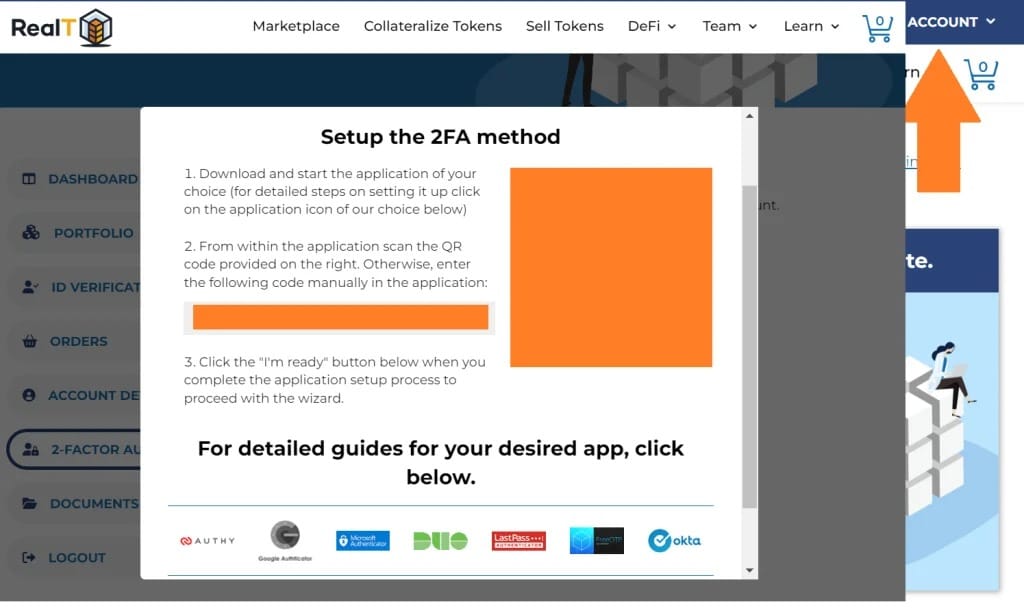

Next, you will need to add a new item to your chosen application and then scan the QR code or enter the key that has been generated:

Figure 4: Configuration of the 2FA identification application on RealT

Be sure to write down the key somewhere, in case you need to change your mobile phone. Do not save this key on a device connected to the internet where you would be vulnerable to a hack.

A 2FA application will generate a new ephemeral code every 30 seconds. To finalise the configuration, RealT will ask you to enter this code. At the end of the operation, you will be offered to save a recovery code with the same functionality as the key we just mentioned. Keep it safe as well, on a piece of paper for example.

Is your investment in RealT safe?

With the Walletless option, you are actually delegating the storage of your tokenized real estate, and RealT is setting up what is called a custody service. In a way, the platform then has a ledger where it says “I owe this person X RealT tokens”.

On the technical side, your investments will be safe and secure on the blockchain, stored on what is called a multisig wallet developed by Gnosis Safe. You can think of this as a safe with several locks and several people at RealT each have a unique key, so that a single employee cannot steal your assets.

If you decide to use your own wallet, your tokens will be transferred to your address, so that they are in your custody.

With Walletless, RealT once again manages to reduce the frictions of real estate investing, making “the stone” accessible to everyone, provided they have an internet connection.