Learn why gold and Bitcoin (BTC) are two complementary assets that can help build solid savings to ensure resilience in uncertain times. We will also look at how to buy gold safely with GOLD AVENUE, a leading platform for the sale, storage, and redemption of precious metals

What is the difference between gold and Bitcoin?

If Bitcoin (BTC) sometimes enjoys the nickname “digital gold”, it is not by chance. Indeed, Bitcoin and gold, although they are opposites in many ways, are what are known as stores of value.

Bitcoin is a digital asset of which we are the sole owners, provided of course that we retain ownership of its private keys. Gold, on the other hand, is a physical asset, palpable and exchangeable, and has always been so. Moreover, gold was for a long time a reference value for the currency in circulation, and was referred to as the “gold standard”, a structure that was gradually abandoned in the early 1930s in Europe and in 1976 in the United States, leading to a surge in the price of gold.

And while gold is no longer used directly in the world’s monetary systems, the precious metal continues to be of interest to individuals wishing to have physical savings that are impervious to various events in the global financial system, both geopolitical and inflationary, which continues to worry households.

So why does Bitcoin enjoy the nickname of digital gold? To understand this, it is necessary to assess what Bitcoin and gold have in common. First and foremost, the main reason for the interest is the limited amount of gold available. Small amounts of gold are mined every year, and the amount of bitcoins added to circulation is halved every 4 years due to halving. Furthermore, according to the white paper written by Satoshi Nakamoto, there will never be more than 21 million units of Bitcoin available on the market.

We can also draw an interesting parallel between these two assets and their relationship to the fiat money we use in our daily lives. As both gold and Bitcoin can be used as a means of exchange (Bitcoin can be used as a means of payment in many countries), as units of account or as a store of value, they are indeed similar to a currency.

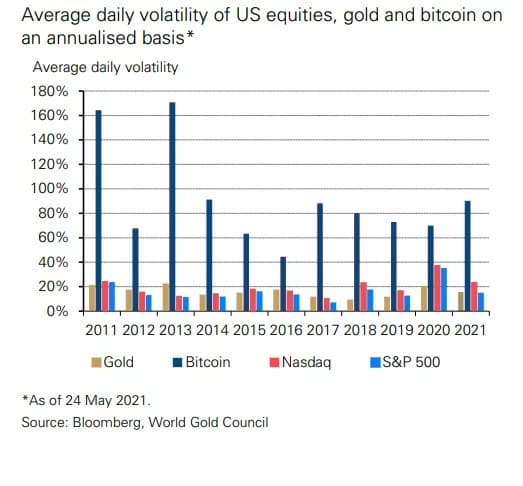

However, the main difference between Bitcoin and gold is probably their own volatility. Indeed, Bitcoin, although it is rising in value in the long term, is extremely volatile in the short and medium term. Moreover, it has a significant correlation with the traditional financial system and remains sensitive to investor momentum and movements in the cryptocurrency market.

Figure 1 – Average daily volatility observed for gold, Bitcoin, Nasdaq index and S&P 500 index

For example, on May 19, 2021, BTC suffered a 30% loss following a negative announcement about the Chinese market.

Gold, on the other hand, is considered to be a relatively stable asset, with some of the lowest volatility of traditional assets and a tendency to appreciate over the long term. Furthermore, gold is said to be inversely correlated to other assets, i.e. when other assets fall, gold tends to rise, and vice versa. It is this low volatility and negative correlation that gives gold its safe haven status.

Finally, a last interesting point is the specific taxation of investment gold. In France, as in most European countries, although gold is not subject to VAT, taxes do apply on resale. Fortunately, the tax on capital gains made on gold is degressive over time, which means that after 22 years of ownership, your gold will be exempt from taxes at the time of resale.

Why do gold and Bitcoin complement each other

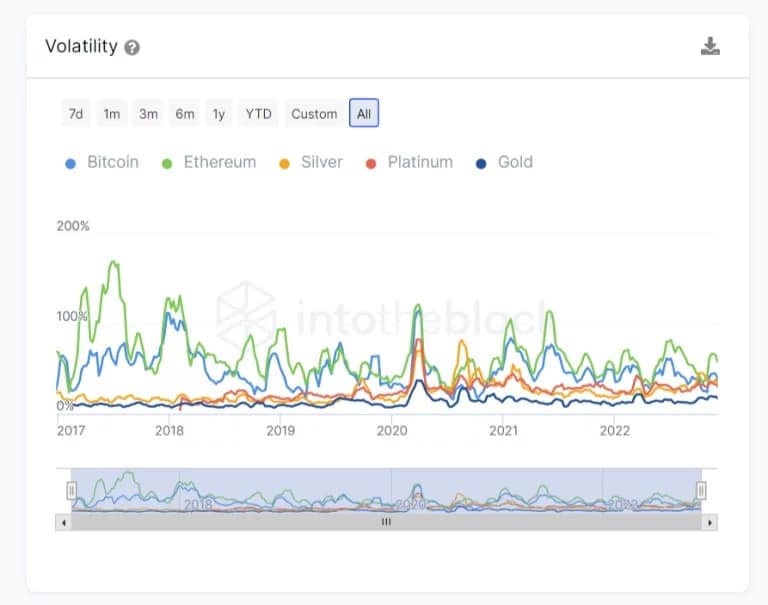

As we have just seen, the main differences between gold and Bitcoin are their volatility and their behaviour towards market movements.

But should investors choose between the two? No, we could even say that gold and Bitcoin are complementary for the reasons we have just listed.

