Nexo is one of the most popular lending platforms. This one offers you the possibility to deposit your cryptocurrencies safely while generating interest on them. Nexo also allows you to borrow cryptocurrencies in a few clicks. Check out our tutorial on how to use Nexo with ease

Generate interest on your cryptocurrencies with Nexo

Welcome to our Nexo tutorial. Nexo is a cryptocurrency financial services platform. You can buy and sell crypto-currencies, trade them, but its main interest lies in its credit system.

Anyone can borrow and lend their crypto-currencies, usually at a very attractive interest rate. There are many crypto-currencies such as Bitcoin, Ether, DAI stablecoin, Ripple XRP, Cardano ADA and many more…

You can invest your crypto-currencies there to receive interest of up to 8-12% per year. You can also borrow crypto-currencies or traditional currency from them, pledging your own crypto-currencies as collateral. These are much more attractive returns than what banks or the stock market can offer in 2022.

Nexo is a regulated platform. It is monitored by many US state financial authorities, as well as European regulations. It is now one of the largest and most popular platforms for cryptocurrency finance.

We sometimes read that Nexo is a DeFi platform, the acronym for decentralised finance. This is not entirely true, in the sense that Nexo is a traditional centralized entity, where you open an account. DeFi involves interactions with a wallet you own, your account is not on the platform.

However, the appeal of DeFi is the same as Nexo: being able to make your crypto-currencies work for you and being able to borrow cash.

Nexo is therefore an opportunity to invest one’s wealth and generate a potentially very interesting passive income, compared to investments offered by traditional banks. However, as with any cryptocurrency tool, it is important to understand it well before you start using it.

In this tutorial you will learn how to create an account on the Nexo platform, how to secure it, and how to perform routine operations and investments/borrowing.

Full tutorial – How to use Nexo

Access to the Nexo platform is open to everyone and is very simple. Once you open your account, you just have to deposit funds to be able to immediately start earning interest, borrowing money by placing your crypto-currencies as collateral, or exchanging your crypto-currencies for others (just like on a classic crypto-currency exchange platform).

Let’s take a closer look at how this platform works and specifically how to generate passive income with your cryptocurrencies.

How to register and secure your account on the Nexo platform

Nexo is a cryptocurrency financial services platform with a centralized architecture that complies with the financial and auditing regulations of both the US and EU administrations.

This makes it a “hybrid” between traditional online financial services such as online banks or investment service providers, and purely cryptocurrency-focused platforms, often specific to one or more blockchains, whose usability for the general public is often criticised.

Registration on the Nexo platform is done at https://platform.nexo.io/.

As this is a “classic” platform, registration simply requires an email address and a password. You can create an account without holding any cryptocurrency.

Once your account is validated, it is very important to secure your account through two-factor authentication (“2FA”).

