In its latest report, CoinGecko looks back at the major statistics for Q2, including the performance of Bitcoin (BTC). The fall in NFT volumes, centralised platforms and the decline in stablecoins are also notable points in this study

Q2 crypto market trends: BTC tops $30,000

CoinGecko has published its retrospective analysis of Q2 2023, recapping the highlights of the cryptocurrency ecosystem such as the Bitcoin (BTC) price surpassing $30,000. This symbolic threshold was exceeded on 11 April for the first time since 10 June 2022.

Since then, the asset has paused to move in a range, ending the quarter up 6.9%, outperforming the total crypto market capitalisation, which rose 0.14% over the same period.

BTC’s quarterly high was reached on 15 June at $30,694, when BlackRock’s ETF filing was announced.

Stablecoins retreat and ETH staking explodes on the rise

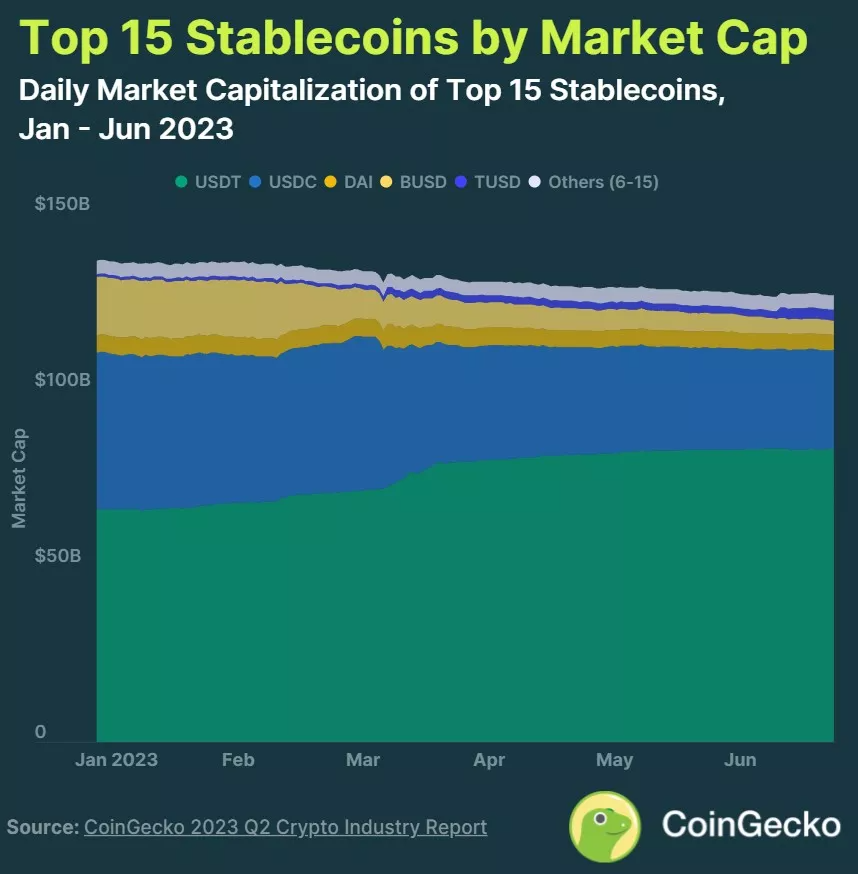

In the last quarter, stablecoin capitalisation fell slightly by 3.5%:

Figure 1 – Evolution of stablecoin capitalisation in Q2 2023

Following on from its temporary difficulties in March, Circle’s USDC fell by 15.9%, with a loss of $5.18 billion on its total quantity in circulation. The BUSD continued its agony with a loss of $3.43 billion and a 45.4% fall in its capitalisation.

Tether’s USDT came out on top, up 4.4% for an additional $3.48 billion, and lesser-used stablecoins such as Gemini’s GUSD and Paxos’ USDP stood out, with gains of 44.4% and 30% respectively.

As for Ethereum staking, all the signs are green, with a 30.3% increase in the number of ETHs staked, following the success of the Shapella update.

Lido continues to lead the sector with a 31.9% market share, while the Kraken platform has been the biggest loser over the past three months, losing 36.2% of ETH staked quarter-on-quarter as a result of its troubles with the Securities and Exchange Commission (SEC).

Coinbase also lost ground, down 3.5%, and now handles 9.6% of ETH staking.

The bear market for NFTs and the flight from centralised platforms

While in 2022, the non-fungible token market withstood the bear market rather well, the dynamics are now quite different. This is reflected in volumes that are down 35%, despite the arrival of Bitcoin Ordinals, which CoinGecko considers to be NFTs despite the fact that they are a completely different technology :

Figure 2 – Comparison of NFT volumes between Q1 and Q2 2023

As an example, Ethereum saw its volumes fall from over $1.48 billion to $840 million between March and June.

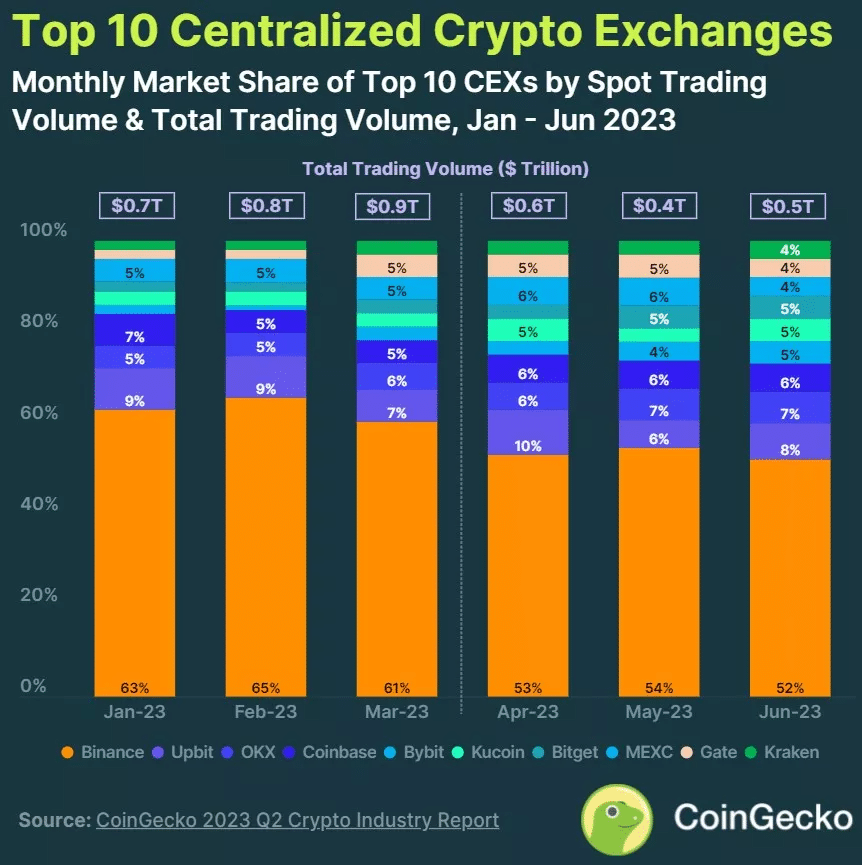

With regard to centralised exchange platforms (CEX), regulatory difficulties have dealt a serious blow to their volumes. As a result, CEX volumes fell by 43.2% and Binance’s dominance fell from 61% to 52%:

Figure 3 – Comparison of CEX volumes between the first and second quarters of 2023

Despite an overall positive first half of the year for the cryptocurrency market, we will therefore have to remain attentive to the few signals of slowdown in this second quarter.