Owning both gold and Bitcoin allows you to consolidate your savings by diversifying your exposure to two assets with similar properties. Thus, owning gold allows you to respond to the problem of securing your savings and investments, insofar as its value is historically stable over the long term, and tends to remain so. And as the price of gold tends to rise when other major assets fall, it is also used to protect one’s portfolio from the vagaries of the crypto and stock markets.

Bitcoin, on the other hand, is best viewed as a speculative asset that can be used to generate profits in the short to medium term (volatility will often be high), or even in the long term for the more patient, in which case volatility can be “smoothed out” via investment strategies such as Dollar Cost Averaging (DCA).

However, with this strategy, you will not be able to use Bitcoin as an asset that can be used at any time as a back-up savings, as you will be dependent on its current price.

Figure 2 – Volatility of Bitcoin (in light blue) against different metals, including gold (in navy blue)

As we know, good savings are diversified, so owning assets with different properties makes sense. If a portfolio consists only of investments of the same kind (bonds, shares, savings, etc.), then the whole value of the portfolio will fall simultaneously when unfavourable factors occur.

Here, by investing in both gold and Bitcoin, you allow your portfolio to react to a larger number of situations that cause one asset to fall. A decline, which in this case can be offset by the rise or relative stability of another asset.

Ultimately, investing in gold is a good way to protect yourself from the high volatility of Bitcoin, especially with a physical asset that has proven itself throughout the ages, especially during periods of rising inflation.

Start saving in gold with GOLD AVENUE

Before buying gold or any other precious metal to build up solid and accessible savings, it is advisable to call on a player recognized in this sector, both for the quality of its services and for the authenticity of the products it offers.

GOLD AVENUE, as an official dealer of the MKS PAMP GROUP and leader on the European market, meets all these criteria. Indeed, its parent company is part of the London Bullion Market Association (LBMA), thus ensuring the quality of the precious metals produced by MKS PAMP itself.

Another interesting point is that the gold bars you buy from GOLD AVENUE are brand new and allocated, meaning that they are 100% yours (unlike other platforms that may sell used or shared gold). If you choose their secure storage solution, your bullion will be kept in their vaults in Switzerland and off their balance sheet. In other words, even if something happens to GOLD AVENUE, your metals will still belong to you and you can get them back at any time.

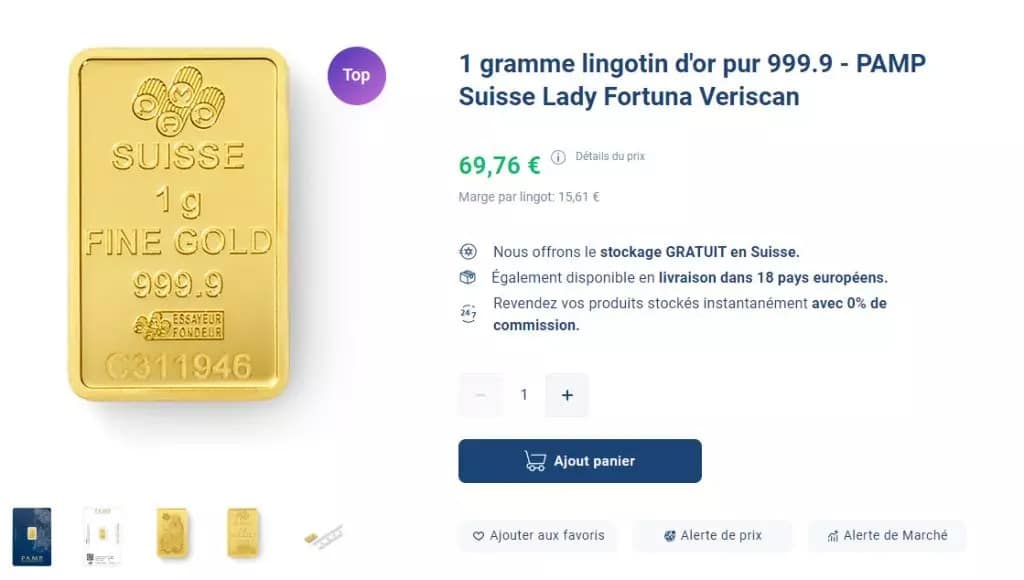

It is important to note that saving in gold is not only for big wallets: GOLD AVENUE offers gold from 1-gram bars that are 99.99% pure gold (24 carat), produced by the MKS PAMP refinery.

You don’t know where to start or you have trouble defining the budget you want to allocate to your investment in gold? GOLD AVENUE offers a savings wizard to help you determine the best buying strategy for you

Figure 3 – Overview of a gold purchase window on the GOLD AVENUE website

As a precious metal dealer, GOLD AVENUE will be required to charge a margin on products sold on the site. This margin is directly included in the prices displayed on the site, thus protecting you from any unpleasant surprises: the price indicated is the amount you will pay for the product once it has been purchased and stored in your GOLD AVENUE wallet, so the price indicated will be the price of the metal less the margin.

In return, GOLD AVENUE is able to store your precious metals free of charge, insured against loss, theft and damage. In addition, GOLD AVENUE does not charge any fees or commissions for any resale transactions.

If you prefer to store your gold yourself, the company offers fast and discreet insured delivery throughout Europe.

Finally, GOLD AVENUE also offers an instant buy-back solution for all products stored with them. This means that if you want to sell your goods quickly, GOLD AVENUE will buy back your metals stored with them at the current market value at any time.