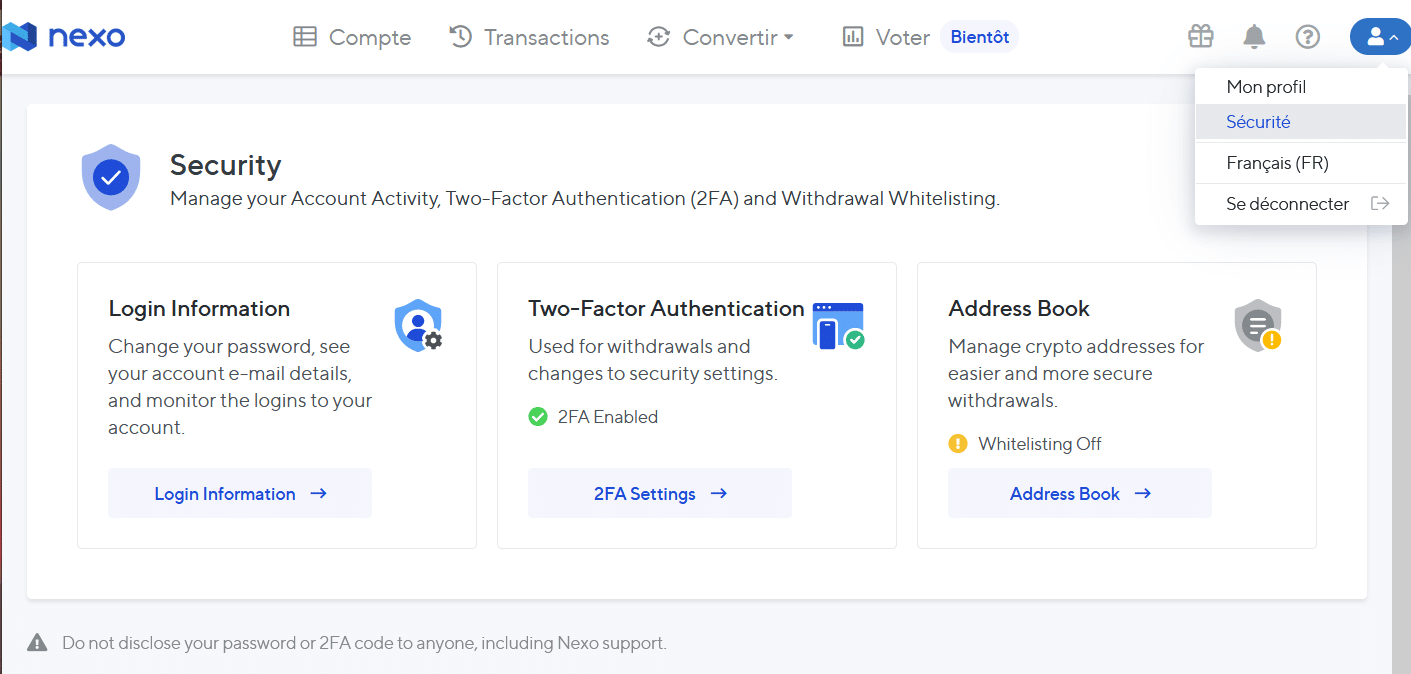

Clicking on the icon in the top right corner will take you to the security page

Two-Factor Authentication adds verification to your account to ensure that it is really you who is accessing it. To do this, download the Google Authenticator or Authy app to your phone, and follow the instructions. Enabling two-factor authentication unlocks the use of most of the platform.

It is very important to use this extra level of security, not only with Nexo, but in general, as data breaches involving passwords associated with certain email addresses are very common. This is even more important if you use the same password on several sites (a practice we do not recommend).

According to EU legislation, when buying cryptocurrencies with euros (or other fiat currency), you will need to complete the KYC (Know Your Customer) process to verify your identity. This step is not mandatory if you do not intend to use the platform to buy cryptocurrencies with fiat currency or to withdraw euros.

How to deposit and withdraw cryptocurrencies on Nexo

Once your account is created, you can fund your Nexo account by sending your cryptocurrencies to it.

