After a retracement phase on most crypto-currencies, what are the scenarios to watch? Technical update on Bitcoin (BTC), Ether (ETH) and The Sandbox (SAND)

Technical analysis of Bitcoin (BTC)

The recent movement has shaken many people, especially those most exposed. However, it is not as dramatic as one might think.

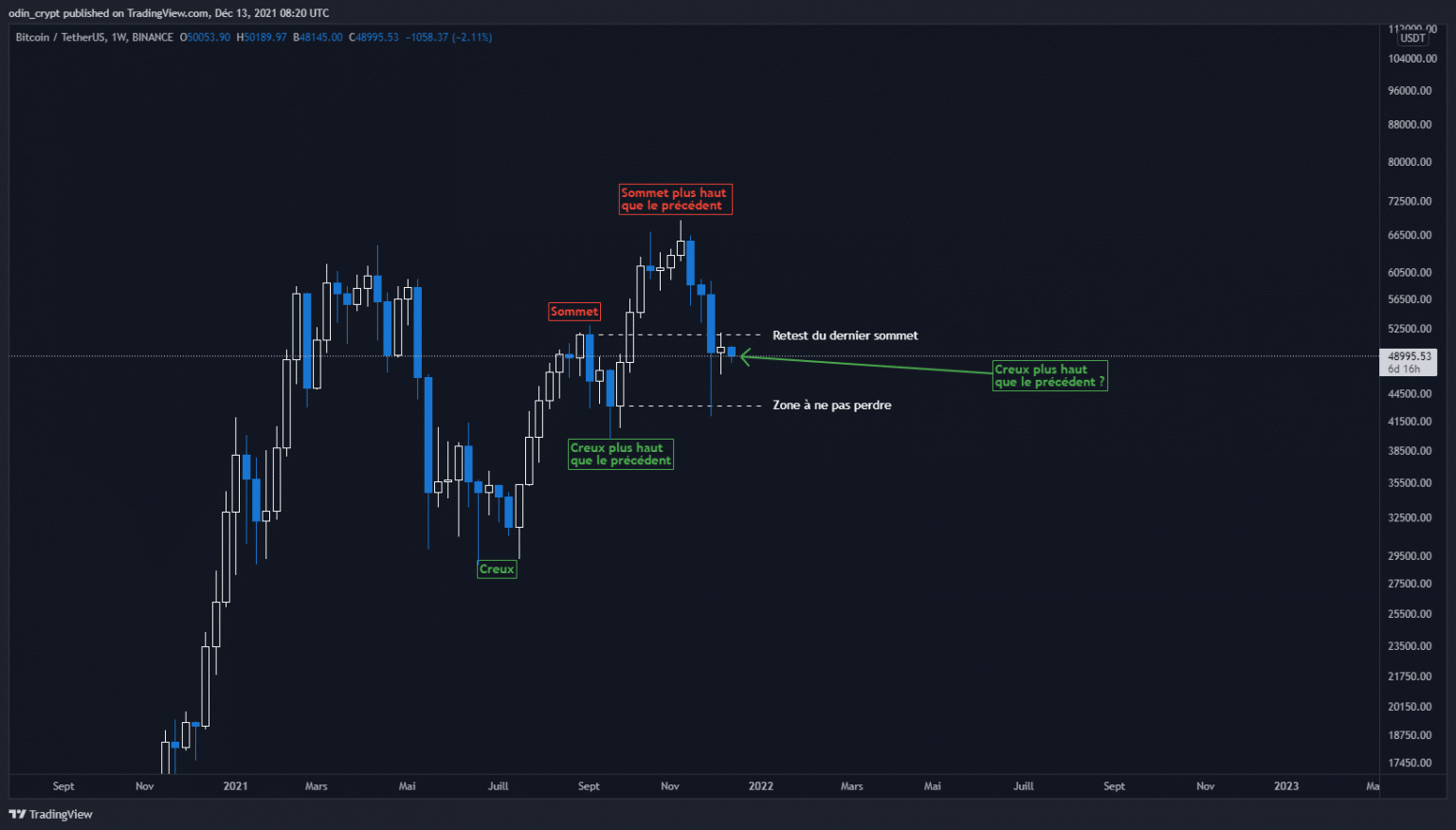

Indeed, we consider that an uptrend is defined by a succession of highs and lows higher than the previous ones. In this case, BTC remains in this macro uptrend.

