On Ethereum, the EIP-1559 update had introduced a “burn” mechanism, which allowed to destroy a part of the transaction fees. Since last August, 1 million ETH have been burned, or $4.2 billion. What effect does this have?

Ethereum continues to burn its ETH

As a reminder, the “burn” mechanism was introduced on Ethereum when the transaction fee processes were redesigned. It allows to get rid of a part of the ETH at each transaction, in order to promote a deflationary effect, and thus to support in the long term the price of the cryptocurrency.

If we look at the data published on Ultrasound.money, we see that the number of ETH burned has recently exceeded one million. This means that the network is burning an average of 6.27 ETH per minute, or almost $27,000 at the current price. This reduces the ETH supply to an average of 5.4 million per year.

The projects that burn the most tokens

We also learn that OpenSea, the largest non-fungible token (NFT) marketplace, is burning the most ETH. In total, it destroyed 110,000 ETH, putting the project ahead of simple Ether

transfers.

Ranking of projects by number of ETH burned (Source: Ultrasound.money)

The decentralised exchange platform (DEX) Uniswap takes third and fifth place in the ranking, in its V2 and V3 versions. And the Axie Infinity project is one of the few NFT projects to appear at the top of the rankings, confirming its current appeal.

A mechanism to support the course

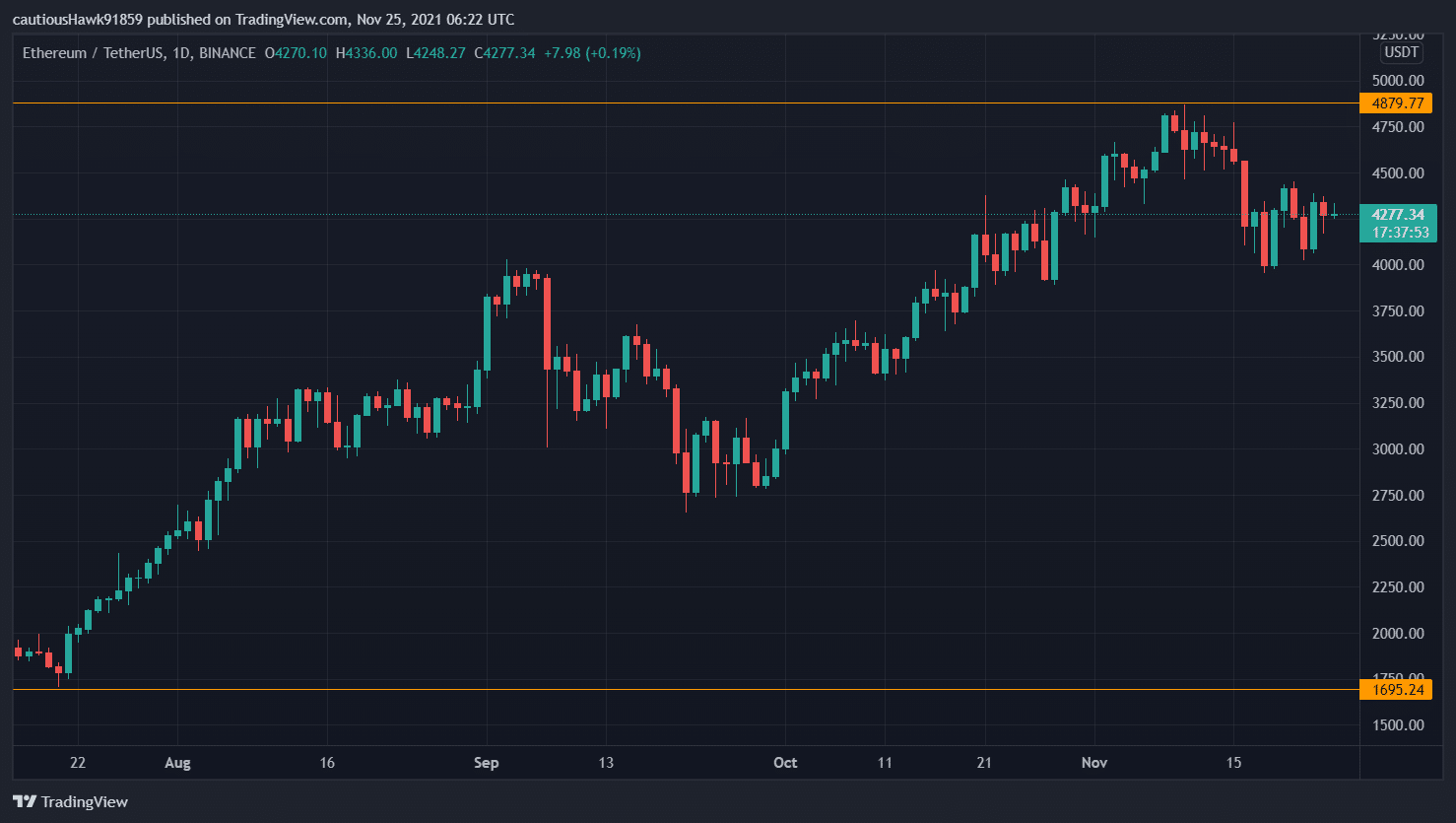

The reason why the ether burns have been so closely watched is that they are supposed to support the price in the long run. From this point of view, the manoeuvre seems to have worked. The ETH price has risen almost continuously since EIP-1559, which took place on 5 August. Ether hit an all-time high of $4,879 in early November

ETH price progression since EIP-1559 (Source: TradingView, ETH/USDT)

However, it is worth noting that the trend is widespread: the price of Bitcoin (BTC) has also been soaring in recent months, with an all-time high reached around the same time.

Fees continue to be prohibitive

On the transaction fee side, however, the news is less encouraging. Users had hoped that fees would not necessarily be reduced, but at least be more predictable and stop skyrocketing as a result of PIE-1559.

Instead, the opposite has happened, with transaction fees once again reaching record highs earlier this month. And while this makes layer 2 solutions happy, it strangles some users unwilling to pay more than $60 in average fees.

Hence some criticism from the community, which, as is often the case, welcomes positive price movements, while regretting that they are accompanied by exorbitant fees. From this point of view, nothing is really new at Ethereum.