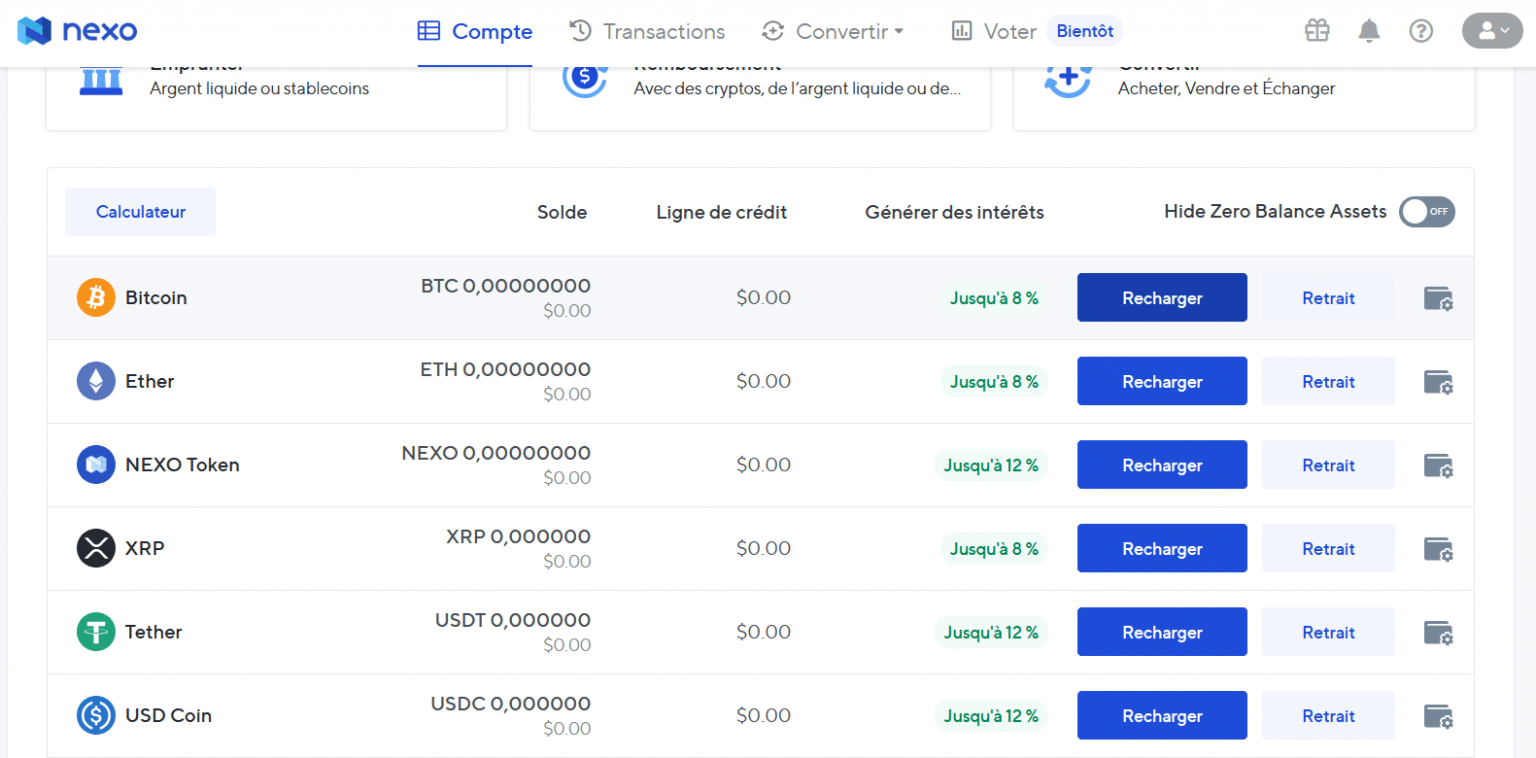

For example, let’s say you want to transfer 1 BTC to your Nexo account. To do this, simply scroll down the main page until you find the list of assets supported by the platform.

This is where crypto-currency deposits and withdrawals are made

The “Reload” button opens a window with a Bitcoin address. You can send BTC to this address, it is your Bitcoin wallet at Nexo.

The “Withdraw” button opens a window allowing you to withdraw cryptocurrencies held in your Nexo account in the opposite direction. Here you enter the wallet to be credited and confirm the upload.

How to generate interest via the Nexo platform

Once you have purchased cryptocurrencies on the platform, or transferred them from another wallet, interest is generated automatically.

You don’t have to do anything!

All crypto-currencies on your Nexo account are automatically stored. Once your account is funded, it starts generating compound interest paid daily. This makes it easy for you to build up term savings, with no constraints on withdrawals when you need cash.

This applies to all cryptocurrencies deposited on the platform, but also to Fiat currencies like the euro and the dollar. So if you load your account with euros, you can start earning interest before you decide which crypto-currency you want to invest in.

Nexo insists and pokes fun at this simplicity: their “how to generate interest on Nexo” video tutorial is only 14 seconds long!

