The U.S. Court of Appeals has ruled in favor of Bitcoin giant Grayscale in its lawsuit against the Securities and Exchange Commission (SEC) over its Bitcoin ETF, saying the ruling was unfounded. The impetus needed for the various BTC cash ETF applications to be accepted?

Grayscale wins against the SEC for its Bitcoin ETF

The Court of Appeal has ruled in favour of Grayscale, a subsidiary of Digital Currency Group (DCG) and the world’s largest crypto fund manager, in its case against the Securities and Exchange Commission (SEC), which had opposed the conversion of its Grayscale Bitcoin Trust (GBTC) into a Bitcoin cash ETF.

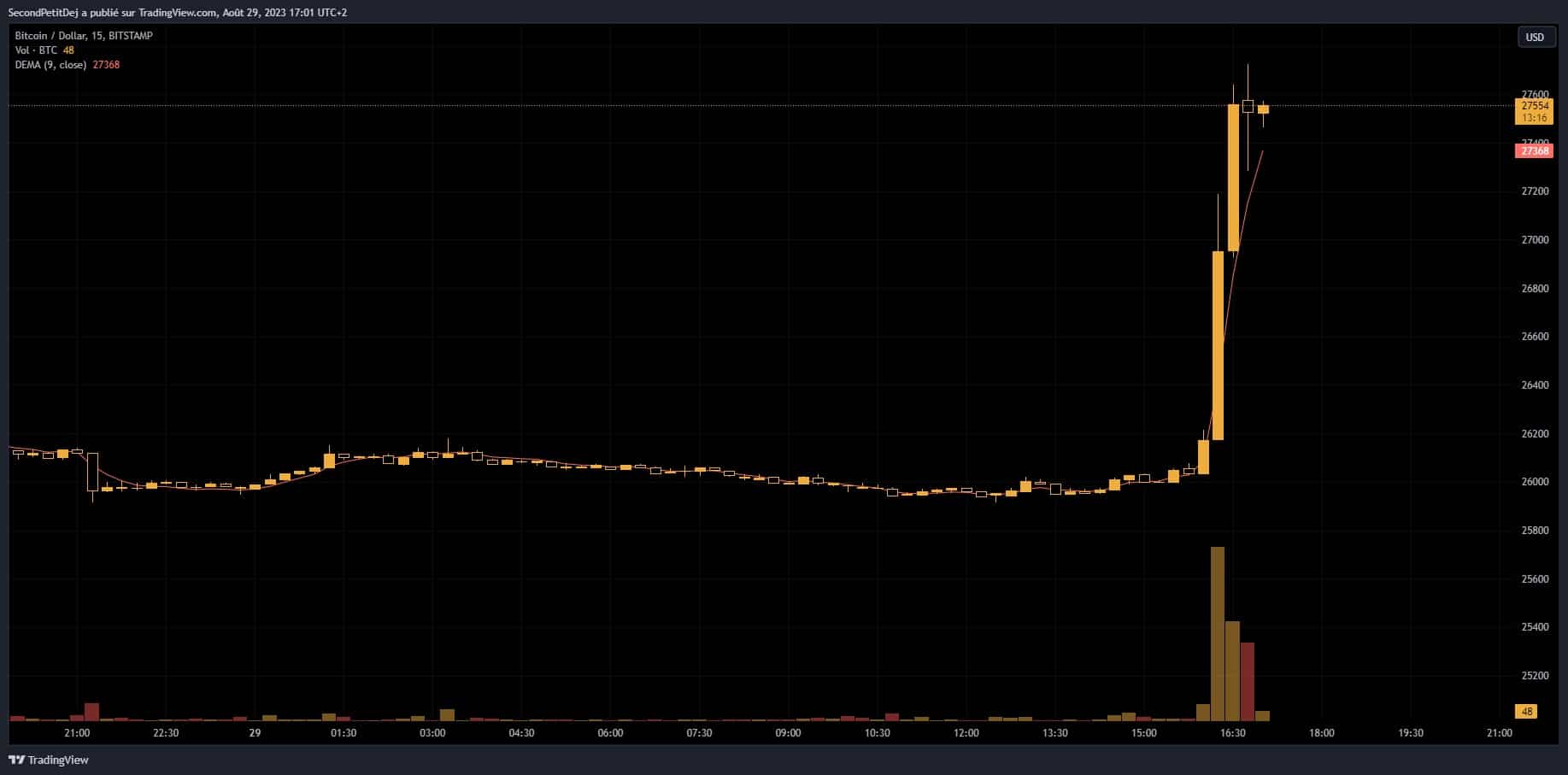

Following this major news, the Bitcoin price exploded upwards, gaining 5% within the hour to reach $27,450 at the time of writing. At the same time, more than $100 million has been liquidated in the last 4 hours.

Bitcoin price (BTC/USD pair)

The court document thus indicates that the SEC’s decision was indeed unjustified:

“It is a fundamental principle of administrative law that agencies should treat similar cases in the same way. The Securities and Exchange Commission recently approved the trading of 2 Bitcoin futures funds on national exchanges, but refused to approve Grayscale’s bitcoin fund. “

As a result, the SEC must review Grayscale’s Bitcoin ETF application:

“Grayscale seeks review of the Commission’s denial order and argues that its proposed Bitcoin exchange-traded product is materially similar to exchange-traded products for bitcoin futures and should have been approved for trading on NYSE Arca. “

A major breakthrough for the ecosystem as a whole, confirming that the SEC does not necessarily have the final say on all matters, as a Grayscale spokesperson confirmed:

“This is a monumental step forward for US investors, the Bitcoin ecosystem and all those who have defended Bitcoin’s exposure through the additional protections of the ETF wrapper. “

The spark that Bitcoin spot ETF demand has been waiting for?

While Bitcoin futures ETFs are already available to investors on the US market, the crypto ecosystem has always believed that the arrival of spot Bitcoin ETFs could go a long way to democratising it. Grayscale estimates that converting its GBTC into an ETF could bring in $5.7 billion.

Initially, the SEC opposed the conversion of Grayscale’s product into an ETF on the grounds that a Bitcoin cash ETF did not include the necessary fraud detection mechanisms.

It was precisely in response to this argument that Grayscale launched a lawsuit against the SEC, the federal agency having accepted applications for future Bitcoin ETFs with the same characteristics, which the judges at the Court of Appeal made clear:

“The denial of Grayscale’s proposal was arbitrary and capricious because the Commission failed to explain its different treatment of similar products. “

The court also said that Grayscale had been able to “advance substantial evidence” that its GBTC was similar to ETFs already approved by the SEC, particularly as the shared surveillance arrangements on the Chicago Mercantile Exchange (CME), one of the major US futures markets, are identical.

Since the Bitcoin ETF race was launched by BlackRock, many companies have been keeping their fingers crossed for their Bitcoin cash ETF to be accepted, including WisdomTree, Fidelity, Inveso, Ark Invest and 21 Shares or VanEck.