Ether (ETH) a better investment tool than Bitcoin (BTC)? This is the theory defended by the financial institution JPMorgan, in a note to investors. What is it based on?

The influence of the global economy on Bitcoin and Ether

As reported by Business Insider, JPMorgan believes that the price of Bitcoin will be more influenced by rising interest rates than Ether. According to the institution, the largest cryptocurrency has been able to rise recently amid low policy rates, and bond buybacks by central banks.

But that could change. JPMorgan, which compares Bitcoin to gold, points out that central banks are reviewing their support for economies. The Bank of England wavered recently, ultimately choosing not to raise its key rate for now.

The same is true of the US Federal Reserve, which has announced that it is beginning to reduce its purchases of Treasury bonds. In Europe, the ECB is also hesitating, despite Christine Lagarde’s confident speech.

This type of economic context tends to be dangerous for gold, and could therefore also weaken Bitcoin, according to JPMorgan. The institution considers BTC to be the equivalent of “digital gold” and could be affected in a similar way:

Rising bond yields and the possible normalisation of monetary policy is putting downward pressure on Bitcoin as digital gold, in the same way […] as traditional gold.

JPMorgan prefers Ether to Bitcoin

Against this, it’s Ethereum ETH that may fare better, again according to JPMorgan. The institution relies on one thing: the use cases of the cryptocurrency network. Unlike Bitcoin, Ethereum supports many uses, including decentralised finance (DeFi), which is exploding this year. Also worth mentioning is the non-fungible token (NFT) sector, which broke all records in 2021.

Because Ethereum derives its value from its applications, which range from DeFi to gaming to NFTs to stablecoins, it appears less vulnerable than Bitcoin.

The financial institution also notes the issue of energy use. Ethereum’s move to a Proof of Stake model seems crucial, and could set the second cryptocurrency apart from Bitcoin.

The greater focus of investors on environmental, social and governance issues has shifted attention from Bitcoin’s electricity-intensive blockchain to the Ethereum blockchain.

An ETH that outperforms BTC in 2021

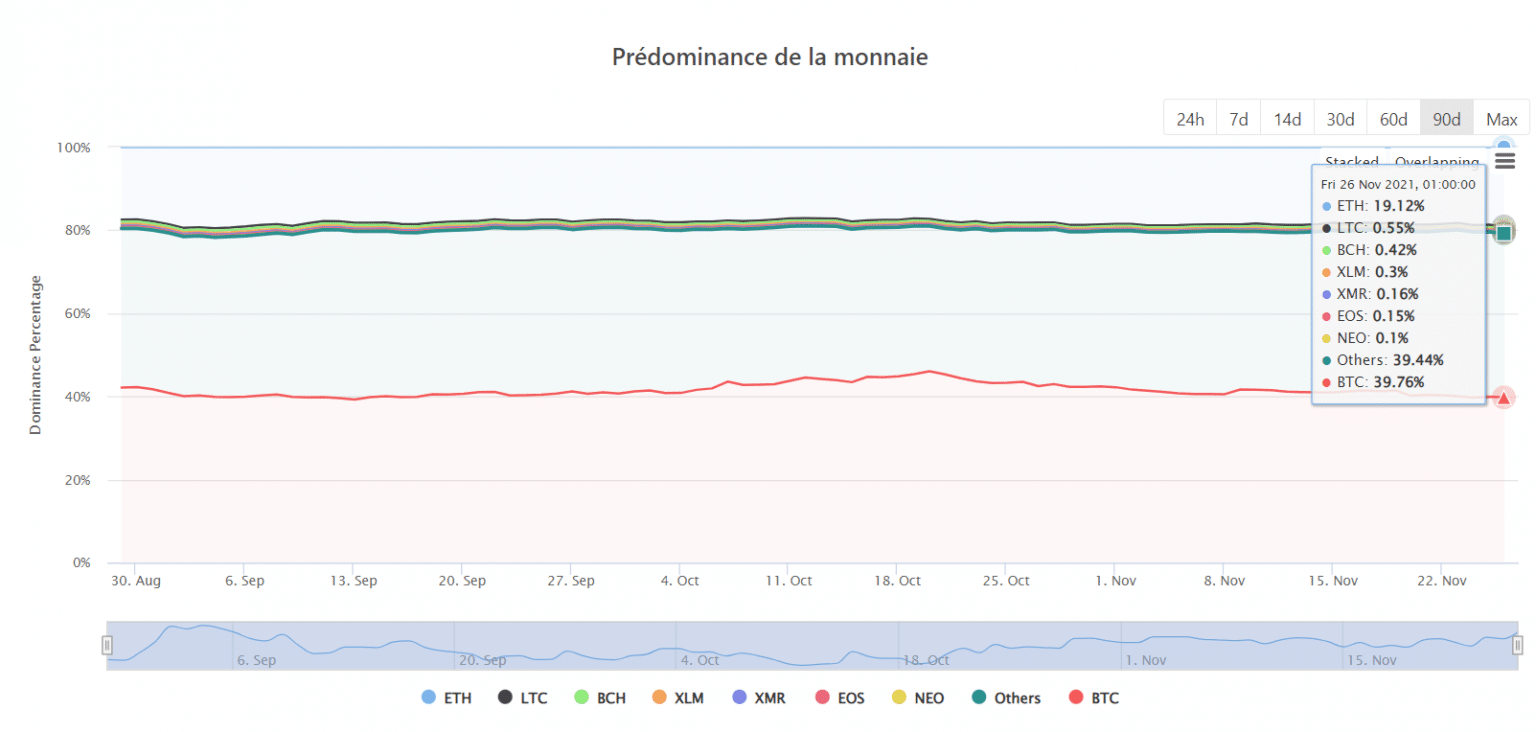

Over the last twelve months, ETH is indeed the fastest growing. The Ethereum cryptocurrency has taken +677% over the period, compared to +207% for BTC. There is also a redistribution of capitalization: since yesterday, Bitcoin’s dominance over altcoins has dropped below 40%

Bitcoin’s dominance over altcoins (Source: CoinGecko)

However, Ethereum has attracted some criticism in recent weeks, with transaction fees remaining exorbitant and alternatives gaining increasing attention. So will it manage to maintain its advantage? This is the crucial issue that should find a beginning of resolution in 2022.