The Bitcoin price has come in for a big retest from its last high, and manages to close in the $49,000 area. If it manages to bounce back into this area, we can consider that the trend remains intact. The weekly time unit tells us that the $43,000 level should not be breached on a weekly close.

Bitcoin (BTC) analysis in 1W

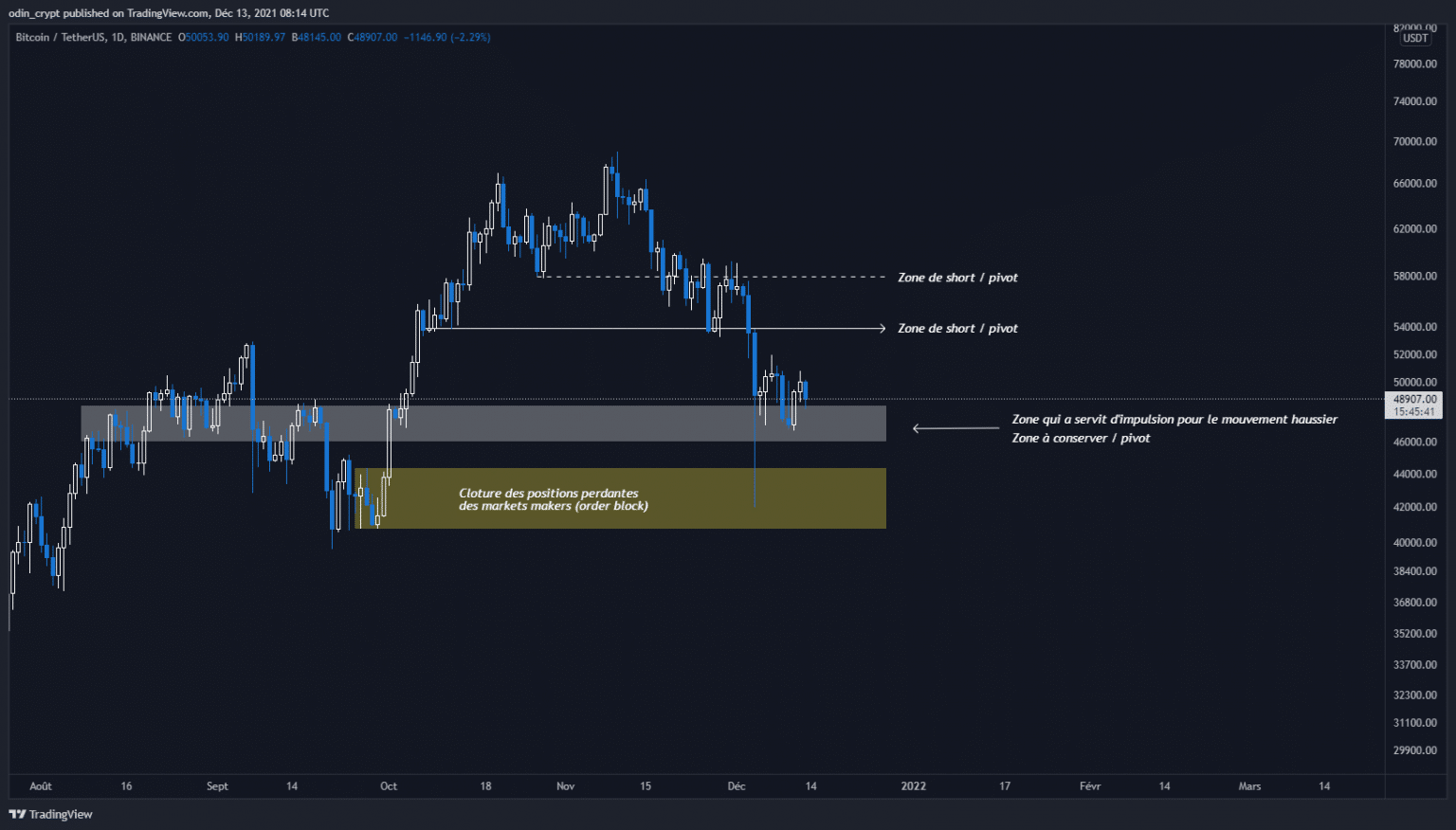

If we zoom in on the daily view, we can refine our analysis.

The $46,000 – $48,300 area had allowed the price to start its bullish impulse to end its run at $69,000. It now serves as a liquidity zone that the price should maintain.

3 other zones are emerging:

- The $53,900 that will serve as price resistance;

- $58,000 which will need to be breached to re-start this local uptrend and join the macro uptrend;

- The $40,000 – $44,000 has allowed market makers to come in and create liquidity.

Bitcoin (BTC) analysis in 1D

What to expect now

I think the price will have to establish a lateral phase between $46,000 and $53,900 before making a decision. For now, the most likely outcome would be a breakout from the top, but it’s important to protect yourself by placing a stop-loss order below $45,500.

Analysis of Ether (ETH)

