On Friday, the FDIC published a document on the closure of Signature Bank. According to the FDIC, the bank’s failure was due to poor management and unchecked growth.

The FDIC publishes a report on the failure of Signature Bank

This week, the Federal Deposit Insurance Corporation (FDIC) unveiled a 63-page document in which it reviews the Signature Bank (SBNY) affair.

For the FDIC, the conclusion is simple: although the bank was affected by the liquidity crisis caused by the defaults of Silicon Valley Bank and Silvergate, the main reason for this was the company’s management:

However, the root cause of SBNY’s failure was poor management. SBNY’s board and management pursued unbridled rapid growth [and funded] growth through over-reliance on uninsured deposits, without implementing fundamental liquidity risk management practices, and failed to understand the risk of its association with the crypto industry. “

In addition, the bank was reportedly not always responsive to the FDIC’s various investigations.

To highlight the rapid growth being discussed, Signature Bank has grown from $43.1 billion in assets in 2017 to a high of $118.4 billion in 2021, an increase of 175%. More broadly, the federal agency reports that while the bank grew 134%, the average for other institutions in the sector was 33%.

A crypto-friendly bank

Signature Bank was renowned for its openness to cryptocurrencies, and was in fact a partner of several players in the ecosystem. In particular, it was Binance’s intermediary for processing dollar transfers, and after the closure, Coinbase and Paxos had announced that liquidity was blocked at the bank.

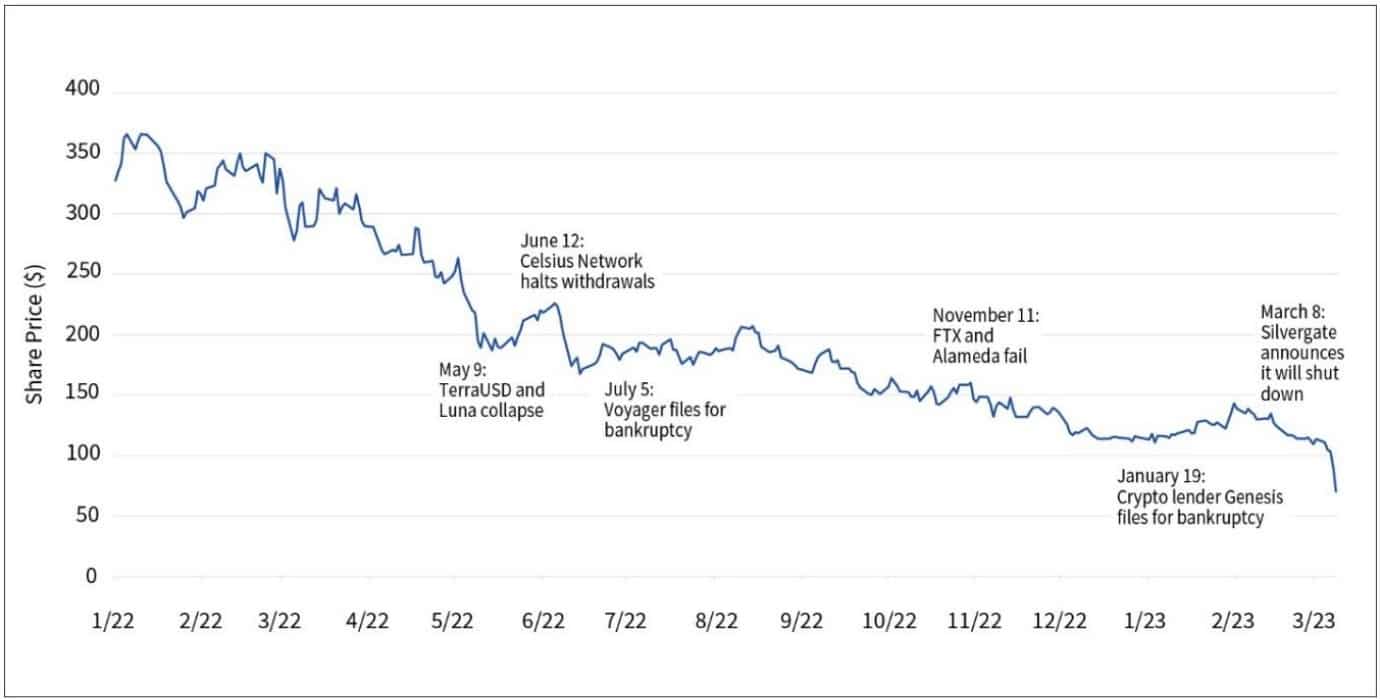

For its part, the FDIC shows a correlation between Signature Bank’s share price and events affecting cryptocurrencies in 2022. While the graph speaks for itself, we should remember that 2022 was a catastrophic year for many asset classes, although we cannot deny this correlation:

Signature Bank share price

As at 30 September 2022, the “Digital Assets Group” represented 23.5% of the bank’s deposits, and the bank informed last January that it wanted to reduce this exposure to cryptocurrencies to 15%. What’s more, the bank faced legal action last February, alleging that it had helped to facilitate the fraud FTX is accused of.

We know what happened next: customer withdrawals became more and more widespread, and Signature Bank was closed on 12 March by the FDIC. The FDIC estimates that this case could cost its deposit insurance fund $2.5 billion.