Aside from sending the entire cryptocurrency market into a tailspin, the FTX platform affair has mostly caused huge collateral damage, especially for Solana (SOL), which is down nearly 55% in two days. We explain the current risks for Solana.

Solana down 55% in 2 days

The case involving FTX and Alameda Research, the two companies owned by Sam Bankman-Fried, will ultimately have sent the cryptocurrency market into a huge slump. While Bitcoin (BTC) is down nearly 10% in the space of 24 hours, other assets are more affected than others.

This is particularly the case for Solana (SOL). After falling by 20% on Tuesday 8 November, from 29 dollars to 23 dollars, the asset continued its descent into the abyss on Wednesday 9 November. The price of the SOL quickly fell below 15 dollars, a further 40% drop on Wednesday.

Solana (SOL) price falls

But why is the SOL falling more than the rest of the market? Simply because the Solana ecosystem is historically linked to Sam Bankman-Fried. Indeed, his companies have invested a lot of capital in the SOL and in various projects based on this blockchain.

As a reminder, FTX and Alameda invested in Solana in 2019, at its launch, via a series of OTC transactions. The average entry price for both entities was around ten cents on the dollar, making them the majority owners of SOL.

What are the risks for Solana?

First, it should be noted that the market faced a huge liquidation wall if the SOL price fell below $20. Specifically, a whale had taken out a loan on Solend worth $40 million, depositing about 2 million SOL as collateral.

As foreseen in the rules of the decentralised protocol, 20% of the position was first liquidated. This represents about 10 million dollars that were immediately sold on the market, and there are still more than 30 million dollars ready to be liquidated.

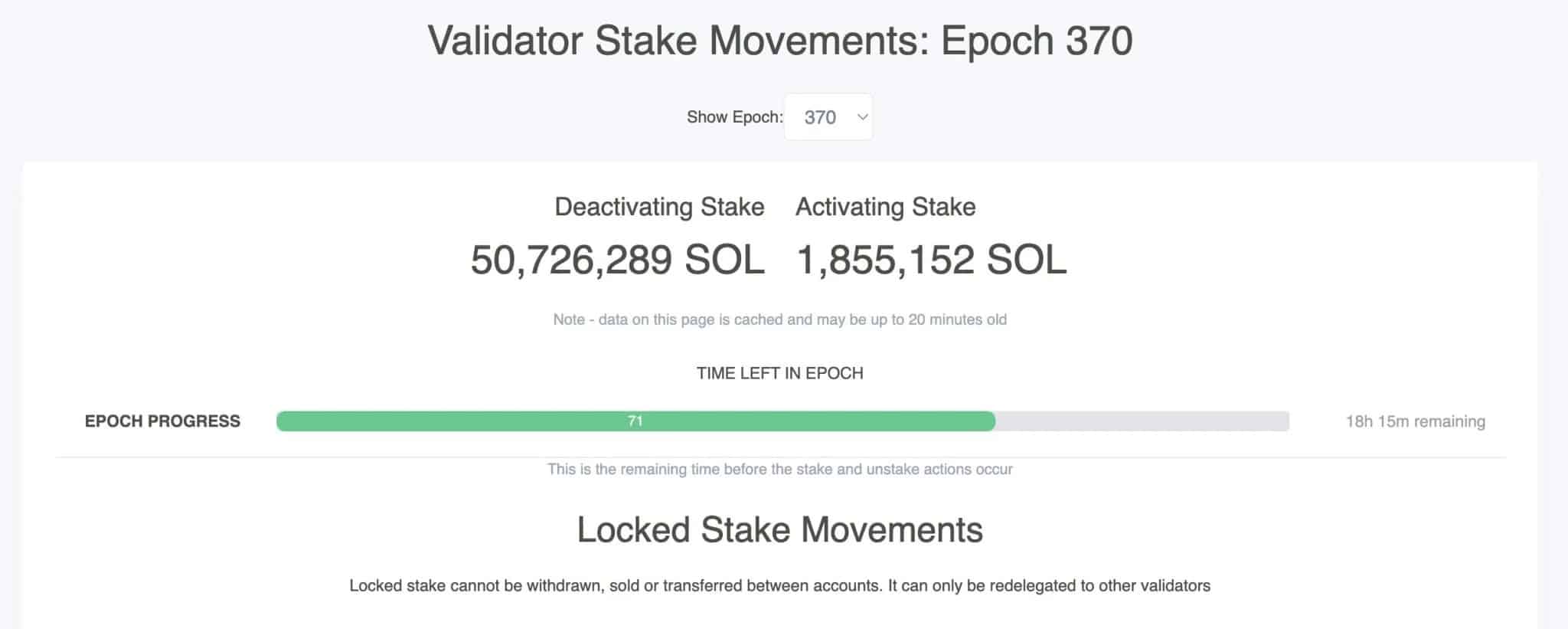

However, this kind of problem happens regularly in decentralised finance (DeFi) when the market is falling sharply. The real problem lies elsewhere. This Thursday, at approximately 9am (that’s Solana’s epoch 370), nearly 51 million SOLs will be released and ready to sell on the market.

Movement of SOLs staked on the Solana blockchain

In concrete terms, these tokens represent $900 million at the time of writing. They represent 13% of the total amount in circulation. As you might expect, the SOL tokens are facing a threat of unprecedented magnitude that could drag them down significantly.

These are tokens that were initially locked on the Solana blockchain by validators and whose withdrawal request has just been made. Even if nothing has been confirmed, there is a strong chance that some of them belong to Alameda Research.

We’ll skip over the important risks for the functioning of the Solana blockchain, with only 1.8 million SOL tokens in staking. As a reminder, Solana operates under a Proof-Of-Stake consensus and therefore requires a certain amount of validators to function.

In short, as the saying goes, “you can’t catch a falling knife”. In other words, be very careful. Especially since a scenario of market manipulation orchestrated by Alameda (to drive up the price of SOL before selling their assets) could very well be possible.