A new report from Kiln allows us to identify some trends among Ethereum (ETH) community players who have staked large amounts of Ether. We can see from the answers given by the panel interviewed here that ETH staking should see a growing interest after the Shanghai update scheduled for next March.

Ether withdrawals expected soon

According to a report by Kiln, a company that specializes in staking solutions for businesses, only 9% of individuals who have deposited Ethers (ETH) in the form of stakes would like to withdraw and retrieve them.

But first, a bit of background: following the Merge update implemented on the Ethereum blockchain last September, the network’s consensus method was completely changed.

Indeed, the method of proof of work (PoW) under which Ethereum (like Bitcoin) was operating until then has been abandoned in favour of the proof of stake, a method that presents a number of notable advantages, whether it be in terms of energy, the scope of technical possibilities drastically extended, or even concerning the issuance of the number of ETH per block, which has been reduced by a factor of 10 times its initial value.

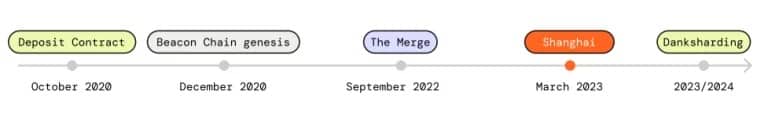

Figure 1 – Key dates in the evolution of the Ethereum blockchain

Thus, following Ethereum’s move to proof-of-stake, miners had to give up their mining equipment and resolve to become network validators in order to continue to be rewarded for their participation in the smooth running of the blockchain. The only condition for this was to deposit 32 ETH in staking. This is a considerable amount of money, but fortunately, people wishing to stake their ETH to a lesser extent can do so by delegating them.

The ETHs in question will remain blocked until the Shanghai update, which should be deployed on the mainnet during the month of March, according to the developers’ current schedule. Things seem to be going well, as the update has just been successfully completed on the Sepolia testnet, the last test before the rollout to the Goerli testnet, which will itself make way for the mainnet afterwards.

What will the validators do with their ETHs?

After surveying a panel of about 120 players who have deposited their ETH at the staking, Kiln has compiled their respective responses to provide a post-Shanghai perspective. It should be noted that this data concerns a significant number of institutional players, who have large amounts of Ether under management.

Here are the key figures that we can observe following the various responses collected:

- 68% of the entities surveyed plan to start staking their ETH or making them work through decentralised finance protocols (DeFi);

- 70% of these will start staking their ETH as soon as Shanghai is deployed or shortly thereafter;

- And only 9% plan to withdraw their ETH.

Some of the retail investors surveyed are happy to be able to store their ETH “natively” on the blockchain and not via liquid staking methods (such as Lido or Rocket Pool):

“Since 2020, I have already been using a mix of liquid staking tokens (LST). With the Shanghai upgrade, I will complete my strategy with native staking. “

Others worry about a hypothetical drop in staking rewards, or a large exit queue (for validators):

“I hope the staking rewards will still be good after the upgrade, but what worries me is the queue I’m likely to get. “

The validator release queue is indeed one of the concerns about the Shanghai upgrade rollout. To learn more about the conditions for withdrawing ETHs stored on Ethereum, we invite you to read our dedicated article.

How are validators organizing themselves for the post-Shanghai era

If we take a closer look at the 68% planning to make their ETH work post-Shanghai, we can see that 35% of them plan to start staking their assets natively once withdrawals are allowed, and 33% of them will do so via DeFi protocols. On the other hand, 23% of the individuals in this panel stated that they would “do nothing”, and finally, 9% simply plan to stop staking their Ether.

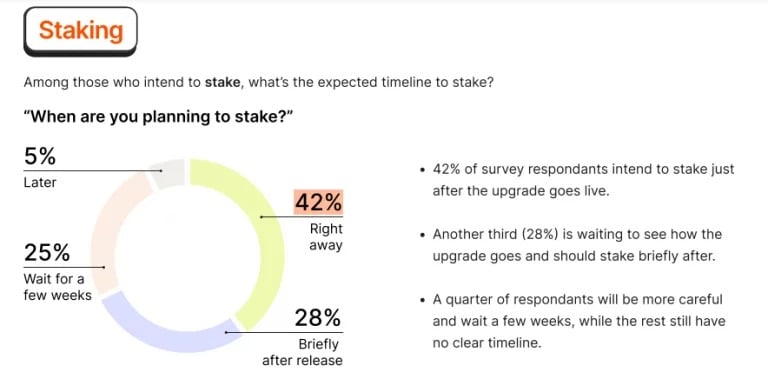

The timeframe within which validators plan to touch their ETH so far locked up is likely to vary. However, we can observe a certain trend within the panel surveyed, as 42% of respondents wish to stash their ETH as soon as possible. Another 28% plan to do so “shortly” after the upgrade, while 25% plan to wait at least a few weeks.

Figure 2 – Graph of staking results

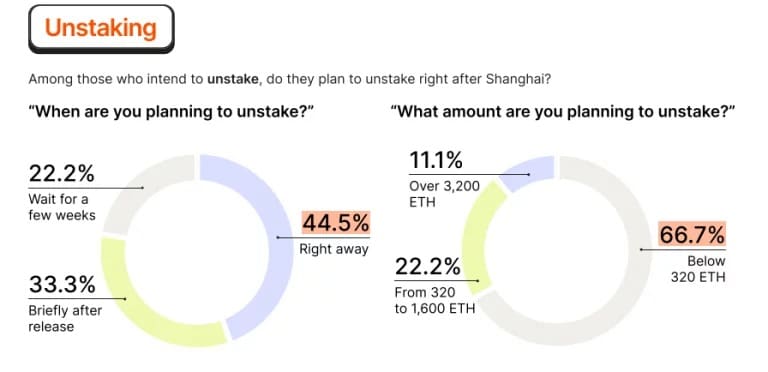

Finally, concerning the actors wishing to unstake their ETH, we observe that 44.5% of them wish to do so as soon as possible. However, the majority of the surveyed sample (66.7%) only want to withdraw a small part of their stashed ETH (less than 320 ETH), while 22% of the surveyed players want to withdraw an amount varying between 320 and 1,600 ETH.

Just over 11% plan to withdraw a significant amount (from an institutional perspective) of ETH, i.e. more than 3,200 units.

Figure 3 – ETH unstaking data of respondents

In conclusion, this study allows us to identify certain trends concerning the post-Shanghai period. We can observe that, in general, the players who deposited ETH pre-Shanghai are still very interested in the possibility of continuing to work their Ethers via staking, whether it is native or carried out thanks to DeFi.

On the other hand, there may be a gap between their desired timeframe and the actual possibilities, due to the famous queue mentioned above, as confirmed by Laszlo Szabo, the CEO of Kiln:

“With 68% of participants confirming that they wanted to stake or increase their stakes, we can imagine a growing demand after Shanghai. However, what many institutions and individuals forget are the mechanisms of entry and exit queues… The more people who want to enter, the longer it will take. “

It should also be noted that currently only 14.7% of Ethers in circulation are in staking, but this trend should evolve positively once the update is in place given the notable enthusiasm of the community for the post-Shanghai era.