The price of gold has risen significantly since November 2022, with a pronounced increase during the collapse of Silicon Valley Bank in March. Gold-backed stablecoins, such as PAXG and XAUT, have also seen an increase in market capitalization, together surpassing $1 billion. Bitcoin, meanwhile, is decorating itself from the major stock market indices and showing a strong correlation with gold and silver.

The price of gold is rising, the capitalization of stablecoins that are backed by it also

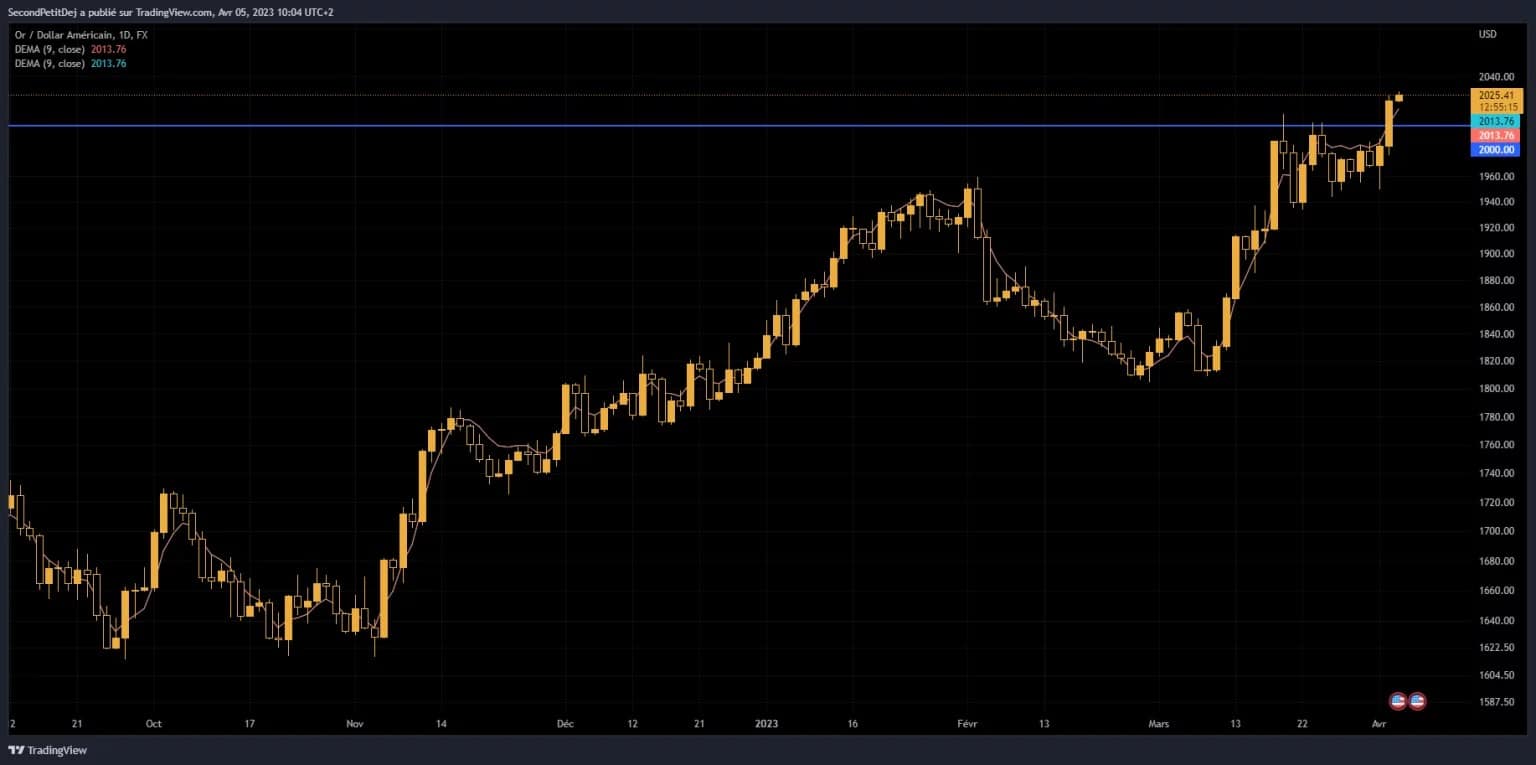

While the price of gold has been on an upward trend since November 2022, we can note that this rise has been particularly pronounced since March 10, the date that corresponds to the collapse of the Silicon Valley Bank (SVB), the fallout from which is still felt in banking circles.

Figure 1 – Evolution of the gold price against the US dollar (XAU/USD)

This interest in gold, a historic safe haven that has endured through wars and eras, is also felt in the stablecoins that are backed by it. Indeed, the market capitalization of gold-backed stablecoins has just passed the symbolic $1 billion mark.

The market for gold-backed stablecoins is limited almost exclusively to PAXG, issued by Paxos (which until very recently issued Binance’s BUSD) as well as XAUT issued by the giant Tether, the American company that is also in charge of the most capitalized stablecoin in the cryptocurrency market, namely USDT.

Bitcoin (BTC) is decorrelating from the indices and getting closer to gold

