While the altcoin market has taken advantage of Bitcoin’s rise to catch its breath, some tokens are positioning themselves as outsiders with particularly notable rises. These include LINK, the token of the Chainlink oracle network, which has risen by over 35% in the last 7 days. Why?

The LINK, big winner of this week’s pump

Benefiting successively from the false news surrounding the acceptance of BlackRock’s iShares cash Bitcoin ETF and Ripple’s victory over the U.S. Securities and Exchange Commission (SEC), the BTC price achieved a very handsome increase of around 10% over the last 7 days, dragging almost the entire altcoin market higher as usual.

However, one outsider in particular attracted the interest of investors: LINK, the token of the Chainlink oracle network. In fact, over the same period, the LINK token’s price has risen significantly, gaining over 35%, placing it in second place behind Injective’s INJ, albeit at a much lower level of capitalization.

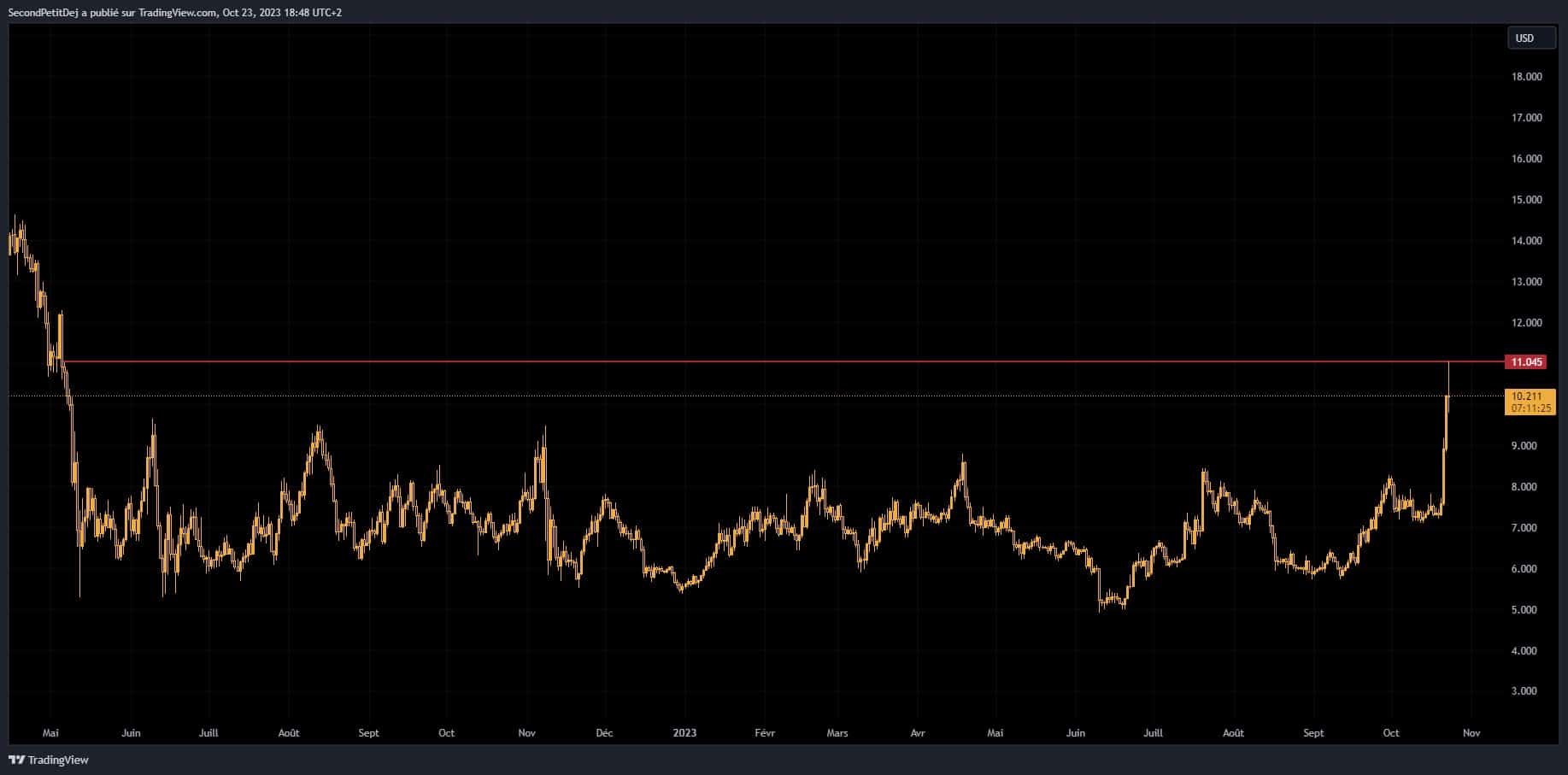

After stagnating for some time at around $7.3 each, LINK tokens broke through the $11 mark this morning, before falling back to around $10.2. This momentary rise took the LINK price to its May 2022 level, which corresponds to the fall of the Terra ecosystem (LUNA) on the calendar.

Chainlink LINK token price from May 2022 to today

So, apart from the surge generated by Bitcoin’s rise, what else could this sudden pump be due to?