How to trade cryptocurrencies directly on Nexo

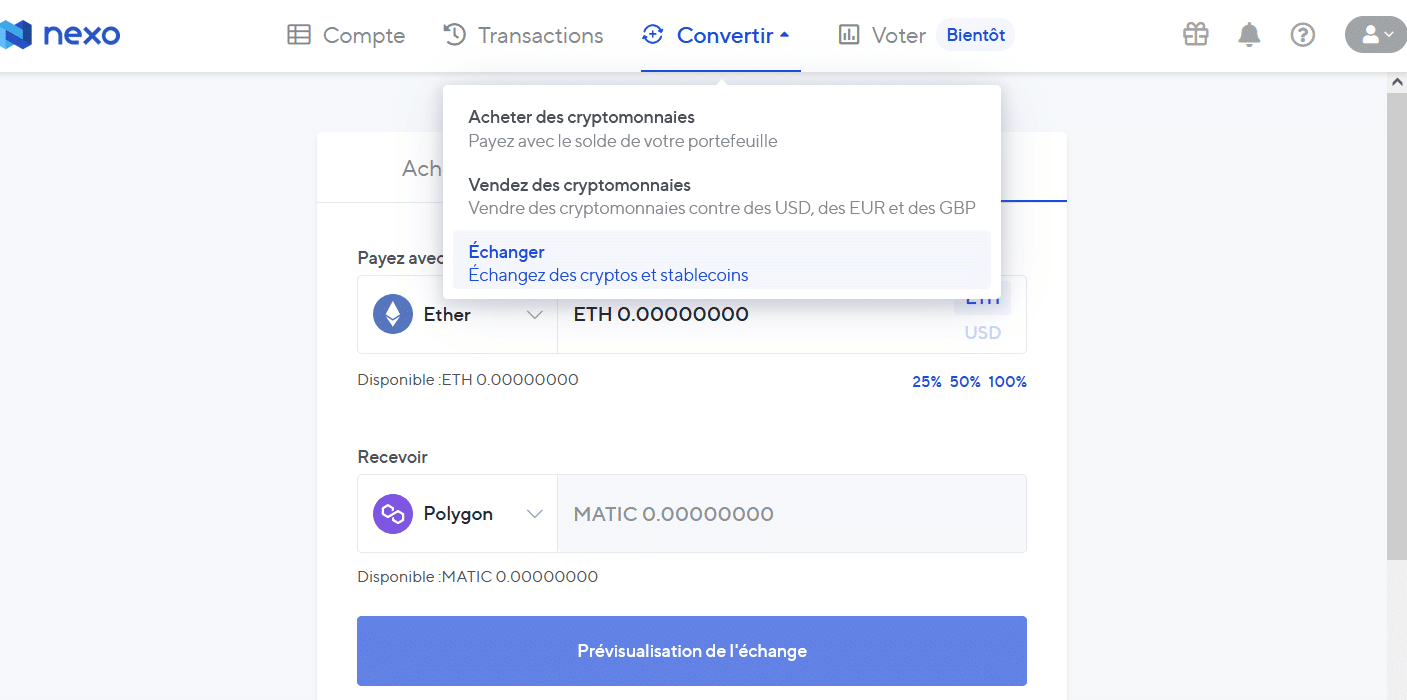

The Nexo platform includes a cryptocurrency exchange feature, which allows you to easily exchange one cryptocurrency for another.

This can be interesting in many cases: when you anticipate a rise in a particular crypto-currency or when you want to make a withdrawal in another crypto-currency.

In this example, we can trade Ether (ETH) for MATIC

The exchange is done directly. You can instantly get the cryptocurrency of your choice. There are no fees that apply and no limit to the amount of cryptocurrencies you can exchange for another.

You’ll also notice the buy and sell cryptocurrency features, in the same drop-down menu. These are limited to users who have completed the identity verification process, as required by EU regulations.

How to borrow crypto through Nexo

To be able to borrow cryptocurrencies on the Nexo platform, you must first credit your account in order to provide collateral. That is, a sum of cryptocurrencies that you will allocate to your “credit line” in order to be able to borrow a certain percentage of that sum (depending on the collateralized asset).

