After inventing the concept of the Bitcoin Savings Plan (BSP) for individual investors, the French startup StackinSat is launching its Bitcoin (BTC) cash investment platform for companies. An efficient way for companies to protect themselves from the galloping inflation of the euro. Focus on this new offer from StackinSat

Bitcoin, a solid hedge against inflation

As you know, inflation has been exploding for several months now and unfortunately this trend is expected to continue for quite some time. As a direct consequence of the economic crisis linked to the Covid-19 and the Russian-Ukrainian conflict, the prices of many goods have not stopped rising.

According to INSEE, consumer prices rose by 3.6% over one year in February. They had already risen by 2.9% over one year in January.

In addition to the consequent impact on the purchasing power of individuals, companies are also affected by such sudden and high inflation, especially as many of them have accumulated cash during the health crisis.

At a time of high inflation and a scarcity of effective investment products, companies are well advised to seriously consider an alternative to avoid letting their capital burn up over time. This makes it particularly attractive for a company to invest in Bitcoin.

It is in this context that the Biarritz-based startup StackinSat is opening its Bitcoin Savings Plan (BSP) to companies, a service that allows them to buy Bitcoin at regular intervals with ease.

This investment strategy has been proven since the early days of Bitcoin, smoothing out the entry point and reducing the impact of price volatility

Figure 1: Cumulative return of Bitcoin and other assets over the last 10 years (2011 – 2021)

Why do businesses have so much to gain by using this new service? In an interview with Madyness, Jonathan Herscovici, co-founder of StackinSat, explains:

“All companies have dormant cash, which they have accumulated with the health crisis, which can represent between 5 and 10% of the total cash. We propose that they allocate part of this cash flow, which will not be used in the short term for operations, to innovative savings”.

The idea that Bitcoin acts as a store of value and a hedge against inflation is shared by the US bank JPMorgan. Analysts at the firm said in October 2021 that they saw Bitcoin as a better hedge against inflation than gold.

How does this new StackinSat offer materialize?

First of all, it should be noted that StackinSat complies with the guidelines of the Autorité des marchés financiers (AMF) to be allowed to offer such services. Indeed, the company is registered as a digital asset service provider (DASP).

The new service is aimed at all companies based in France, Belgium, Luxembourg and Switzerland. It is accessible from an initial payment of €1,000 and a recurring payment of €25 per week or €100 per month. Remember that StackinSat Pro offers €100 of bitcoins for any initial payment of more than €10,000.

StackinSat charges a fixed commission of 1.5% in euros for any purchase of bitcoins, which is one of the lowest prices on the market. In a few months, all StackinSat customers, individuals and professionals, will also be able to resell their bitcoins via the platform, at the same price conditions.

For the time being, StackinSat’s customers are themselves responsible for the safekeeping of their bitcoins, but the company plans to offer a digital safe solution in the near future for those who do not wish to keep their assets themselves. An option that should undoubtedly attract a new audience.

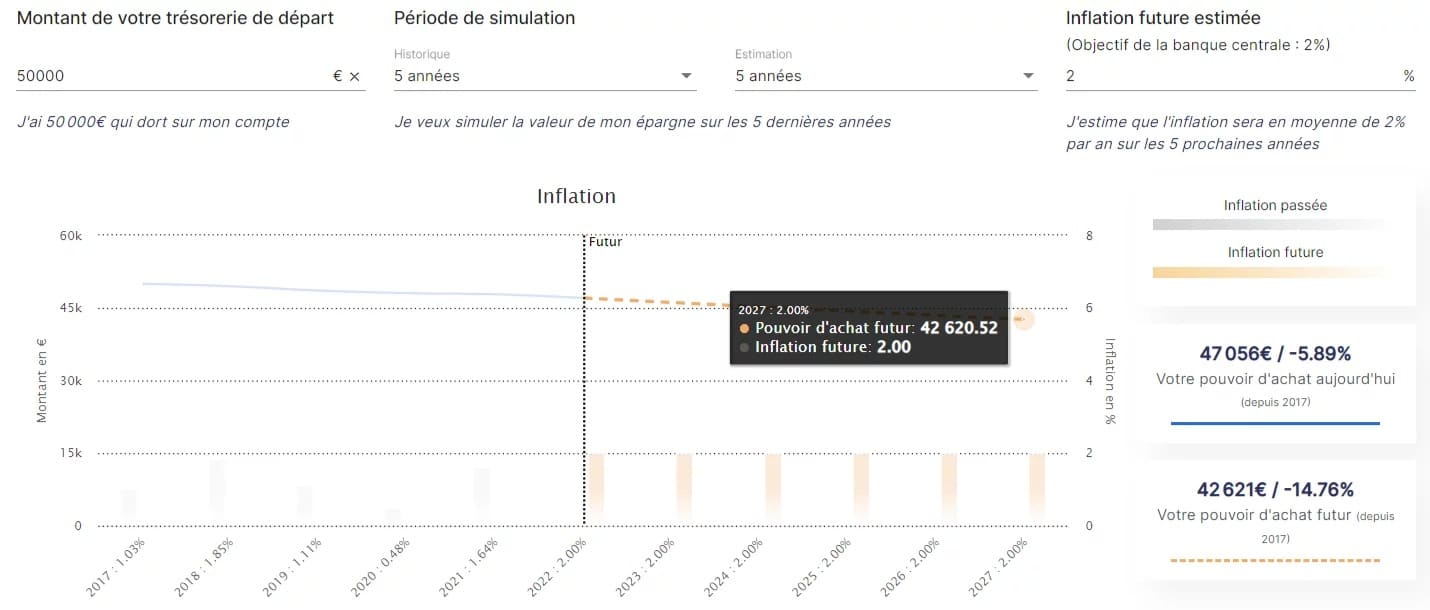

Also to assist French companies in their adoption of Bitcoin, StackinSat has developed an inflation simulator to accurately measure the real effects of inflation, particularly with regard to the dormant cash of these companies.

At a glance, this allows you to visualise the effects of the decline in purchasing power in the future:

Figure 2: The StackinSat inflation simulator

At the same time, to help companies take their first step towards Bitcoin, StackinSat provides several resources:

- A white paper “Investing in Bitcoin for Business” written in partnership with the law firm ORWL;

- 3 educational videos on Bitcoin;

- A webinar dedicated to tax and accounting, organised in partnership with ORWL and Mr Capital, to be held on 19 April 2022.