The negative evolution of the Bitcoin (BTC) price affects some sectors more than others. For the major mining equipment suppliers, the pill is hard to swallow: their shares have fallen by half in recent months. How to explain such a sharp decline?

Shares of major mining companies have plummeted

A publication from analytics site The Block Research says Bitcoin’s price swings are affecting mining companies more than other cryptocurrency-related companies. This is due to the nature of their operations, which is said to act as a lever on stocks.

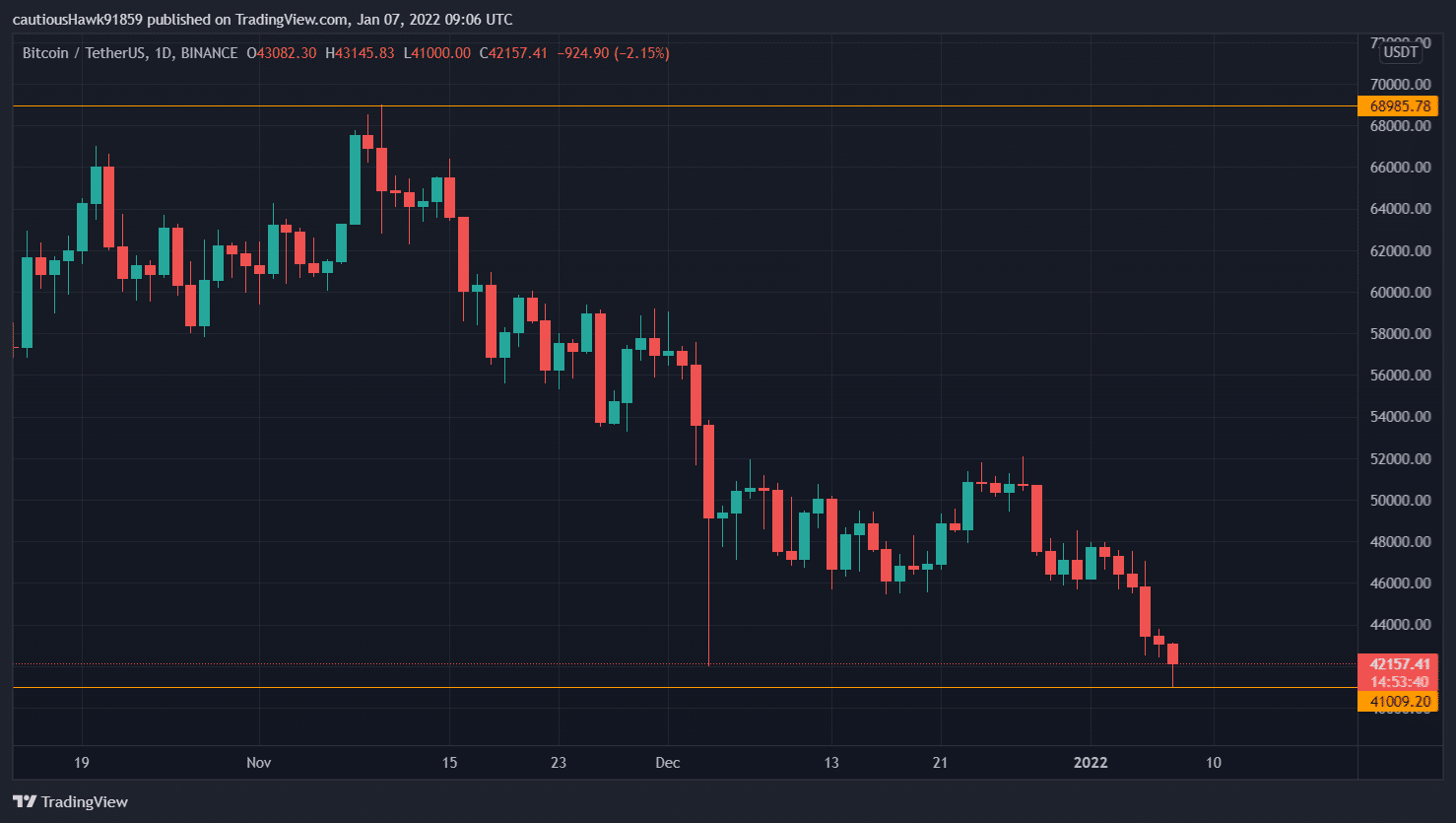

In recent months, shares in mining companies have indeed declined by half, a sharper drop than the price of Bitcoin. BTC has fallen from a record high of nearly $70,000 to a price of $41,000 this morning:

BTC’s price evolution since its last record (Source: TradingView, BTC/USDT)

BTC is known for its high volatility, but its year-on-year performance has been overwhelmingly positive. One might therefore think that the shares of mining companies, which have a long-term perspective, would be more stable. However, the opposite is true.

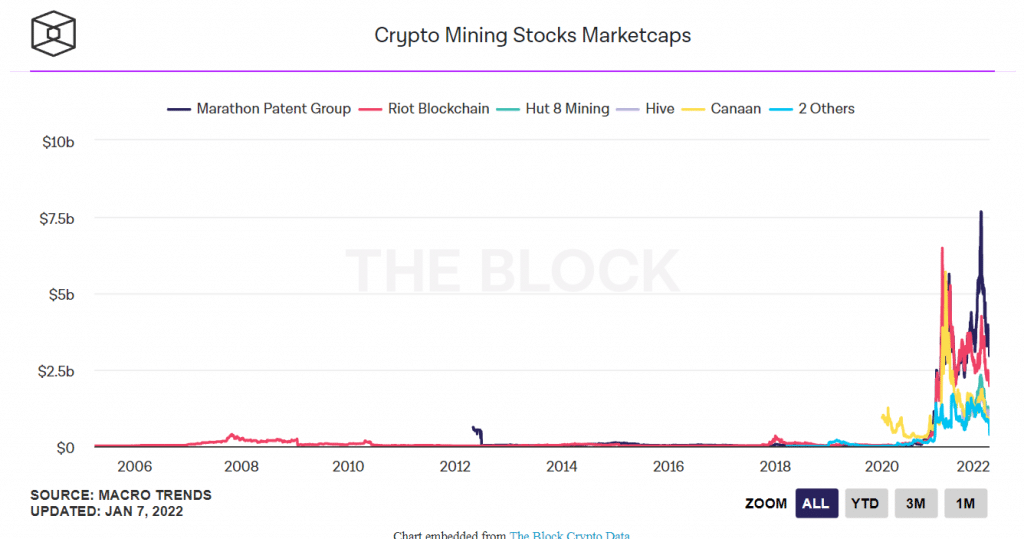

Marathon’s capitalisation plummeted from $7.65 billion last November to $3 billion yesterday. The same scenario for Riot Blockchain, which fell from $4.25 billion to $2 billion.

The overall capitalisation of the sector, which had exploded in 2021, has thus fallen sharply since November:

Mining sector stock capitalisations (Source: The Block Reseach)

How to explain these more intense variations

Mining companies are linked to Bitcoin in several ways, which would explain why they are more affected by its price fluctuations. They have Bitcoin in their treasury, of course, and the ASICs they offer themselves vary in price according to the BTC price. These factors increase the effect tenfold, and act as levers.

Another element to take into account is market dilution. Companies must constantly raise funds in order to continue to offer suitable products, which increases the number of shares in circulation. According to The Block, in the fourth quarter of 2020, Marathon Patent had 51,600,000 shares, a figure that has risen to 102,630,000 in the fourth quarter of 2021.

So these things are very typical of this industry, and explain these large variations. Not to mention the fact that 2021 was a year full of twists and turns for the mining sector. China’s ban has reshuffled the deck, and several governments have started to monitor the power consumption of mining farms. So there is a multi-factorial logic to this share price drop.