For the first time, Grayscale’s GBTC recorded net positive flows as an ETF, ending more than 78 days of consecutive net outflows. Meanwhile, after 7 days of net outflows, spot Bitcoin ETFs are all back in the green.

First net positive flows for Grayscale’s GBTC spot Bitcoin ETF

For the very first time since its introduction as an ETF on January 11, 2024, Grayscale’s GBTC recorded its first net positive flows. In doing so, it ended more than 78 days of consecutive net outflows with the inflow of $63 million.

However, Grayscale still holds a considerably reduced number of Bitcoins compared to the beginning of the year. Whereas the firm held 619,200 BTC on January 11, this figure has now fallen to 291,200, or less than half.

This decline can be explained by the waning interest in the company’s ETF, which is now facing stiff competition, particularly from the giant BlackRock’s IBIT ETF, which is steadily gaining ground. Grayscale’s GBTC also offers the highest fees, although the company is planning to launch a “mini Bitcoin spot ETF”, which should instead offer the most competitive fees on the market.

At the same time, all Bitcoin spot ETFs in the US ended 7 days of consecutive global net outflows. In fact, they had suffered their worst day since their introduction on May 1, with $563.7 million in outflows.

Evolution of flows for all Bitcoin spot ETFs in the United States since their launch

Except for Hashdex and WisdomTree’s spot Bitcoin ETFs, which had neutral flows, all had positive flows, led by Fidelity with $102.6 million in net inflows to its FBTC. In all, $378.2 million in net positive flows were recorded on May 3.

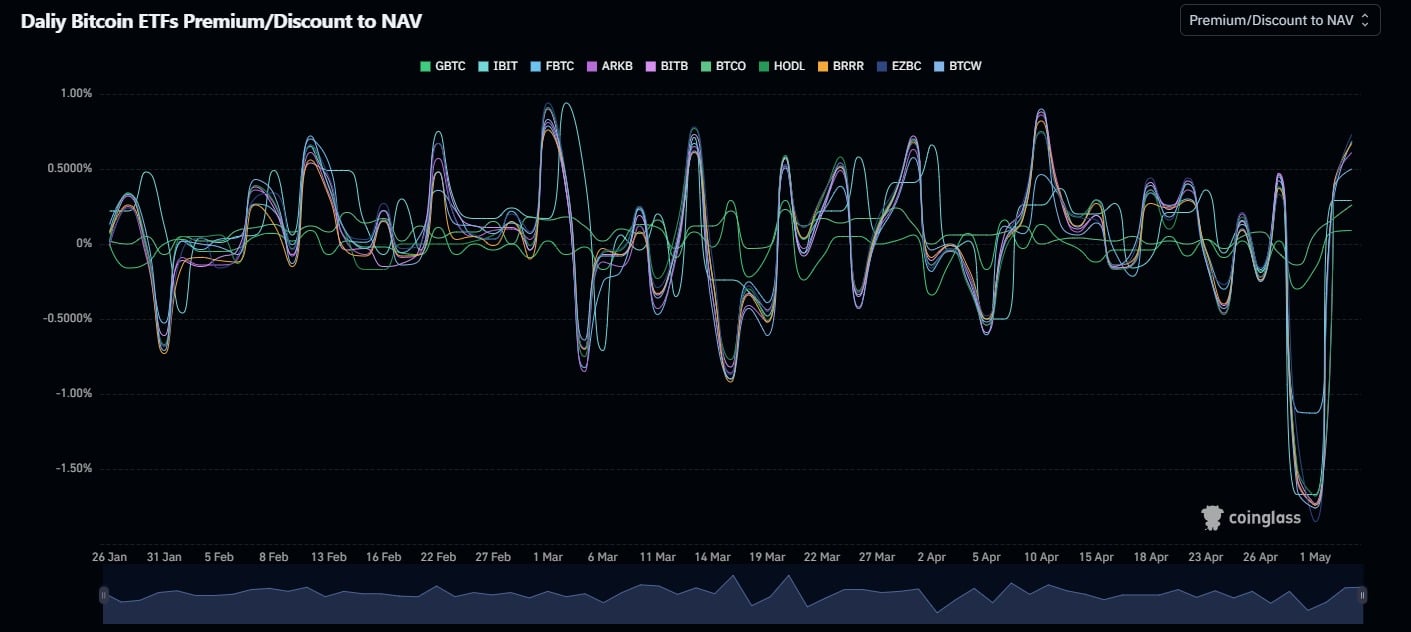

Meanwhile, on the evening of April 30, ETFs closed at a discount to their benchmark asset, Bitcoin. BlackRock’s IBIT closed at a 1.7% discount, while Ark Invest and Bitwise’s ETFs closed at a 1.4% discount.

A discount on an ETF means that its units trade at a lower price than the value of their underlying asset. In contrast, a premium means that ETF shares trade at a higher price.

Evolution between the market price of Bitcoin spot ETF units in the US and their net asset value (NAV)

Interviewed by Bloomberg, Bitwise president Teddy Fusaro reported that this was nothing to worry about, and part of the usual rebalancing of their customers’ portfolios on the last day of the month. As it happens, these movements should be seen in the context of Bitcoin’s falling price at the time.

The volatile nature of Bitcoin also highlights the “problems” that can arise on the institutional side, as in this case.

In any case, the relationship between the ETF’s market price and its net asset value (NAV) has since returned to normal, oscillating between 0 and 1 or -1%.