The resurgence of systemic geopolitical risk is prompting investors to consider the best option for preserving their capital against a potential drop in value, either of their stock market investments or of their domestic currency. Since Monday October 9, precious metals have proven to be a safe haven, but what about the Bitcoin price?

Global view of the markets

The revival of systemic geopolitical risk with the conflict in the Middle East has had a massive bullish effect on the price of gold on the stock market, as well as on its corollary, the price of silver. This arbitrage in favor of the historic safe-haven par excellence occurred at the same time as new record highs in long-term bond interest rates, with the risk of a second wave of inflation built on the rebound in oil prices.

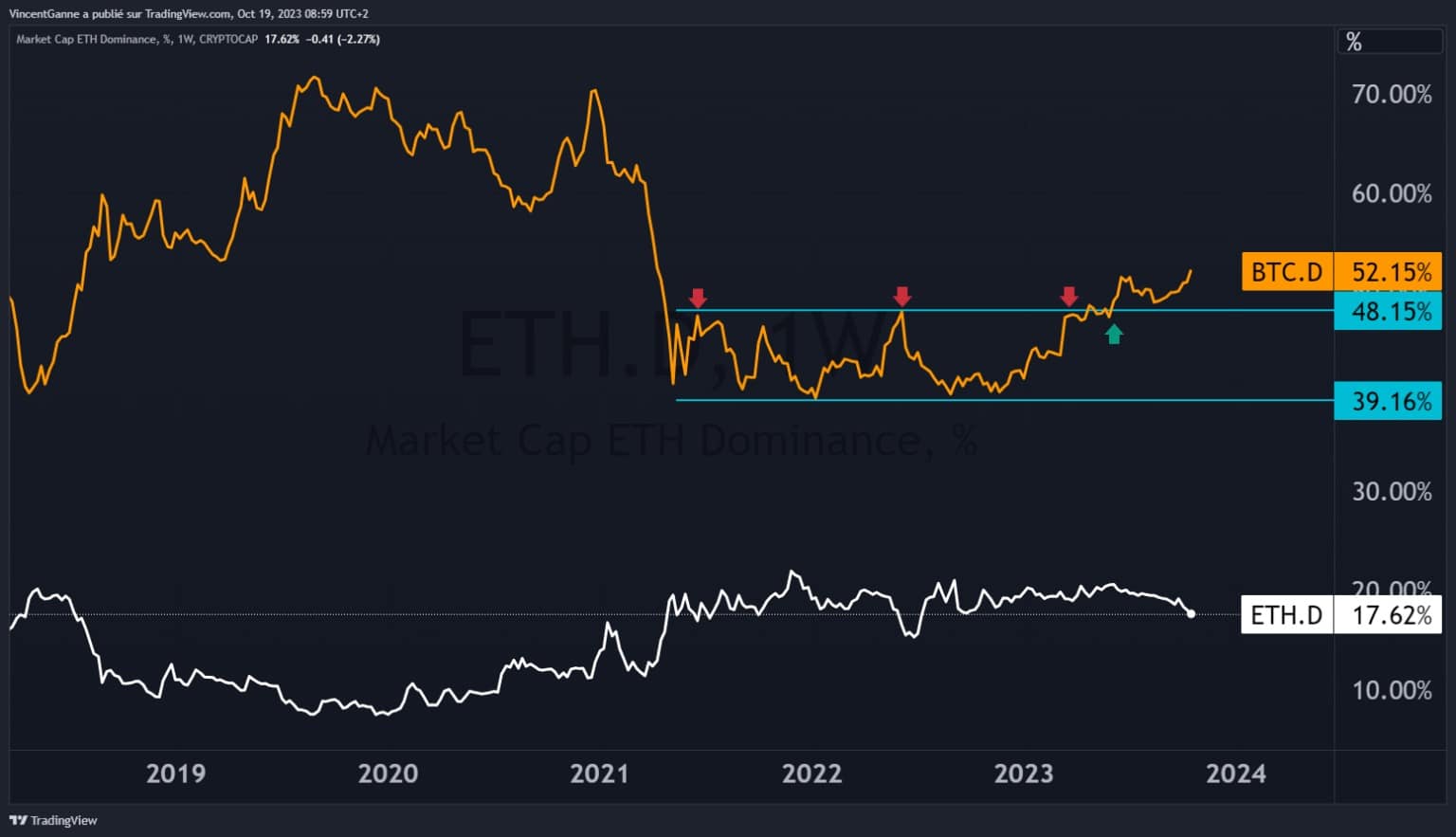

The crypto market was not swept away by the storm that descended on risky assets on the stock market, in particular the bitcoin price with a new annual high of its dominance.

Graph representing the dominance of bitcoin compared to ethereum

Bitcoin, the safe haven?

So the bitcoin safe-haven buzz is back, but let’s be clear: it’s a myth, or rather a legend. Indeed, despite its resilience to current events, BTC does not have the characteristics of a safe-haven financial asset. Bitcoin’s current resilience is due to its own fundamentals, in particular the theme of bitcoin spot ETFs expected to be a game changer for the year 2024, alongside the next halving.

Here are the characteristics of a safe-haven currency that bitcoin, as a digital currency, possesses only in tiny part:

- Economic and political stability of the state minting the currency in question: A safe-haven currency is issued by a country deemed to be economically and politically stable. This means that the country has solid institutions and a serious long-term economic policy. Political stability is also important to ensure investor confidence. Bitcoin doesn’t fall into this category, as it doesn’t belong to any state;

- Reserve currency: Safe-haven currencies are still recognized as reserve instruments throughout the world. The US dollar and gold have this universally accepted status, but BTC does not;

- Inflation under control in the long term: Reserve currencies are generally associated with moderate rates of inflation so as not to erode the value of the currency (yes, that’s a characteristic bitcoin possesses);

- High liquidity: To be a safe-haven currency, a domestic financial market must be of sufficient size (the critical size) to accommodate the capital that wishes to come and invest in it. Bitcoin does not have this depth of liquidity. This is a major factor in the accessibility of a safe-haven currency, as is the economic position of the country concerned.

Chart representing weekly Japanese candlesticks of the US 10-year bond yield

Technical analysis of Bitcoin

To conclude, the technical configuration of the bitcoin price remains under the short-term influence of the unsuccessful breakout attempt on Monday October 16 following the fake news on Blackrock’s bitcoin spot ETF. As long as the market fails to break through the $29,000 resistance level at the close, it is exposed to the risk of a correction. On the other hand, breaching this resistance would allow the market to go in search of new annual records.

Chart showing Japanese candlesticks in weekly and daily data for the CME bitcoin future contract