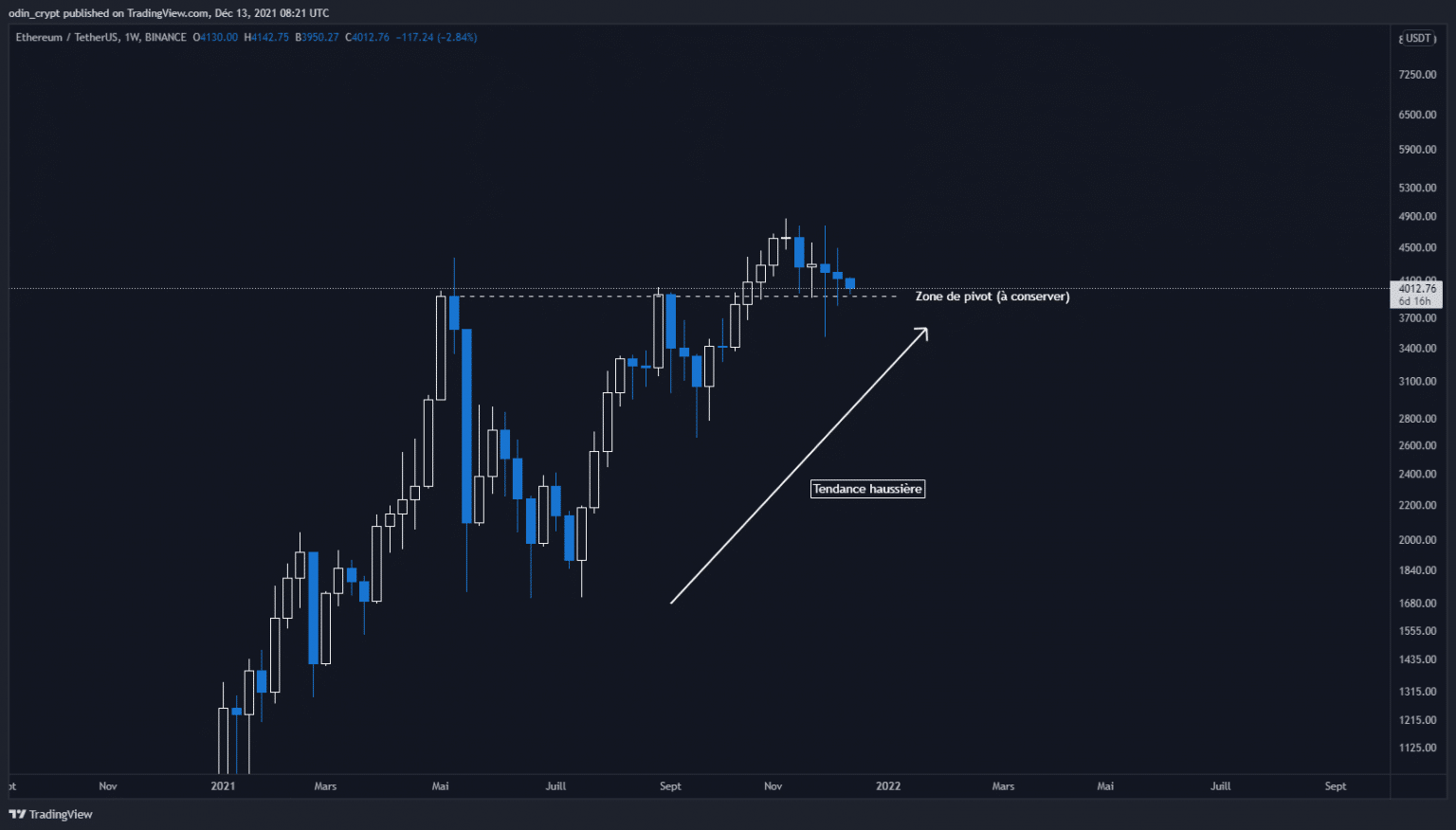

On the Ether (ETH) side, the macro trend remains perfectly bullish.

Indeed, as long as the $3,900 level is held at the weekly close, the configuration is favourable for an expansion phase (price discovery). This zone is very important, as it brings together two elements:

- Old resistance that holds 2 times the price;

- Last peak to retest.