Naturally, once you have taken out a loan, you need to keep an eye on your ability to repay. The “Repayment” button allows you to repay a loan taken out on the platform.

What are the fees associated with the platform and what is the Nexo token?

Nexo does not charge any direct fees for using its platform. It pays itself, much like a traditional lending institution would, by playing on interest rates.

The cryptocurrencies entrusted to it are thus invested in order to generate a return that allows the platform’s users to be remunerated at rates higher than the banking market.

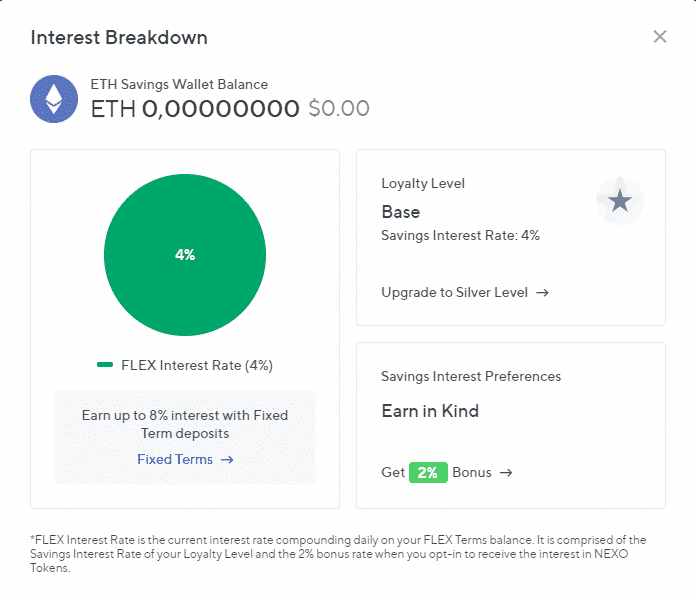

This mechanism is best understood when we look at the NEXO token. When you stake your cryptocurrencies on the platform, the interest is usually paid in that same cryptocurrency, at a rate of up to 8% or even 12% on some assets.

Nexo offers the so-called “Earn in Kind” option, which means that your interest will no longer be paid in the crypto-currency you deposited, but in NEXO tokens. If you choose this option, your interest rate is automatically increased by 2%, as shown in the screenshot below:

For example, here the user is offered to trade ETH for a variable rate currently at 4%. If he chooses the “Earn in Kind” option, his interest will be paid in NEXO with a 2% bonus (on the converted amount of the deposited crypto-currency).

What is the Nexo card and how to get it

The Nexo credit card is available to all users of the platform who have completed the highest level of identity verification. This card allows them to spend the balance of their credit line.

It is a useful and convenient addition for investors wishing to use their earnings and interest in cryptocurrencies to make everyday purchases.

Your Nexo credit card is linked to the mobile app, to manage its availability, credit line, and stashed cryptos in real time.

For example, you add 1 Ether to your line of credit in order to borrow about 50% of the value of one ETH in euros. For example, let’s say that’s €2,000.

With the Nexo card, you can withdraw or spend that €2,000 just like any other bank card.

Our review of Nexo

The Nexo platform offers very solid services to earn interest on its cryptocurrencies and use them as collateral. It allows the buying, selling and trading of cryptocurrencies, just like a traditional exchange platform would.

With its very simple interface and clear dashboard, it is relatively easy to use the Nexo platform. Everything is done to welcome the new investor and they find their bearings immediately.

Much more accessible than decentralised finance applications (DeFi), Nexo is therefore a great way to make your cryptocurrencies work for you. In addition, the platform is regulated in many countries, subject to audit, so its solidity and seriousness are widely demonstrated.

Finally, Nexo has a fast and intuitive mobile app on iOS and Android. These work in the same way as the platform on the web, so follow the steps in this tutorial to get to grips with Nexo’s mobile applications.