Analysis of the rise of the Chainlink token

According to analysis firm Lookonchain, the first answer lies with Korean exchanges Bithumb and Upbit, which between them have reportedly invested over $9 million in LINK, or more than 945,000 tokens. What’s more, as Lookonchain again points out, the LINK token price actually began to fall when Bithumb decided to sell the equivalent of $2.05 million of its tokens.

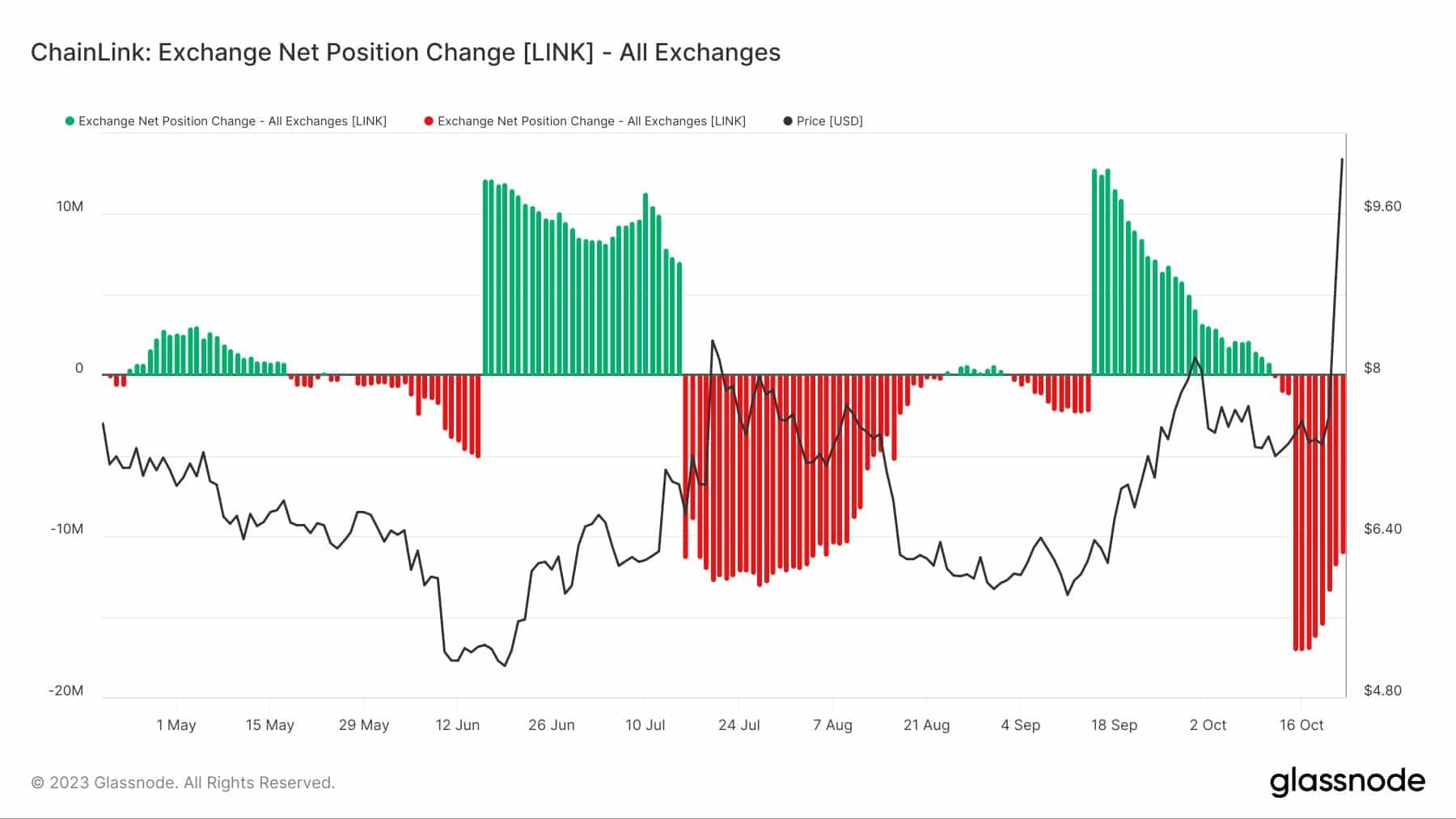

In parallel, it is interesting to note that a colossal quantity of LINK tokens have been withdrawn from exchanges in recent days, constituting one of the largest exits of the year. It is likely that, following the announcement of Chainlink’s Staking V2, many investors wanted to recover their LINK tokens or buy new ones to move them to their own wallet.

LINK net inflows and outflows on exchanges over the past 6 months

At the same time, a whale is said to have accumulated $79.22 million worth of LINK tokens since last February through some forty different addresses, before selling them this month. The whale we’re talking about acquired its LINK tokens at an average price of $7.58 and earned over $2.1 million in profit on resale. Still according to Lookonchain, another whale accustomed to generating profit on LINK price fluctuations took advantage of the LINK’s falling price to short more of it.

Chainlink ambassador ChainLinkGod.eth took the opportunity to highlight the various partnerships the oracle company has established with financial institutions such as DTCC, the SWIFT network (including BNP Paribas, BNY Mellon, Citi and Clearstream) and the Australia and New Zealand Banking Group. At the same time, he also announced that V2 of Chainlink’s staking solution would be released before the end of the year