Except for the Nasdaq index, which is mostly made up of companies in the technology sector, we can see that Bitcoin (BTC) has become significantly decorrelated from the main stock market indices such as the S&P500, the DAX or the Dow Jones Industrial Average, as we can see below (the closer the curve is to 1, the more pronounced the correlation is):

Figure 2 – Correlation between BTC and different stock indices

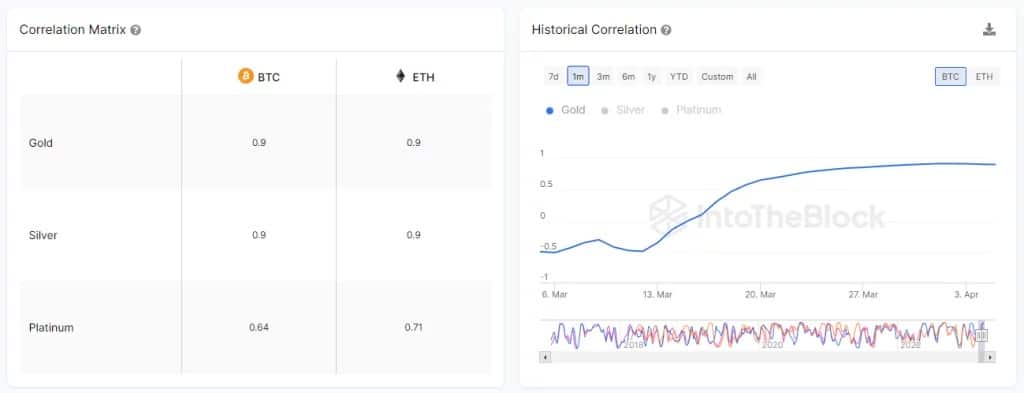

On the contrary, Bitcoin seems to correlate more with gold, which is a safe haven in the face of the prevailing banking uncertainty, among others. Bitcoin and Ether (ETH) have a very high correlation of 0.9 with gold, but also with silver:

Figure 3 – Correlation between BTC and gold

This proves that for a growing number of investors, Bitcoin seems to be a safe haven, a trend we did not see in the year 2022, for example. For all that, while the correlation between BTC and the golden rare metal is very significant, it should be noted, however, that the volatility of the king of cryptocurrencies remains much higher than that of gold.

While Bitcoin’s price has risen by 72.5% since January 1, gold has very recently surpassed its historical resistance of $2,000, an event that had occurred twice in the past, namely in August 2020 and in March 2022.

Often dubbed “digital gold,” Bitcoin also shares with gold the distinction of being rare, as only 21 million units of the cryptocurrency will be available.