Ether (ETH) analysis in 1W

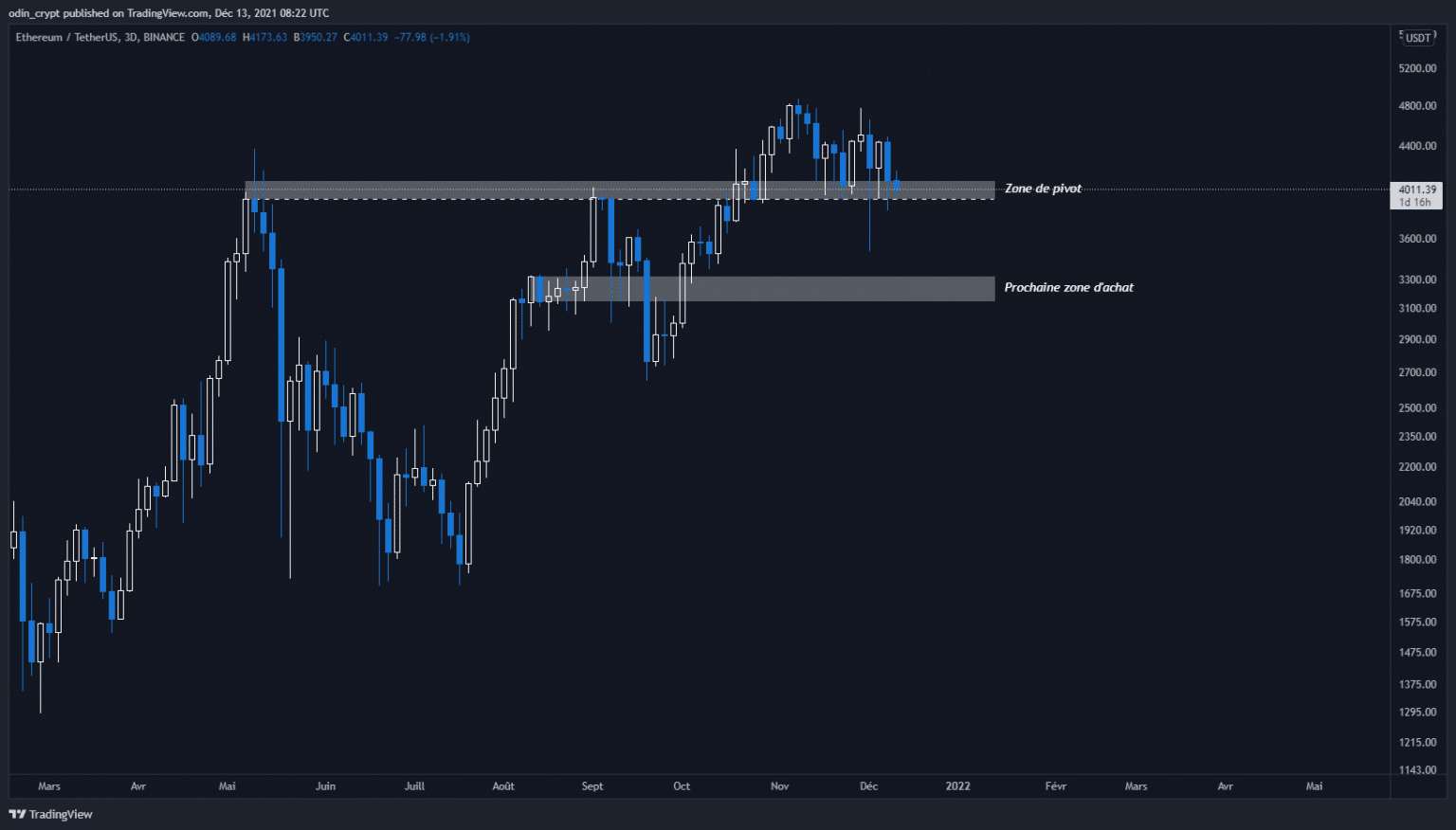

If we zoom in on the daily view, the area identified becomes clearer. The pivotal buying area is between $3,900 and $4,000. We would like to see a bounce on this area to look for a new all time high (ATH).

However, if the price were to break down this area, the next buy zone would be at $3,100 – $3,300. It represents the last interesting buying point in this bullish logic. Losing the last daily low at $2700 would put the whole bullish structure into question. It is therefore the point of invalidation of all our bullish theories

Ether (ETH) analysis in 1D

Analysis of The Sandbox (SAND)

