It’s no secret that many famous brands are entering the non-fungible token (NFT) market. This is a lucrative turn for them with millions of dollars at stake. But in the lot, it is Nike which seems to benefit the most from this new growth vector.

A lucrative NFT shift for big brands

Noah Levine, a Stanford student, compiled a lot of data on Dune Analytics to get a sense of how big brands are doing in the non-fungible token (NFT) sector:

Created a comprehensive dashboard on the IRL Brand NFT landscape. Crazy to see how lucrative NFTs have been for some of the largest brands. dune web3 NFT https://t.co/dBRAaNjA9e

– Noah Levine (@nlevine19) Aug 22, 2022

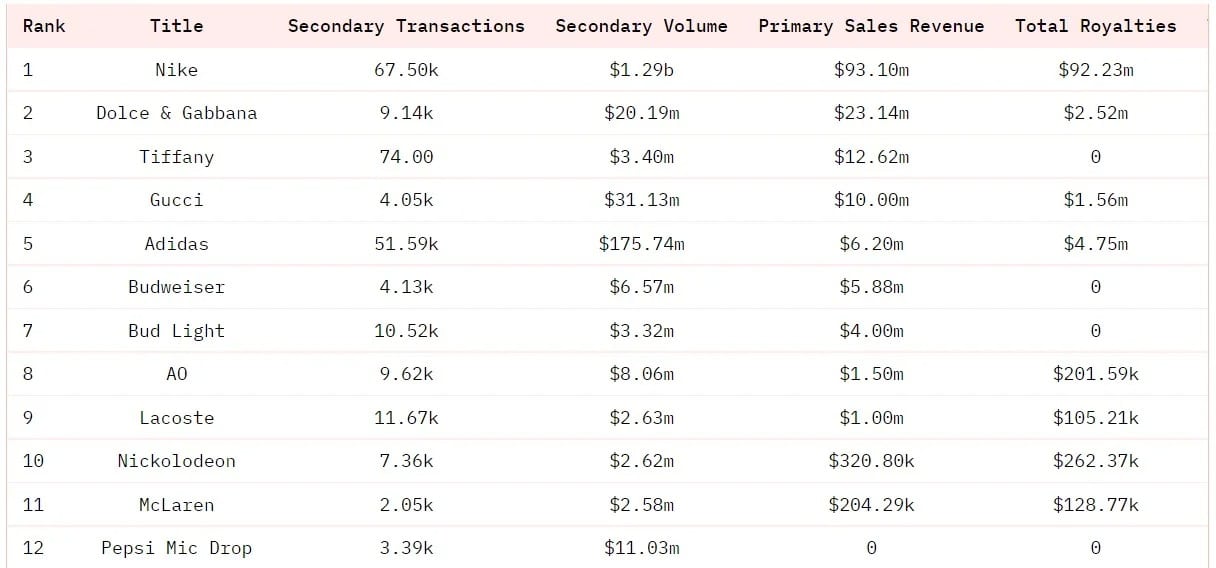

A total of 12 famous brands are reviewed and the data highlights several elements such as the turnover at the time of the initial sale, or the royalties collected at the time of resales on the secondary market in particular:

Figure 1: Revenues generated by major brands through their NFT projects

Unsurprisingly, it is the fashion sector that is most represented with a podium made up of Nike, Dolce & Gabbana, but also Tiffany & Co. thanks to its recent collection of CryptoPunks-themed pendants. However, we can also find the brewing sector with the AB InBev group represented by Budweiser and Bud Light, or the automobile sector with McLaren.

However, it would seem that Nike is leading the way, and by a long way compared to its competitors. The brand has generated $93 million in sales for its own account since it entered the industry. It has also collected almost as much in royalties since then.

Nike and its appetite for NFTs

Nike’s various NFTs collections total 67,500 transactions and have produced $1.29 billion in secondary market volume. CLONE X is the hottest collection with nearly $780 million in volume alone. Its 5% resale royalties therefore generated nearly $39 million for RTFKT and therefore for Nike by extension.

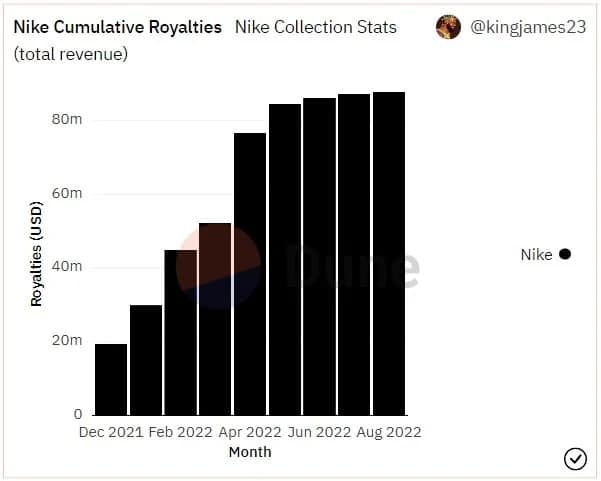

As for the said royalties, we observe a clear acceleration in the spring followed by a deep slowdown since the beginning of the summer:

Figure 2: Nike’s accumulated royalties on its NFTs

Very concretely, this slowdown is not specific to Nike, but depends on an overall market trend in the second half of 2022.

Of course, if all the figures mentioned so far are significant, let’s remember that they are only a drop in the bucket for Nike. Indeed, in its last financial year ending in May, the company recorded a turnover of 46.71 billion dollars worldwide.

Nevertheless, it is worth noting the increasingly pronounced growth of non-fungible tokens, whose business represented almost nothing even two years ago. There is no doubt that today’s brands are leading the way and that these various initiatives will become more and more widespread over the years as Web3 takes off.