Paxos has been ordered to cease issuing Binance’s BUSD stablecoin, and the crypto market has already picked its big winner. Tether’s BUSD has amassed a billion dollars in capitalization since yesterday, thanks to the flight of investors. The king of stablecoins has just consolidated its position again.

Investors are fleeing the BUSD to Tether’s USDT

Although Changpeng Zhao, the CEO of Binance, was reassuring, news earlier this week put a damper on the BUSD. Binance’s stablecoin, which had dreamed of being a serious competitor to Tether’s USDT, is in trouble. As we explained yesterday, the exchange platform saw more than $1 billion worth of stablecoins leave its vaults yesterday, in a huge panic among users.

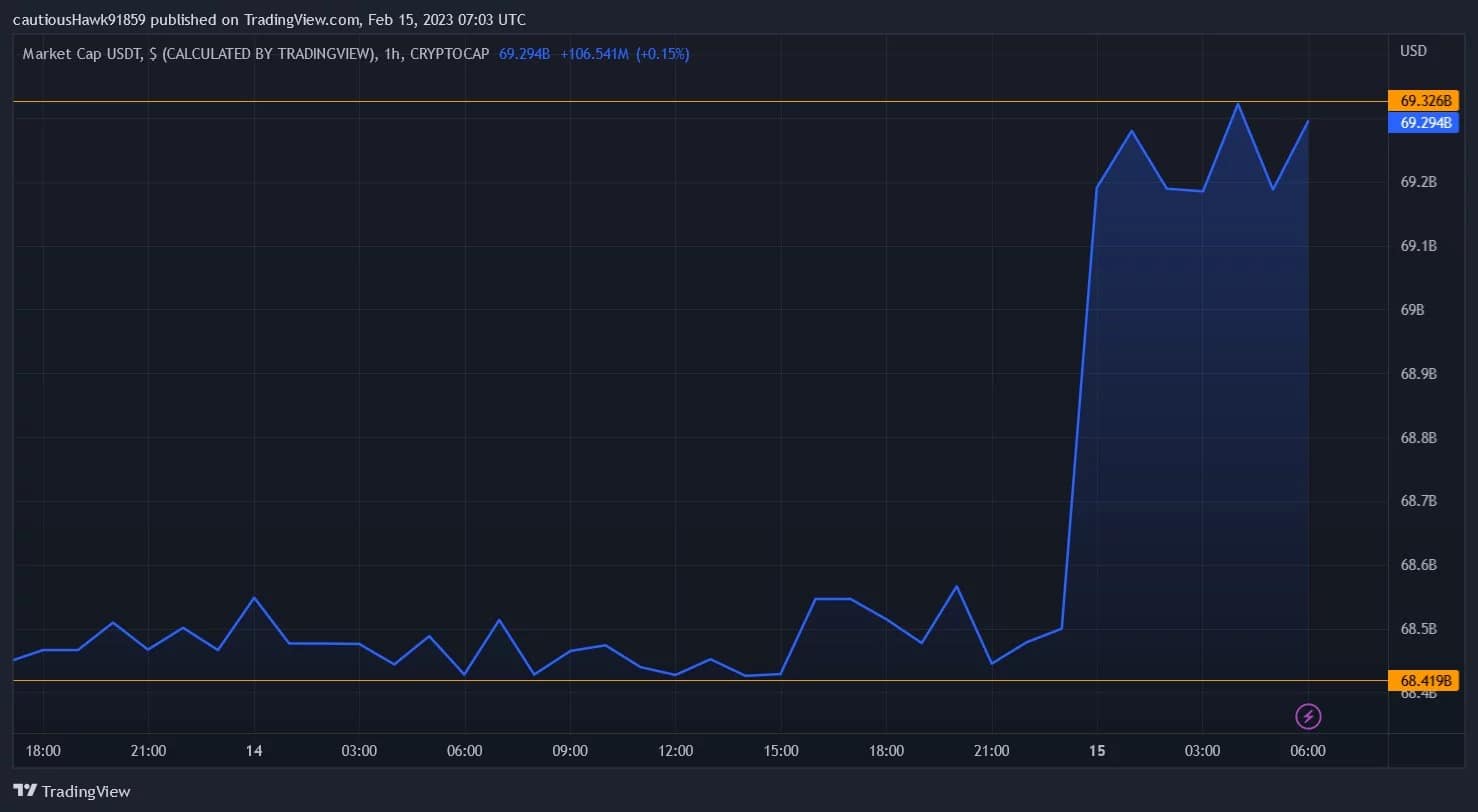

And the winner is… Tether. USDT’s capitalization has indeed taken over a billion dollars since yesterday, a sign that ex-BUSD supporters have taken refuge in the arms of the biggest stablecoin of the moment:

USDT capitalization explodes since Binance’s BUSD troubles began

The capitalization of the BUSD shows the opposite movement. From $16 billion on February 12, it has shrunk to $15 billion this morning.

Tether (USDT) is the undisputed king of stablecoins

If there is one constant in the world of cryptocurrencies, it is Tether’s almost supernatural ability to continue to exist and rally investors, despite the scandals and doubts that have plagued its existence. Its stablecoin USDT has just proved that it is still the king, and its dominance of the “stable” crypto market is now over 50%.

The trend is not so much reflected in Circle’s USDC, the second largest stablecoin of the moment. It too has actually lost momentum: its market cap was over $41 billion on 12 February, but has dropped to $40 billion this morning.

Why is Tether so popular with investors? The reason seems to be partly geographical. Both Paxos and Circle (the issuer of USDC) are located in the US, where the SEC is lurking. As for Tether, it is located in Hong Kong, and is therefore not reachable by the US financial watchdog. This is a reminder that despite the decentralisation ideals of cryptocurrencies, geographical location plays a significant role.