Will Tether finally have full transparency? The USDT issuer has announced through its future CEO Paolo Ardoino that it is working to make its reserves transparent and verifiable in real time. Although no precise timetable has been communicated, this could be implemented sometime in 2024.

Tether will soon be 100% transparent on its USDT?

According to information from Bloomberg, Tether is currently working on a system to publish reports on its reserves in real time. Tether is the issuer of USDT, the most capitalized stablecoin on the cryptocurrency market, and has long faced criticism for the opacity with which its reports were managed.

Paolo Ardoino, Tether’s CTO and unofficially the company’s spokesperson, revealed the information to the American newspaper. He points out that Tether currently has no precise timetable for this innovation, but that it should be effective sometime in 2024.

This should be a welcome move, as USDT is, at the time of writing, capitalized to the tune of $84 billion. In other words, Tether USDT alone represents over 67.5% of the stablecoin market.

After being fined $41 million during 2021 by the U.S. Commodity Futures and Trading Commission (CFTC), the American company has begun publishing quarterly updates of its reserves signed by BDO Italia, a branch of BDO, the world’s 5th largest auditing firm.

Further proof of transparency, but not enough for many: BDO Italia provides quarterly attestations of Tether’s reserves, not audits. An attestation by an external firm only verifies the authenticity of documents transmitted by the company itself, which is a lower level of confidence than an audit.

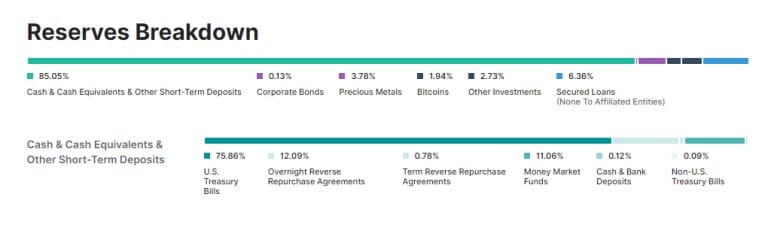

Constitution of Tether’s reserves according to its latest report dated last June

While the cryptocurrency market as a whole is struggling to find momentum, Tether is not to be pitied, with its flagship stablecoin only gaining ground against its competitors. The second most capitalized stablecoin on the market, Circle’s USDC, has continued to lose investor interest since its depeg last March.

In its latest quarterly report, Tether reported $1 billion in operating profits, up 30% on the previous quarter. Although US Treasuries still make up the vast majority of the composition of reserves dedicated to USDT, Tether had announced that it was devoting 15% of its profits to the purchase of Bitcoin last March.