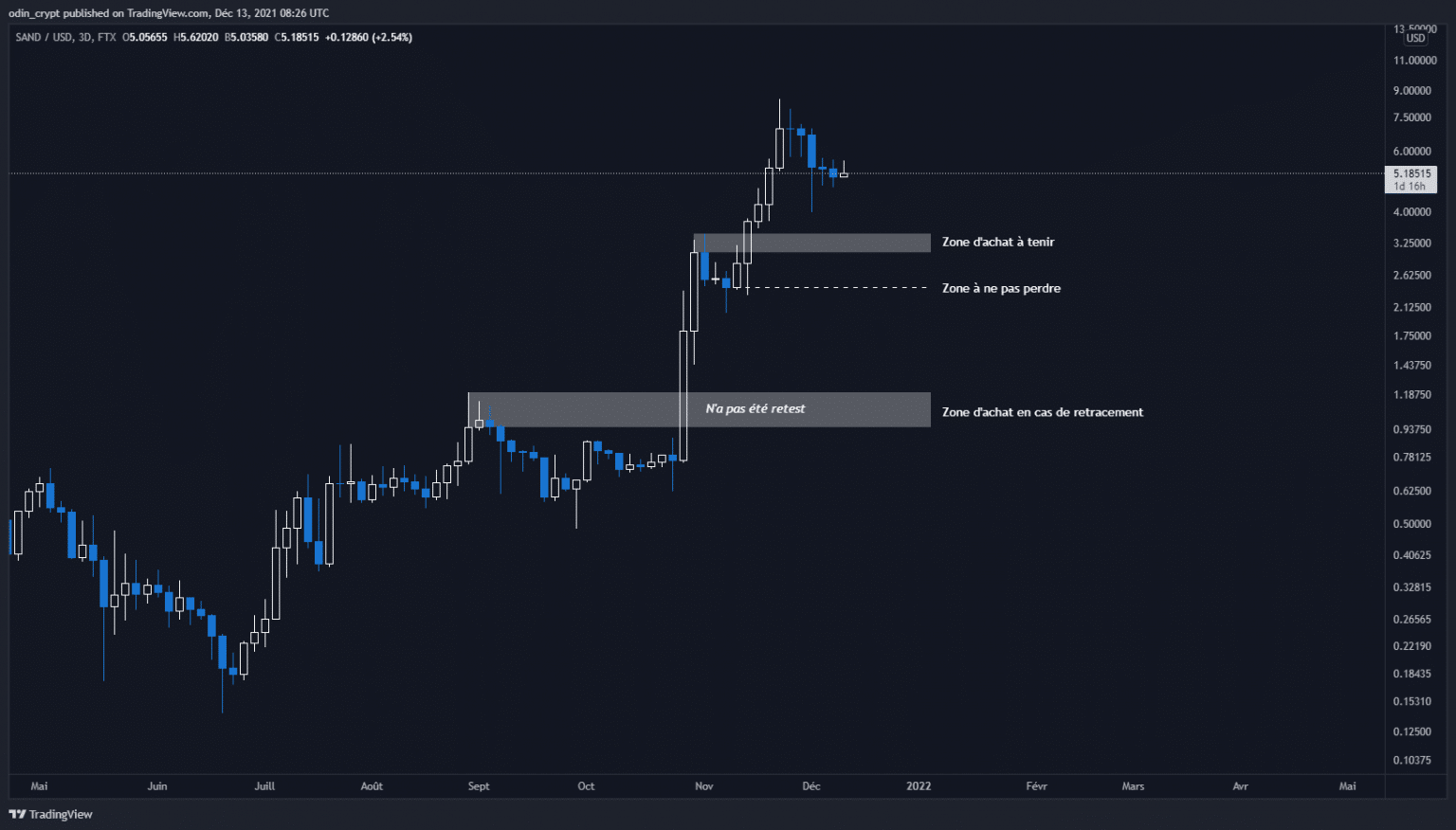

After the huge surge in the SAND token (+1,020% in 27 days), the price now needs to purge some of the late entrants in order to resume a healthy structure. I have noted below the main areas of interest which I will detail.

The first area of interest for me is the last daily high of the price which is between $3.45 and $3.00. If you are planning an entry on this point, your invalidation will correspond to the last low which is at $2.42. As long as the price holds this area at the close, there is no need to panic.

The Sandbox (SAND) analysis in 1D

The next area I identify is the $1.20 – $0.95 area. Why such a low zone? Quite simply, because it corresponds to the beginning of the explosive bullish move, but also to the last important high. It is easy to see that the latter has not been retested, and that makes it a natural area of importance.

I know, if this area were to be touched the retracement would be -75% from the current value. This zone will only be retested if, and only if, the $2.42 is not held on the daily view. It is therefore imperative to always secure one’s strategy

In conclusion

The macro trend remains bullish on Bitcoin (BTC) and Ether (ETH). It will take a lot of area to regain to re-start a strong move higher, but for now the market needs to digest the previous move by creating liquidity. A range-bound scenario is to be expected, which could benefit some of the altcoins that have held this local bearish phase.

For the Sandbox token SAND, the configuration also remains bullish, but the recent explosive bullish movement requires a market correction.

In any case, it will be important to keep an eye on the daily and weekly closes. They will give precious indications on the continuation of the movements.

On our side, we’ll see you next week for a new analysis.

It was cryptOdin to serve you